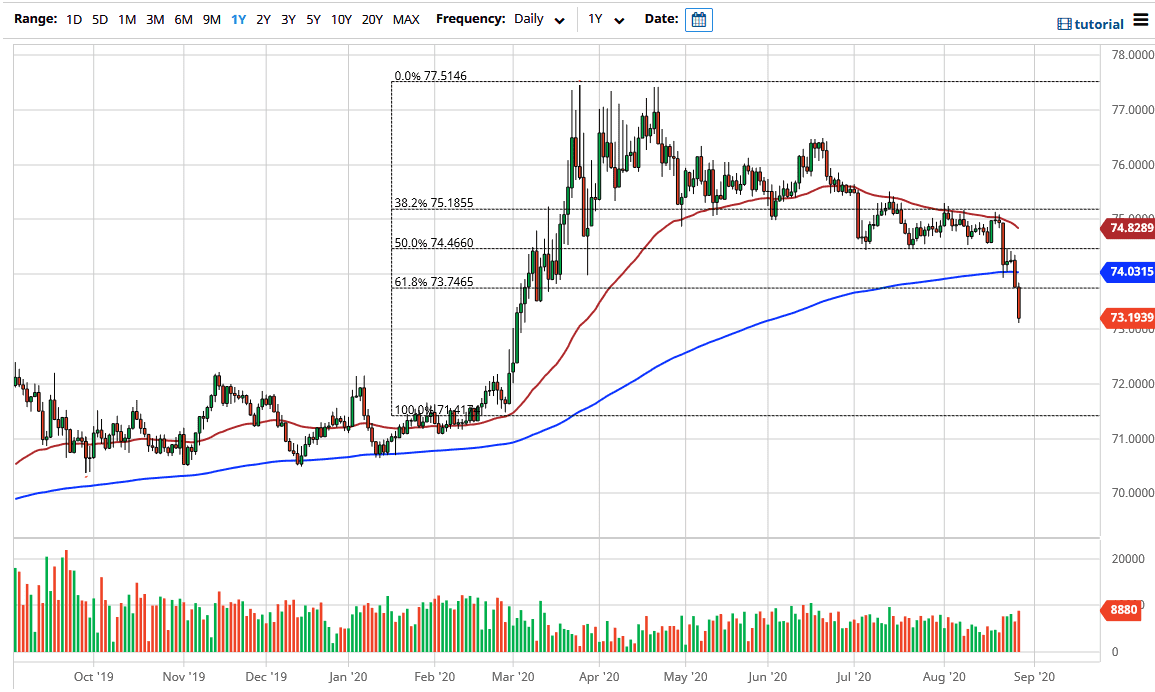

The US dollar has broken down significantly during the trading session on Friday again as Jerome Powell on Thursday suggested that the bar to raising higher interest rates was even higher than it had been previously. This has had an extremely negative effect on the US dollar, and it is even starting to be seen in the emerging markets. The Indian rupee has strengthened towards the ₹73 level and is now comfortably below the 200 day EMA. Furthermore, we have even broken down below the 68.1% Fibonacci retracement level, so it is very likely that we will try to wipe out the entirety of the previous uptrend.

Rallies at this point should run into trouble near the ₹74 level, which was the latest clustering of trade. Until we would break above the ₹75 level, you would have to assume that the downtrend will continue, as the bottom has started to fall out. Looking at this chart, it is very likely that if we wipe out the ₹73 level, we will drop another big handle rather quickly. Ultimately, this will be exacerbated by any type of recovery in India, which of course is coming down the road.

At this point, the impulsive move lower should have most people think in the same thing, so I think at this point in time any rally that comes down the road people who were long will be more than willing to get out of the market as it gives them an opportunity to escape. Beyond that, people who have missed the move, including me, will be more than willing to short if we get any pop. In other words, this is a massive shift in sentiment, which makes quite a bit of sense considering that the Federal Reserve is now going to use the “average of inflation” to make a decision as to when to raise interest rates, meaning that they may never do so again. It looks as if the currency markets have caught on to this, and it is only a matter of time before we continue to see a lot of US dollar selling. This is probably just the beginning of a major shift in attitudes, and this could bring in massive amounts of inflation so pay attention to gold, because it will give you an idea as to just how weak the greenback has become.