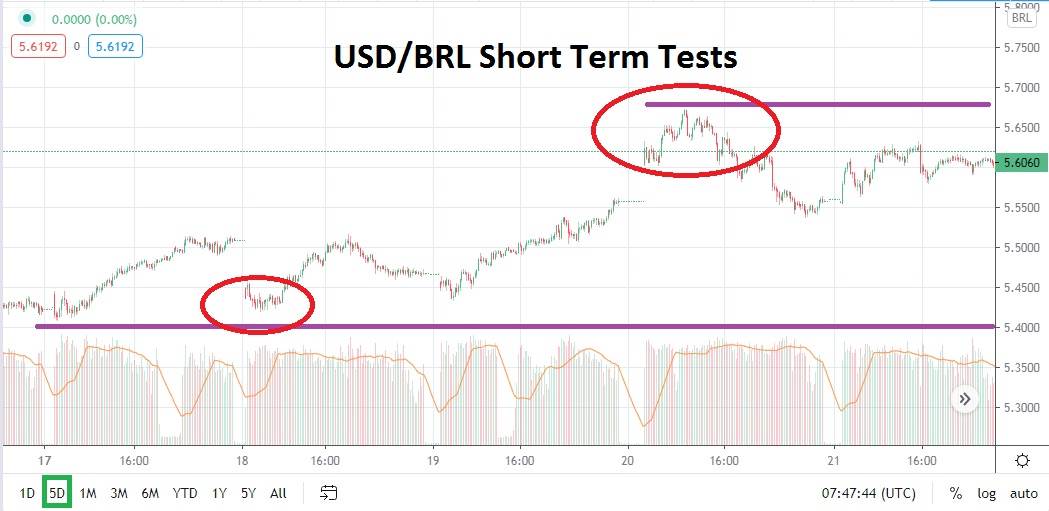

The USD/BRL continues to test important resistance and prove its bullish trend since the last week of July is not a mistake. The value of assets within the marketplace are always correct, no matter how much technical evidence you may have and your perceived ratios indicate, your analysis can be wrong no matter how strong your conviction. The value of the USD/BRL is testing resistance not seen since late May.

Speculators also need to be aware since late July the USD/BRL has consistently seen support levels incrementally get higher. A look at a five-day chart of the Brazilian Real shows it was testing important support near the 5.4000 juncture but could not break its hold and continued to see bullish behavior within the USD/BRL develop. Going into the weekend there seemed to be some selling, but the current price vicinity of 5.6000 to 5.6300 is hovering below important resistance near the 5.7000 mark.

Speculators who are tempted to sell at these levels because they believe the USD/BRL has attained too much-buying momentum cannot be faulted. However, technically the USD/BRL via charts with one month and three-month perceptions do not offer much encouragement for short term sellers. At some point, speculators should ask themselves why the USD/BRL is seeing a bullish trend when many other major currencies have done relatively well against the US Dollar during the same time period? It is a troubling question.

Technical traders who are comfortable with the direction of the USD/BRL may simply choose to continue pursuing the bullish trend within the forex pair unworried. However, traders who have wagered against the emergence of the buying momentum need to consider that ‘smart money’ may know something most players within the forex market do not know. Smart money consists abstractly of government institutions, large corporations, and financial houses. Even though risk appetite globally has been strong the past month the Brazilian Real has not been able to reflect this sentiment and has seen a clear loss of value against the US Dollar.

Yes, the range of the USD/BRL remains within acceptable trading values and has not seen volatile spikes. Incrementally the USD/BRL has shown a consistent amount of buying and it is perched near important resistance untested since late May. Buying the USD/BRL may be speculative, but it may be the position that needs to be pursued short term.

Brazilian Real Short Term Outlook:

Current Resistance: 5.7000

Current Support: 5.5500

High Target: 5.8700

Low Target: 5.2000