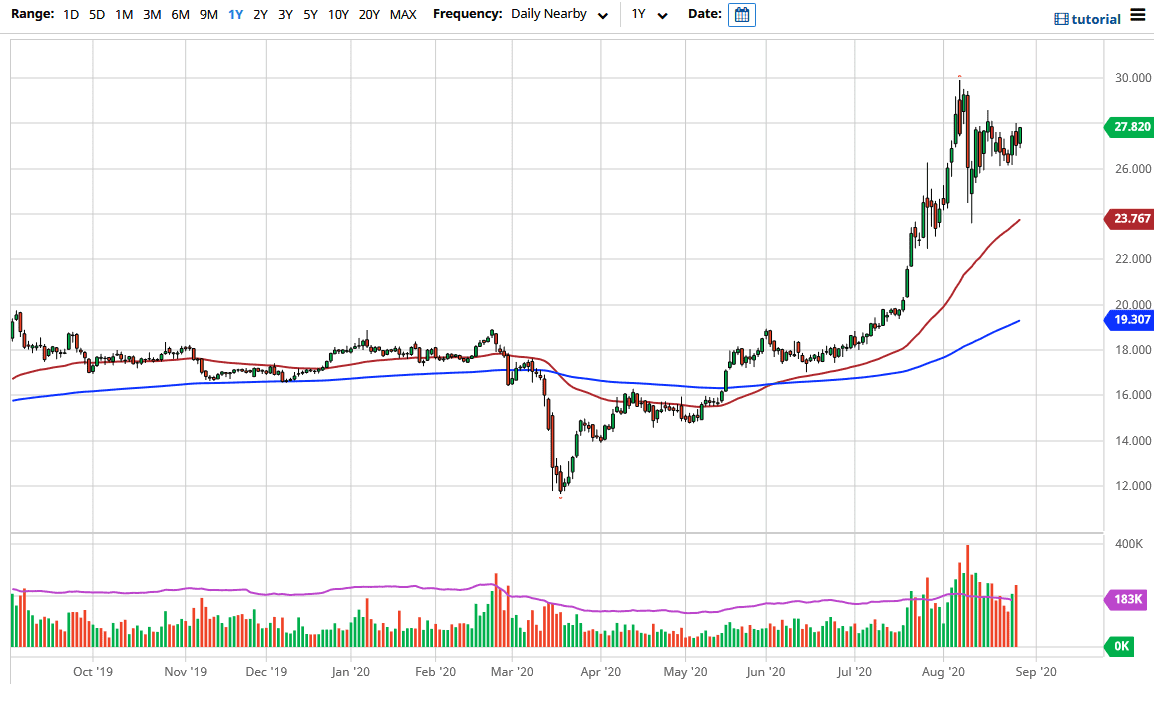

The silver markets have initially pulled back during the trading session on Friday but found enough strength to turn around and rally towards the $28 level. That is an area that has been trouble for buyers recently, and if we can break above there, then it is likely that silver will go looking towards the $29 level, and then eventually the $30 level. The $30 level course has been massive resistance, and I think it makes for a nice target considering what we are looking at as far as the trend is concerned.

To the downside, I think that the $26 level will continue to be massive support, as it has been so reliable. At this point in time, the market is likely to see a lot of buying pressure in that general vicinity, assuming that we can even get down there. Remember, this is about the US dollar, and whether or not we are going to continue to see that currency fall apart. With Jerome Powell suggesting that the bar for interest-rate hikes in the United States is going to be even higher than originally thought, this will continue to put a lot of negative pressure on the US dollar. In fact, central banks around the world are essentially in a “race to zero”, so therefore they will continue to devalue their currencies in order to help exports in a world that do not want them.

In this type of environment, precious metals tend to do rather well, as they are a way to protect wealth. Purchasing power continues to drop around the world, and therefore it makes sense that people will look to buy assets, and silver falls right into that purview. All things being equal, I think that we will go looking towards the $30 level and then eventually break above there. In the short term though, we may have a little bit of choppy trading. Look at pullbacks as an opportunity to pick up silver “on the cheap”, as it is most certainly in a massive uptrend. As far as selling is concerned, I have no interest in doing so, at least not until we break down below the 50 day EMA, which is closer to the $24 level, which we are nowhere near and will not be heading towards anytime soon.