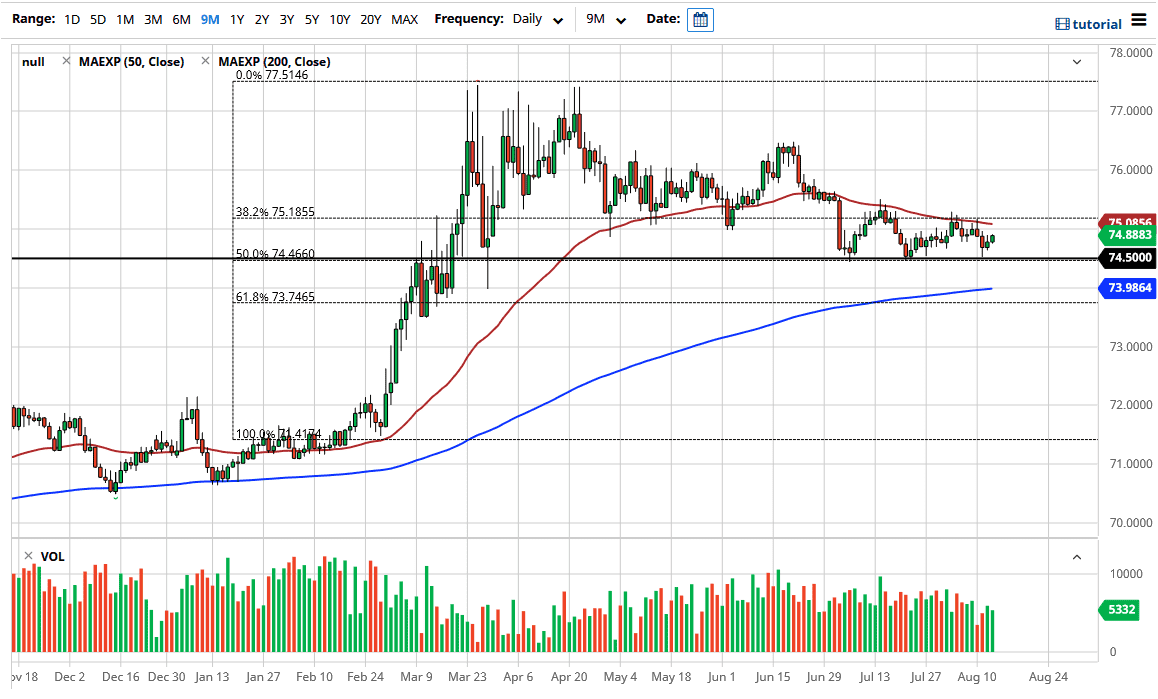

The US dollar has rallied a bit during the trading session on Thursday, as we have broken above the ₹74.88 level during the session. At this point on, it is likely that the market will continue to go looking towards the 50 day EMA which is just above, and then possibly the ₹75.25 area where I anticipate seeing pressure. Looking at the candlestick, it is obvious that there is more bullish pressure than bearish in the short term, but I think really what we are paying attention to now more than anything else is the “squeeze” that is going on. The ₹74.50 level is an area that has been very supportive as of late, so if we can break down below there it is likely that this pair will go looking towards the 200 day EMA, which is currently trading at the ₹73.98 level.

It does not take a lot of imagination to notice that we might possibly be looking at a descending triangle, but overall this is a market that I think will continue to see a lot of sideways action in the short term, if for no other reason than the fact that we are heading in the vacation season for large firms, as this is not typically a retail driven market.

Beyond that, there are a lot of questions as to which is going to drive this market further, the Federal Reserve flooding the markets with greenbacks, or the coronavirus cases in India? At this point, it looks like the market does not really know what to do yet as we are essentially stuck in this general vicinity. The market participants continue to be very short term driven at this point, so if you are a short-term trader, this might open up opportunities for you in this pair. I would not put too much into any position though, because this pair tends to be somewhat thin at times, so a sudden announcement could give you a major shock.

If the US dollar does break down below the ₹74.50 level, that would probably signify that the US dollar was going to fall harder against some of the major currencies, as emerging market currencies are certainly suffering at the hands of the virus around the world, and of course the slowing economic conditions globally. However, the emerging market currencies could be one of the big movers because they have been lagging overall.