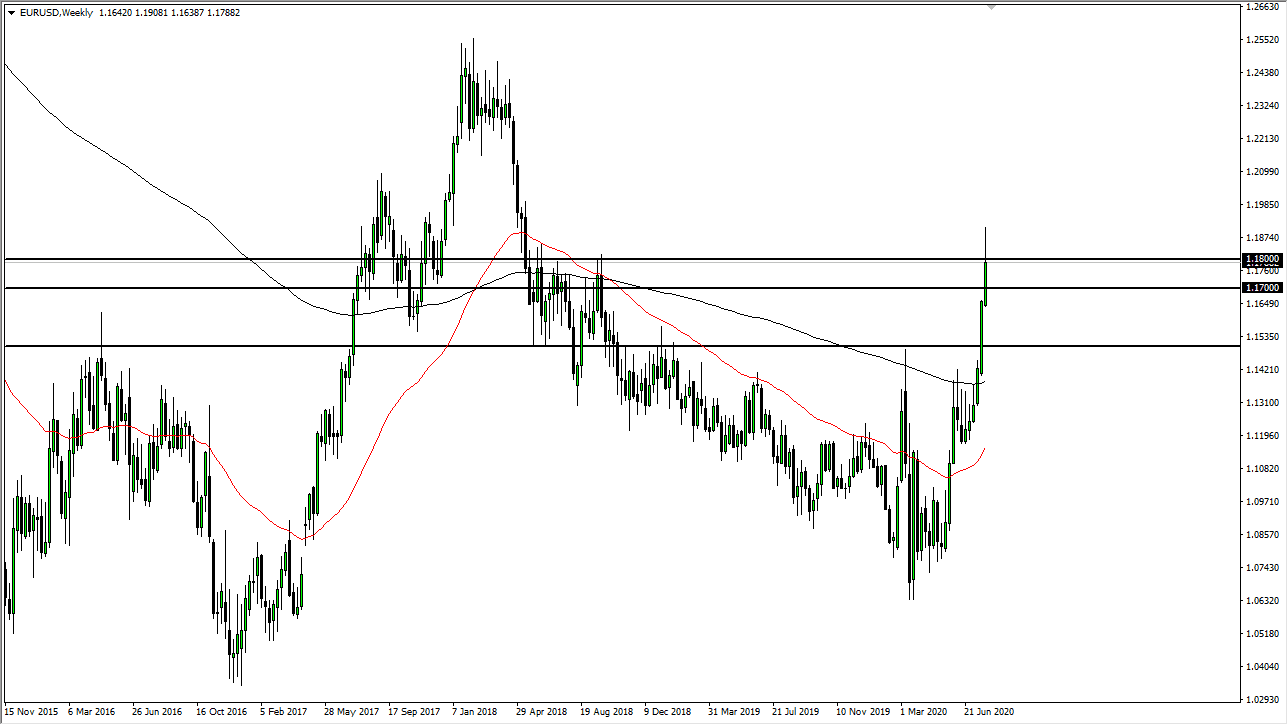

EUR/USD

The Euro has had another bullish week, but perhaps stretched itself a little too far for comfort. In fact, Friday was a very ugly day, as perhaps people started to realize that the overextension was going to cause massive problems. Nonetheless, I think that if we pull back from here there will be buyers underneath. The 1.17 level is an area where I would anticipate some buying pressure, just as I would at the 1.16 level, followed by the 1.15 level which I have as a “floor” in the market. We may have a day or two of selling ahead, but then the trend should resume.

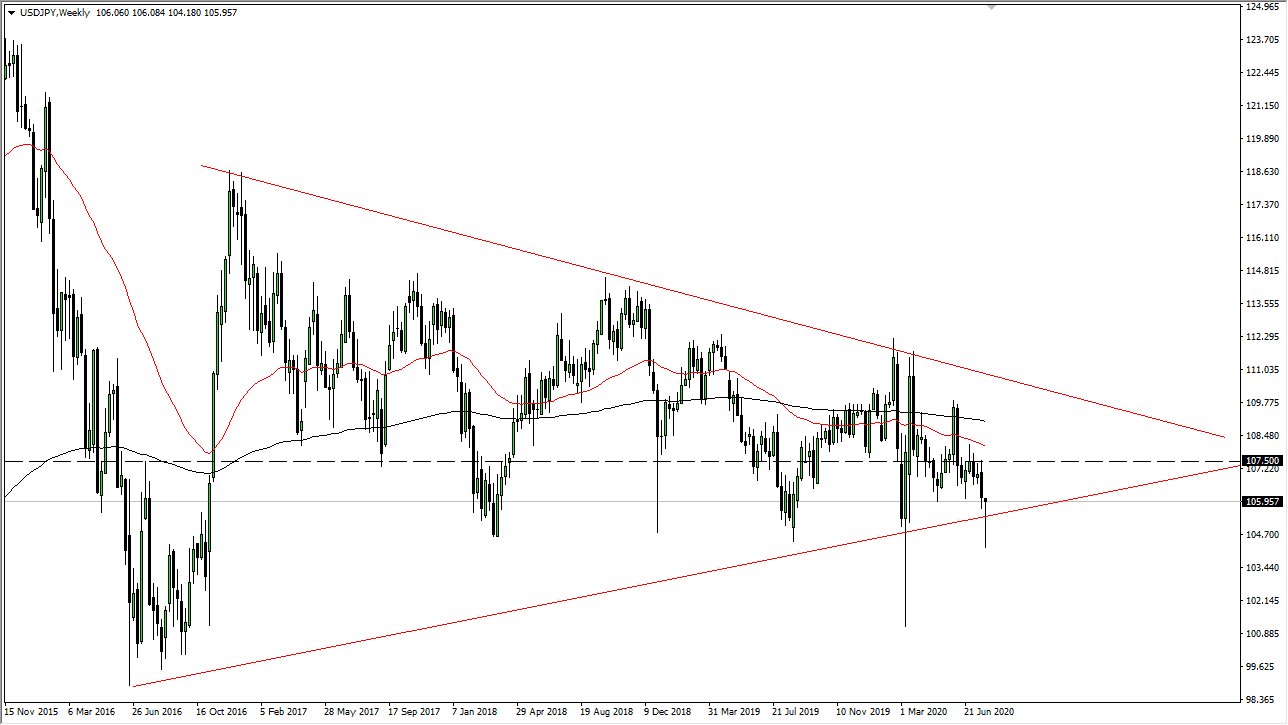

USD/JPY

The US dollar was quite impressive against the Japanese yen on Friday, exploding to the upside and attacking the ¥106 level. That being said, the question now is whether or not there is any momentum here? If we do rally, I anticipate that the ¥107 level should be resistant, extending to the ¥107.50 level. Although the weekly candlestick is rather impressive, I still believe that there are plenty of reasons to short this market on signs of exhaustion. To the downside, the ¥105 level will attract a certain amount of attention yet again.

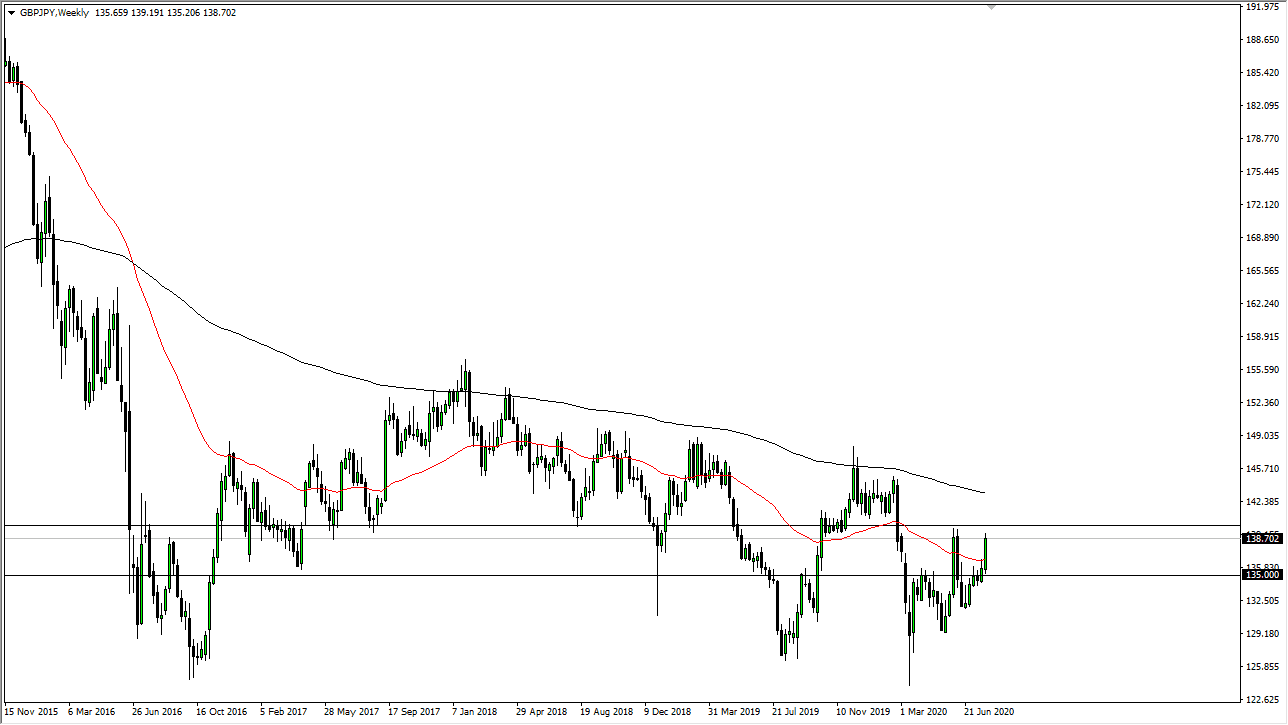

GBP/JPY

The British pound exploded to the upside against the Japanese Yen yet again, as we have attacked the ¥139 level. This is an area that we have seen selling in the past so I would welcome any pullback as a potential buying opportunity at lower levels. Of particular interest for me right now is the ¥137.50 level, where I see support on short-term charts. I do not have any interest in shorting this market, because quite frankly we have seen such massive buying pressure. A break above the ¥140 level opens up the door towards the ¥145 level. That being said, I think that we need to pull back a bit before we get that move.

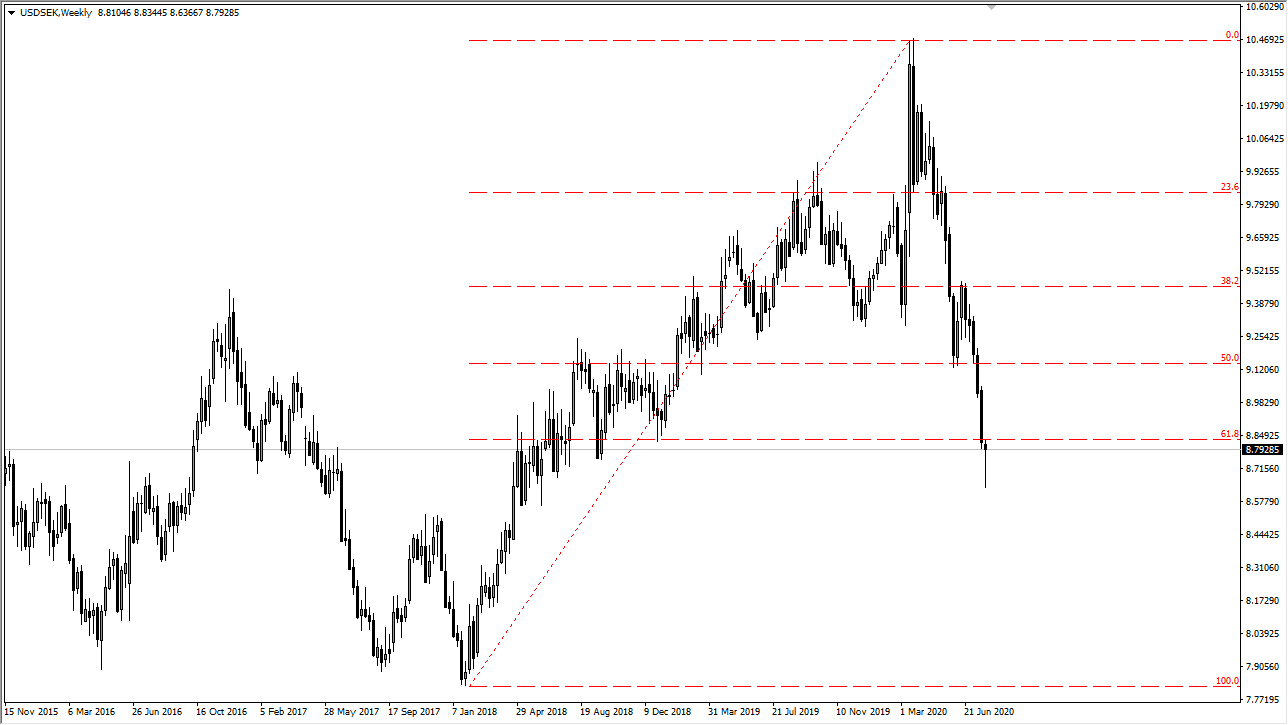

USD/SEK

This chart is a bit different because it goes against the grain of a lot of what I am seeing around the world, as the US dollar looks like it could be due for a major rally. A break above the 8.85 level opens up a move towards the 9.15 SEK level at the very least. If we break down below the bottom of the candlestick for the week, that will almost undoubtedly send in massive amounts of selling. It is worth noting that we are sitting at the 61.8% Fibonacci retracement level, an area that attracts a lot of attention and we are oversold, to say the least. Out of all of the potential pullbacks in US dollar selling, this may have the biggest move potential.