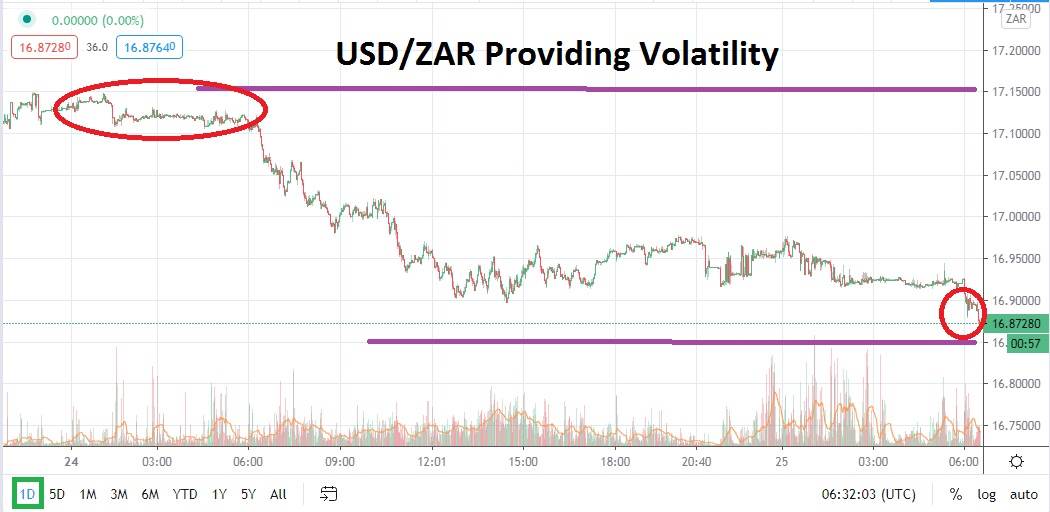

The USD/ZAR’s bearish trend certainly has generated more power since late last week. After challenging the important 17.10000 support barrier last Friday, the South African Rand continued to see selling of the USD/ZAR yesterday. The 17.10000 level was vanquished quickly and then the 17.0000 mark was punctured lower. Speculators within the USD/ZAR have had their endurance and perceptions tested the past month.

This morning’s early trading has battled support levels and technical traders will note the last time the current price vicinity was fought over was the end of July. After reaching low water marks around the 27th of July, the USD/ZAR reversed higher and peaked slightly below the 17.8000 juncture on the 10th of August. This short term bullish behavior happened as the price of gold traversed record territory, which it must be pointed out didn’t match speculative correlations which would have assumed a strong South African Rand would be seen.

It is important to note the reversal and reemergence of the USD/ZAR’s bearish trend since the 10th of August has also occurred as the value of gold has come receded from its high water marks. This morning’s price range for the USD/ZAR has largely been between the 16.87000 and 16.93000 junctures with fast trading conditions prevailing.

Volatility will likely continue within the USD/ZAR as the forex pair searches for equilibrium. The rapid price action within the USD/ZAR the past week may have caught some speculators by surprise, but resistance marks have been incrementally decreasing the past two weeks of trading. A one month chart of the South African Rand should be examined closely and traders need to look at the last week of July. After hitting support near the 16.40000 level a strong reversal was experienced.

South Africa remains challenged by coronavirus and its headwinds have inflicted economic hardships which will be felt for the next year. The nation also has a reputation for a lack of transparent governance. The strong bearish trend which has emerged since the 10th of August should be looked at carefully by technical traders.

Speculator may be tempted to think the bearish trend of the USD/ZAR will not be sustained and it is a logical conclusion. However picking the spot for a reversal higher may prove difficult. Traders with a taste for speculation may want to enter buying limit orders near the 16.85000 vicinity and look for short term reversals, but taking advantage of reversals higher while a bear trend seemingly continues may prove difficult. Quick trades in the USD/ZAR should be sought, limit orders using take profit and stop loss positions should be practiced.

South African Rand Short Term Outlook:

Current Resistance: 17.00000

Current Support: 16.80000

High Target: 17.20000

Low Target: 16.70000