The USD/ARS remains in a long term buying position. However, the dynamics of trading profitably are more complicated so I will explain myself. The government of Argentina has created a deal with creditors which has given it additional time to pay off debt. The challenge is for the nation to now find more capital to take steps forward economically. Unfortunately, a surge of investors are not knocking down the doors looking for opportunities in Argentina. Ladies and gentlemen, Argentina should be a rich country, but because of decades of mismanagement, a staggering amount of its citizens are confronted with poverty.

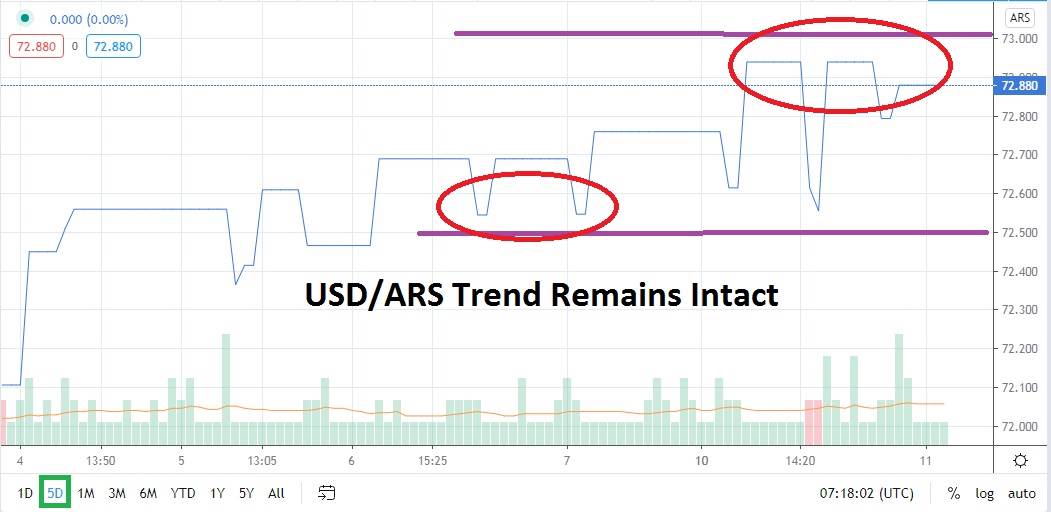

Technically, the USD/ARS looks like a step ladder with a one-way direction upwards as its bullish trend remains intact. However, traders buying the USD/ARS need to have patience, beware of potential spikes downward which can emerge due to a lack of volume in the forex pair’s ‘official’ market and the need to have adequate time parameters for a position to become profitable.

The real exchange rate of the USD/ARS on the streets of Buenos Aires and other Argentine cities remains much higher than the official government rate. The capital markets for finance in Argentina remains under the duress of poorly managed government dictates. Structural financial and economic changes need to be implemented in the nation to help improve Argentina, but unfortunately, there is very little evidence regarding this possibility.

Resistance levels have consistently proven incapable to maintain for the Argentine government’s official rate. The 73.000 level is certainly the next target for traders who use forex platforms to speculate on the movements of the USD/ARS. Targeting the 73.500 juncture as a goal is not a poor decision. However, traders need to understand even though the seemingly one-way avenue of the USD/ARS is bullish, that speculative conditions are still challenging.

Support levels for the USD/ARS have also risen incrementally and speculators should consider using the 72.500 juncture as a stop loss choice. Yes, this support juncture can be broken lower and volatility is a possibility, so pay attention and use a real stop loss, instead of just having one figuratively in your mind.

Buying the USD/ARS remains the easy choice for this forex pair. Traders need to remember patience is the key and they should also be willing to cash in profits when they are made. If a speculator is looking for a violent bullish rally to emerge, they may find themselves challenged by carrying costs when holding the USD/ARS for durations which are not realistic.

Argentina Peso Short Term Outlook:

Current Resistance: 73.000

Current Support: 72.500

High Target: 73.500

Low Target: 72.400