Switzerland continues to report relative stability in new Covid-19 cases, and with a second wave of infections a distinct possibility, business leaders warn against reimposing strict lockdown measures. The Swiss government announced an easing of entry restrictions from 21 countries deemed epidemiologically safe. Individuals who are required to quarantine and fail to do so will face a CHF10,000 fine. Economic risks remain globally, adding to the safe-haven appeal of the Swiss Franc. A new breakdown sequence in the USD/CHF is favored to follow the most recent breakout amid faltering bullish momentum.

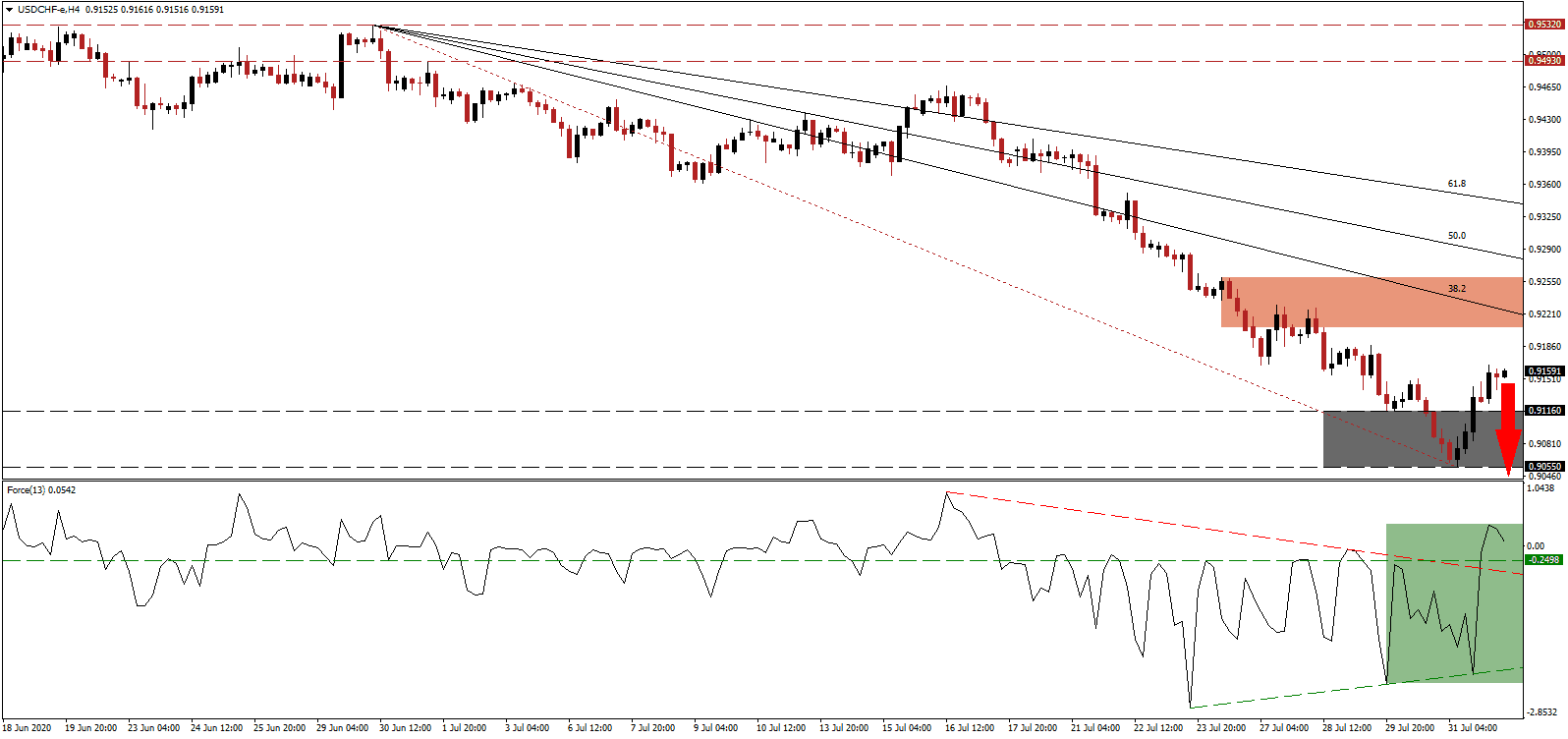

The Force Index, a next-generation technical indicator, confirmed the breakout with a spike above its descending resistance level. It extended through its horizontal resistance level, converting into support, but after moving above the 0 center-line, bullish pressures started to retreat. A collapse into negative territory is expected to increase bearish momentum in the USD/CHF, leading to an accelerated drop below its ascending support level.

Due to the restrictions imposed to slow the spread of the Covid-19 pandemic, hours worked by over 360,000 temporary workers fell by 23% in the second quarter, highlighting ongoing economic pain. The Federation of Staffing Companies remains concerned over the prospects in the second half of 2020. Over 20,000 unemployed receive additional assistance by the government, set to expire at the end of August. The USD/CHF is under intensifying breakdown pressures from its descending 38.2 Fibonacci Retracement Fan Resistance Level. It presently passes through its downward revised short-term resistance level located between 0.9206 and 0.9260, as identified by the red rectangle.

With Swiss tourism and hospitality continuing to struggle, the banking sector performs better than forecast, led by UBS and Credit Suisse. Uncertainty and volatility remain elevated, while the next semi-annual foreign exchange report by the US Treasury could label Switzerland a currency manipulator. Despite costly market interference by the Swiss National Bank, the currency remains in strong demand. The USD/CHF is anticipated to correct below its support zone located between 0.9055 and 0.9116, as marked by the grey rectangle. An extension into its next support zone between 0.8831 and 0.8889 is likely.

USD/CHF Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 0.9160

- Take Profit @ 0.8890

- Stop Loss @ 0.9210

- Downside Potential: 270 pips

- Upside Risk: 50 pips

- Risk/Reward Ratio: 5.40

More upside following the breakout in the Force Index above its descending resistance level could allow the USD/CHF to drift higher. US initial jobless claims are trending higher, the Covid-19 pandemic remains out of control with testing issues on the rise, and the US Congress remains far apart on a fifth stimulus bill. Forex traders are advised to sell any rallies, which are limited to the descending 50.0 Fibonacci Retracement Fan Resistance Level.

USD/CHF Technical Trading Set-Up - Limited Breakout Extension Scenario

- Long Entry @ 0.9235

- Take Profit @ 0.9275

- Stop Loss @ 0.9210

- Upside Potential: 45 pips

- Downside Risk: 25 pips

- Risk/Reward Ratio: 1.80