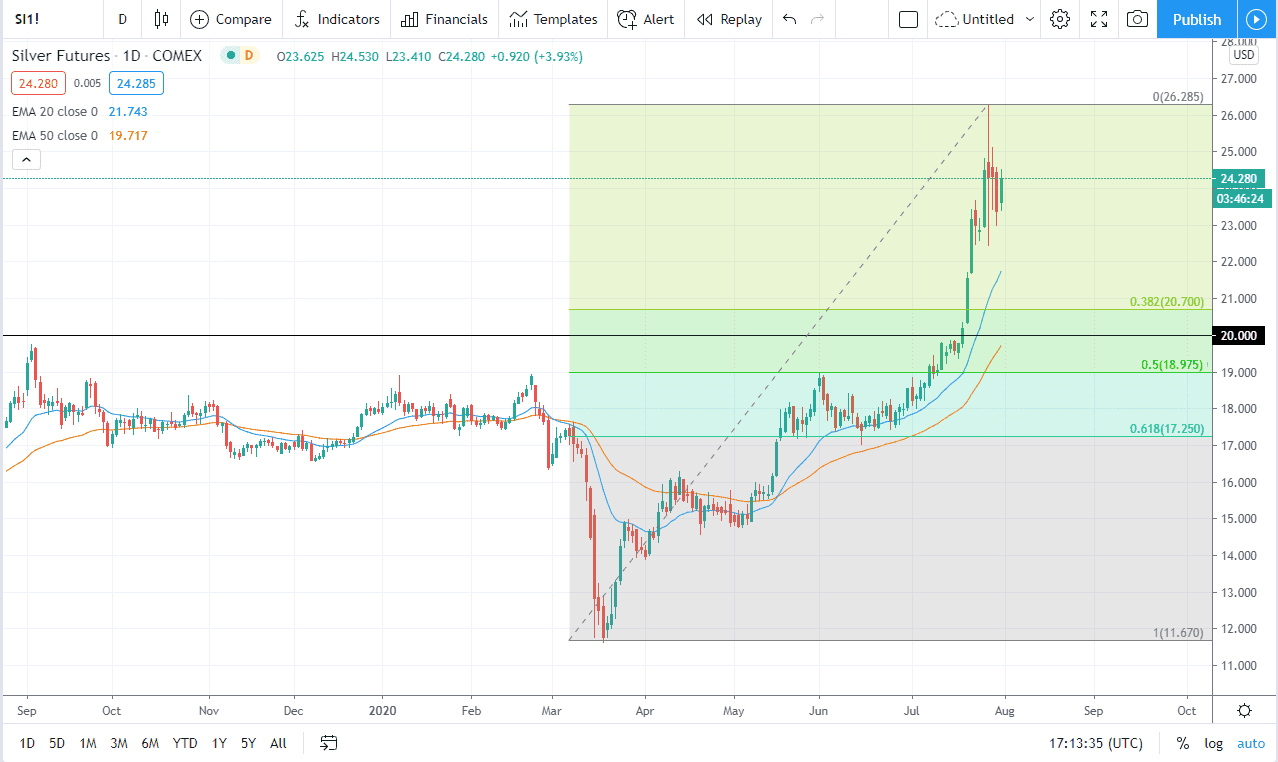

Silver markets have rallied a bit during the trading session on Friday as we continue to see a lot of churn when it comes to the markets. Silver has gotten way ahead of itself, so the question now is whether or not we kill time by going sideways, or do we pull back? I know I would prefer to see a significant pullback, because it would offer value in a market that I am very interested in owning. However, it is also worth noting that sometimes you do not get what you want me situations and you need to just be patient enough to let the market settle in at this elevated price.

To the downside there is the $20 level underneath that could offer a bit of a “floor” in this market, but I do not think we get down there anytime soon. In fact, it would not surprise me at all if we do not even make it down there at all. After all, the Federal Reserve is doing everything it can to liquefy the markets and devalue the greenback. The silver markets are rising basically on the idea of the US dollar shrinking, as it takes more of these US dollars to buy an ounce of silver. However, silver is also at extraordinarily volatile and a much thinner contract than gold so things could get a bit rocky over here in the short term.

Longer-term, I believe that silver will eventually go looking towards the $30 level, perhaps even further than that. I think at this point it is obvious that we cannot be sellers, but we also cannot be buyers at these elevated levels. If we can go sideways for a couple of weeks, then it is possible that we could perhaps look at that as a potential trade as well. Either way, paying these high prices for silver is a great way to lose money, especially considering that the contract can be so volatile and expensive if you are incorrect. With this, I like the idea of waiting for some type of value that I can take advantage of in order to profit off of what has obviously been a major shift in trends, and a major breakout overall. I suspect that sometime next year we will make a serious run towards the $50 level again.