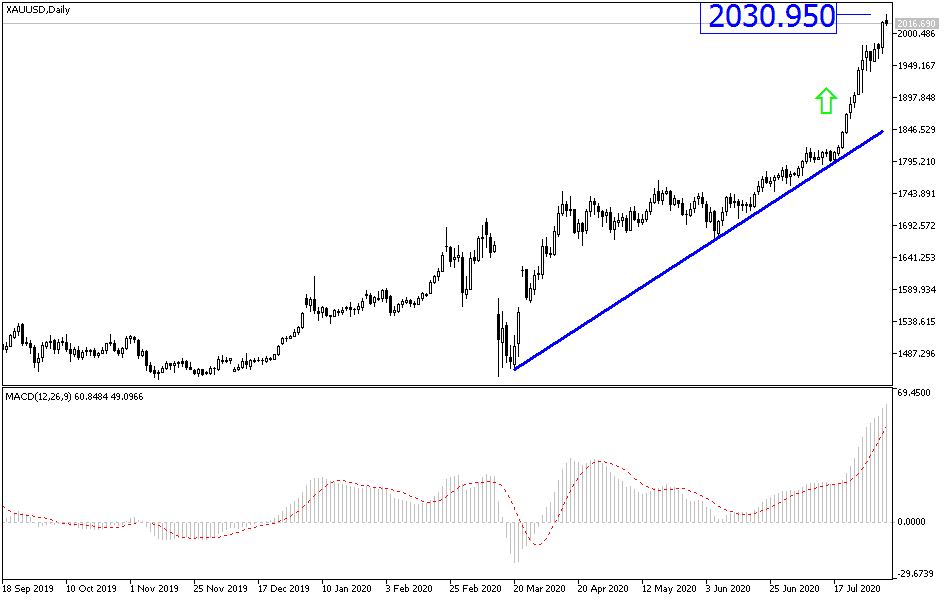

For the first time in the history of gold prices, it has reached $2000. Increased investors rush after that pushed the price of gold to $2030 an ounce, where it is stable at the time of writing. Markets move towards the yellow metal as a safe haven increased amid continuing concerns about the COVID-19 virus and the future of the global economy, along with the decline in the US currency. The growing tensions between the United States and China and the ongoing impasse over the US stimulus package have fueled the jump in gold prices. The US dollar index, DXY, which measures the performance of the greenback versus a basket of six competing currencies, gave up its gains to 93.83 and continued to decline towards 93.40. Silver futures closed at $26.028 an ounce, while copper futures settled at $2.8945 a pound.

In terms of the Coronavirus outbreak, it is reported that many countries have expanded closures to reduce the spread of the deadly virus, and this has reduced the chances of a rapid global economic recovery. On the news of stimulus talks, White House officials and congressional Democrats are continuing to seek a compromise over the formation of the relief package. As Charles Evans, president of the Federal Reserve Bank of Chicago, said on Monday that fiscal policy is really essential to push the economy forward.

Amid increasing talk of no deal being reached until September, St. Louis Fed President James Pollard said separately that he was optimistic that a deal could be reached. Before that, Dallas Fed President Robert Kaplan said on Monday that the expected recovery this quarter was "quieter" than expected, and as a result, this year the unemployment rate is likely to be higher than previously thought.

"I think we have had a refreshment, but it is more subdued than it was before" Kaplan added in an interview on Bloomberg TV. He said he now expects an unemployment rate for the United States between 9% and 10% at the end of the year. This is higher than its previous forecast of 8% of the unemployment rate at the end of the year. The unemployment rate was 11.1% in June and estimates for July show a rate of 10.5%. The Ministry of Labor will publish the July employment report Friday morning. Economists are concerned that the strong pace of job growth seen in the past two months may have faded last month.

Kaplan is a voting member of the Federal Interest Rate Committee this year.

In the interview, Kaplan said he did not believe the economy should be closed to control the Corona pandemic. On Sunday, Federal Reserve Chairman in Minneapolis Neil Kashkari said that a four or six-week closure "could lead to fewer cases and with more tests we will have the ability to control the virus". In this regard, Kaplan said that if all Americans wear masks, the virus can be controlled. He said that some states may be in urgent need of closures.

Meanwhile, tensions between the United States and China continue to affect investor sentiment after US President Donald Trump said he would ban the China-owned popular video application TikTok in the United States unless a technology company like Microsoft bought it. For its part, China Daily said today that China will not accept the American robbery of TikTok. In another development, the editor-in-chief of a newspaper published by the ruling Chinese Communist Party said that Beijing would respond if all Chinese journalists residing in the United States had to leave the country.

According to the technical analysis of gold: The bullish momentum of the yellow metal did not stop nor is there an impact technical indicators reaching sharp overbought areas. There are no distinct selling or buying levels currently, but only awaiting correction with sharp profit-taking sell-offs, and this will not be achieved without the return of confidence among investors of good containment of the virus outbreak, the calming in US/Chinese tensions. The announcement of a vaccine that eliminates the disease may be a quick catalyst to start the expected sales. Currently, the most prominent resistance levels for gold are 2028, 2045, and 2070 respectively.

Gold will react today to the results of the economic releases that shed light on the services sector in the Eurozone, Britain, and the United States and the first update of US job numbers, according to the ADP survey.