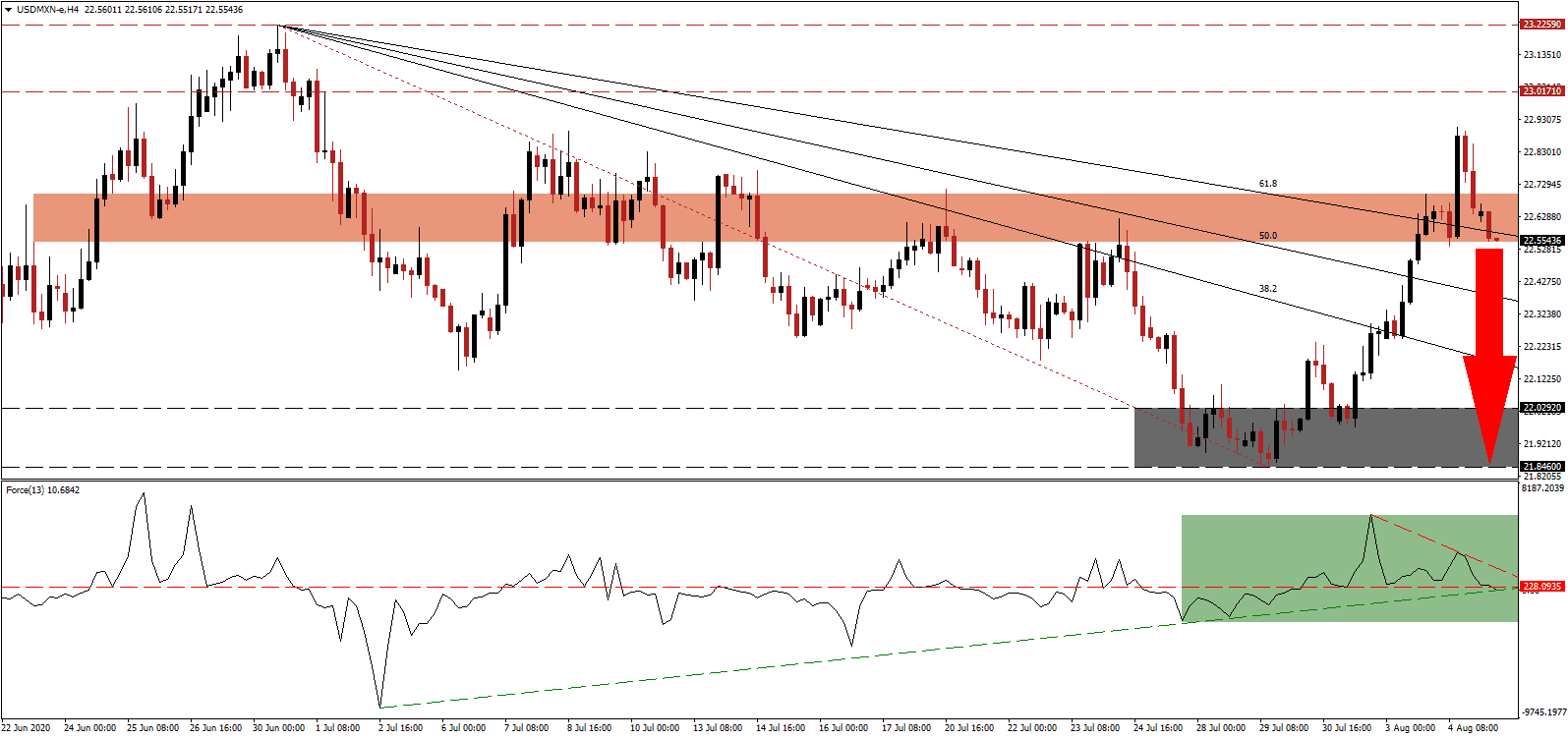

Gabriel Yorio, the Deputy Finance Minister of Mexico, remains confident that the economy will expand in the third quarter of 2020 following the record 17.3% plunge in the second quarter. He expressed optimism that, without a second Covid-19 infection wave and a vaccine, Mexico will reach pre-pandemic economic levels by 2022. Since a global secondary wave of infections is forecast and a vaccine unlikely, his remarks are based on misplaced optimism. The USD/MXN accelerated to the upside amid a necessary short-covering rally. It pierced its short-term resistance zone temporarily before price action collapsed.

The Force Index, a next-generation technical indicator, started to retreat while this currency pair entered the end-phase of its advance. A negative divergence materialized, and the descending resistance level is adding to bearish pressures. It resulted in a move below its horizontal resistance level, and the Force Index is now challenging its ascending support level, as marked by the green rectangle. Bears will regain complete control over the USD/MXN once this technical indicator moves below the 0 center-line.

A new forecast by the Secretaría de Hacienda y Crédito Público (SHCP), the finance ministry of Mexico, shows a 2020 GDP contraction of 7.4%. It also predicts oil production, one essential revenue generator for the Mexican government, at 1.744 million barrels per day, and an average price of $34.40. Per SHCP, tax collection decreased during the lockdown, but the government has ample reserves to avoid issuing more debt. Breakdown pressures on the USD/MXN rose sharply after retreating inside its short-term resistance zone located between 22.5481 and 22.6976, as marked by the red rectangle.

President López Obrador pledged no tax increase and debt issuance, suggesting his government will manage the pandemic by deploying resources to priority sectors, cutting wasteful spending, and eliminating corruption. Remittances provide a much-needed boost to the economy and rose in June and July by 6.8%. July's formal job losses clocked in at 3,430, but millions of informal positions vanished due to the pandemic. Following a move in the USD/MXN below its descending 61.8 Fibonacci Retracement Fan Resistance Level, price action is poised to accelerate into its support zone located between 21.8460 and 22.0292, as identified by the grey rectangle.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 22.5550

Take Profit @ 21.8550

Stop Loss @ 22.7750

Downside Potential: 7,000 pips

Upside Risk: 2,200 pips

Risk/Reward Ratio: 3.18

Should the Force Index eclipse its descending resistance level, the USD/MXN may attempt to seek more upside. Forex traders should consider any price spike as a secondary short-selling opportunity. US employment data weakened in July, and a full recovery is forecast to take years. While negotiations for the fifth stimulus package stalled in Congress, it is likely to be passed as soon as this week, adding more debt to the unsustainable total. The Upside potential is reduced to its resistance zone located between 23.0171 and 23.2259.

USD/MXN Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 22.9250

Take Profit @ 23.1500

Stop Loss @ 22.7750

Upside Potential: 2,250 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.50