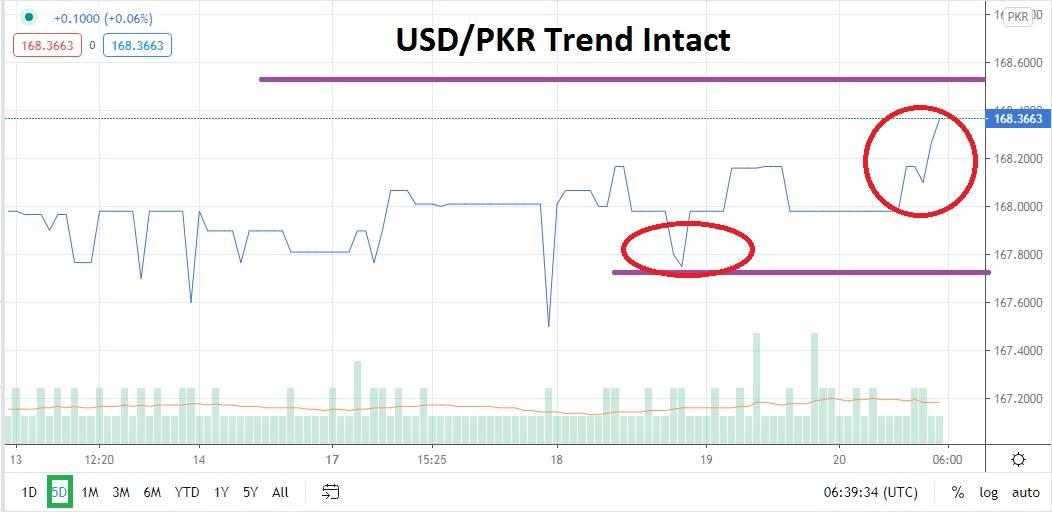

The Pakistani Rupee is challenging important resistance in early trading today. The mark of 168.4000 is acting as a touchstone above while the 168.0000 juncture below seems to be creating a base of support. The long term trend of the USD/PKR has produced a significant bullish trend and this trajectory shows little evidence of changing anytime soon. A target of 169.0000 is certainly being eyed by bullish traders who have watched the USD/PKR trade, but attaining this value may take a long time.

Speculators who wish to take advantage of the buying momentum in the USD/PKR need to have the ability to hold onto their positions and let this forex pair move at its own pace. While it would seem quite easy to say the Pakistani Rupee is a volatile currency to trade – and it is true – it also needs to be said that pursuing upwards momentum needs to be done with a steady dose of stamina.

The USD/PKR has shown the ability to reverse lower and support levels near the 167.6000 mark were challenged just a couple of days ago. However, after hitting the low water mark, a progressive reversal higher ensued rapidly. Current support for the USD/PKR appears to be the 167.7000 level, but a decision to use stop losses below at the 167.5000 could prove to be the right decision.

In order to trade the Pakistani Rupee, a trader should consider the amount of leverage they are using wisely. The amount of movement in the USD/PKR is rather large considering the number of basis points the forex pair is capable of jumping when price action does occur. The trading volume within the USD/PKR is not significant, so when prices do change they happen rapidly and often with a spike.

If a speculator chooses to buy the USD/PKR they should continue to use limit orders. While the Pakistani Rupee is battling important resistance, it could prove a better choice to wait for the USD/PKR to move lower and buy around the 168.0000 level if possible. Experienced traders must guard against their desire to place a market order for the Pakistani Rupee because it is hard to predict the value you will be given when entering your trade.

One possible way to confront volatile market orders via a forex broker’s platform is to see if you can enter a market order by the telephone and ask for a quoted price before entering the market. However, first, you have to have a broker who accepts phone orders, and second, they will ask for your decision to enter the trade very quickly, you will not be given a lot of time to make your trading decision.

Pakistani Rupee Short Term Outlook:

Current Resistance: 168.6000

Current Support: 167.7000

High Target: 169.0000

Low Target: 167.5000