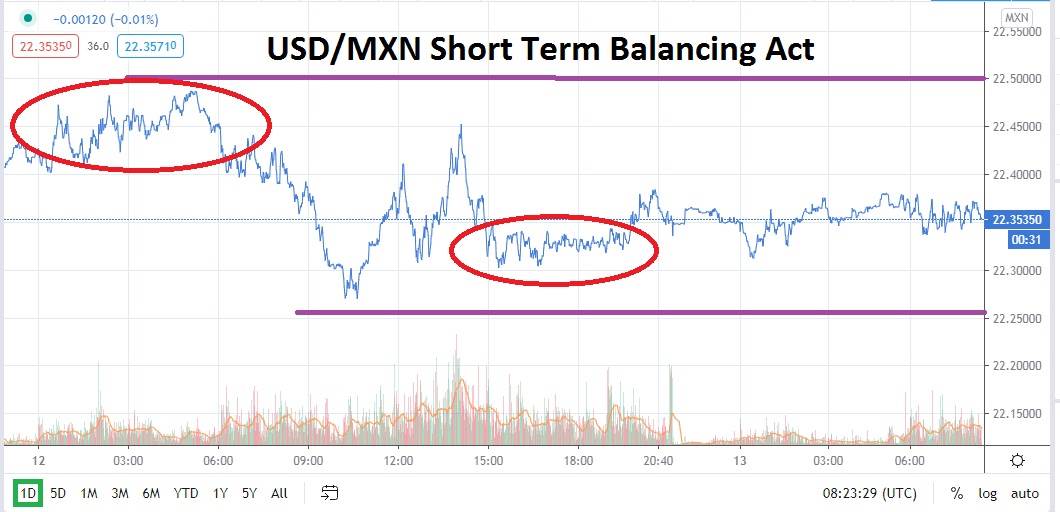

Choppy trading has been a hallmark of the USD/MXN the past month of trading as speculators have had to deal with consistent tests of support and resistance levels. The forex pair has traded approximately between 21.82000 and 22.85000 since the second week in July. With its trading range, the past day between 22.27000 and 22.48000, the USD/MXN on the surface has provided rather tranquil price action.

However, as always the USD/MXN is susceptible to sudden volatility which moves the pair in a rather quick manner. Yesterday’s trading in the forex pair did see rather strong surges and reversals dominate. Risk appetite in the global equity indices is high and optimistic as of this morning, US equities via the future markets appear to be positive going into today’s trading, and some Mexican equities have produced solid gains the past month.

What should intrigue speculators about the USD/MXN today is that it is nearly within the middle of its one-month price range. Importantly since the 4th of August bearish momentum has been strong and resistance levels have incrementally decreased as support levels have been targeted. The 22.30000 juncture which is slightly below current price values should be watched. If this support level is broken and the USD/MXN trades lower the critical inflection point for the forex pair of 22.25000 could produce fireworks.

If the USD/MXN support at the 22.25000 level is sustained and the bearish trend continues to show momentum, traders will believe it is possible for late July values to be tested again. The last few days of trading in July and the first few days of August saw the USD/MXN trade within in range of 21.90000 and 22.20000. This range did see a reversal and spike higher occur. However, speculators may suspect that bullish sentiment for the USD/MXN may continue to be diminished under present market conditions.

Selling the USD/MXN within a price range of 22.35000 and 22.40000 may be the tempting trade for speculators short term. Risk appetite appears to be showing some teeth and technically the Mexican Peso has potential to traverse lower. Traders who ask themselves where the greatest reward is ahead short term for the USD/MXN may believe shorting the pair carries the best possibility for a stronger move.

Mexican Peso Short Term Outlook:

Current Resistance: 22.55000

Current Support: 22.30000

High Target: 22.60000

Low Target: 22.25000