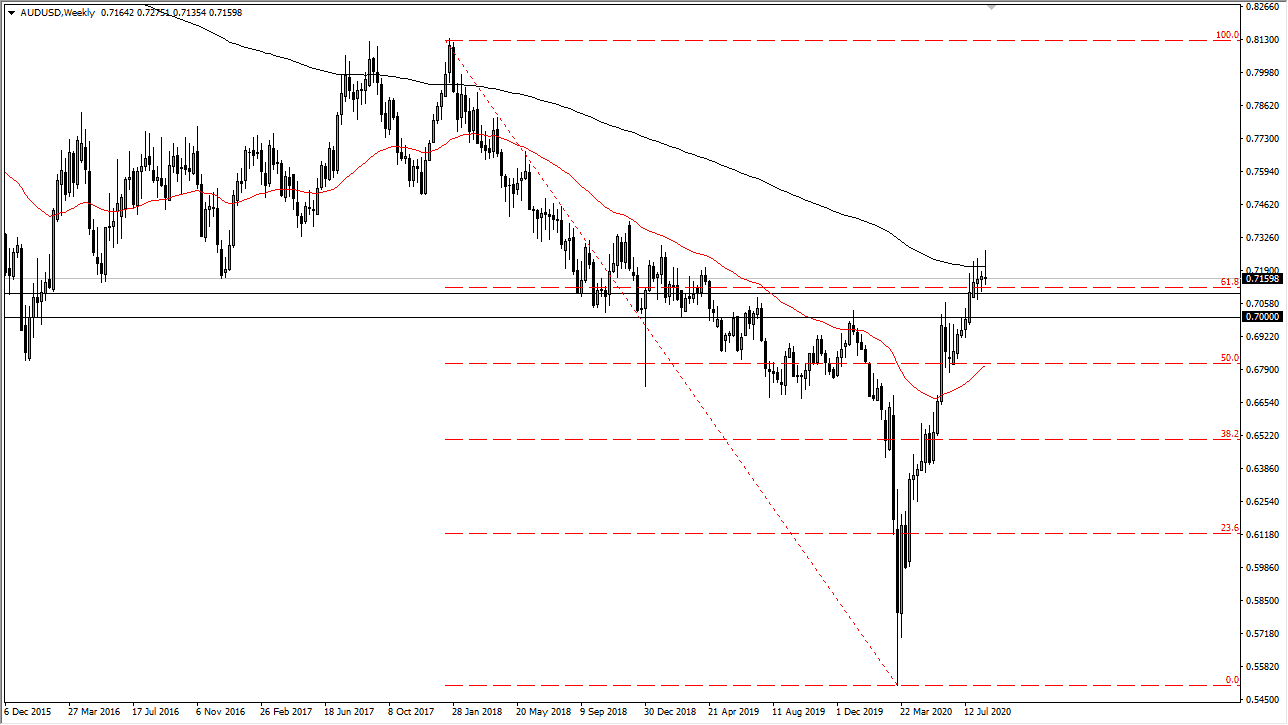

AUD/USD

The Australian dollar rallied during most of the week, but then gave back all of those gains. At this point, it looks as if the 0.71 level underneath begins a significant amount of support out to the 0.70 level. Because of this, I think that we will see another week of choppiness in this market as we try to figure out where we're going to go for the fall. After all, we are in the midst of vacation season, so I think we will stay in the same general vicinity in order to build up the momentum necessary to make the bigger move. For what it is worth, the 200 week EMA is slicing through the middle of the candlestick for the week.

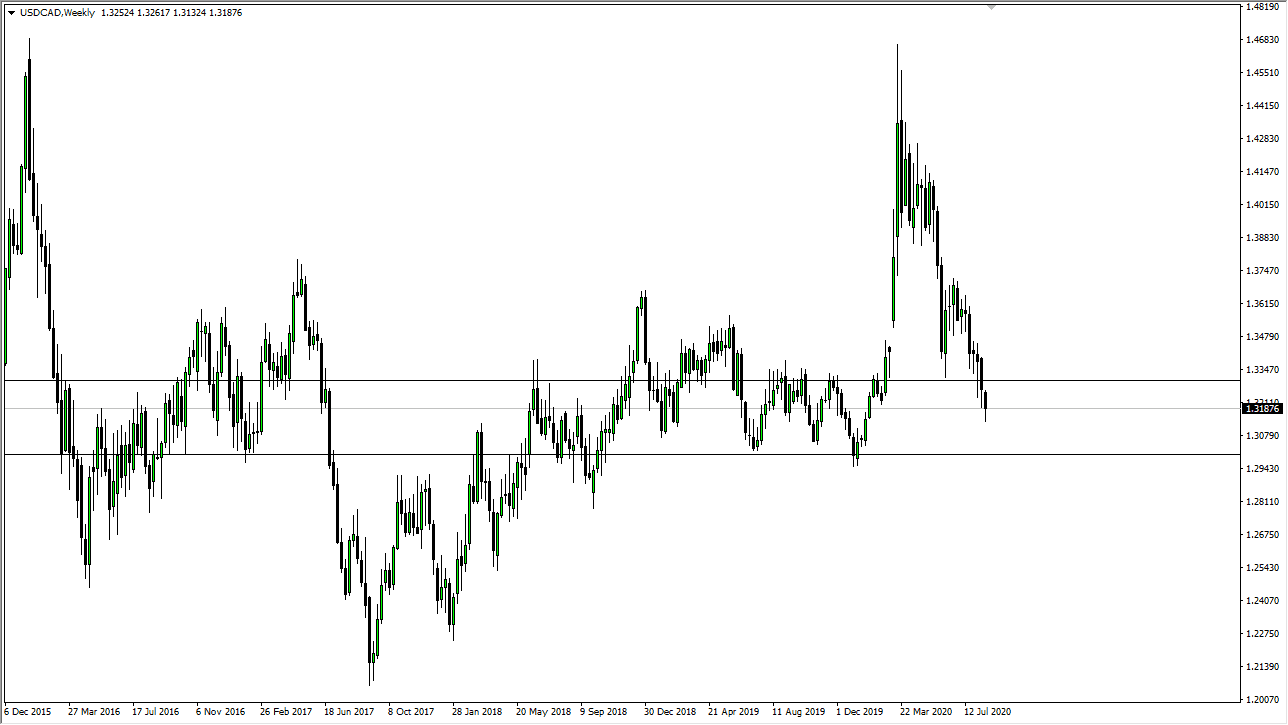

USD/CAD

The Canadian dollar has strengthened during most of the week against the greenback, and now I think it is only a matter of time before the buyers get involved and try to push this market higher. I do not know this is a longer-term breakout, but right now it seems as if there is a significant amount of support in this area that will probably send the dollar higher. For what it is worth, the US dollar has been strengthening on the back half of the week, so I think that going into this week we may see a bounce towards the 1.33 handle. If we can break above there, the market should go much higher. Otherwise, we will experience choppiness more than anything else.

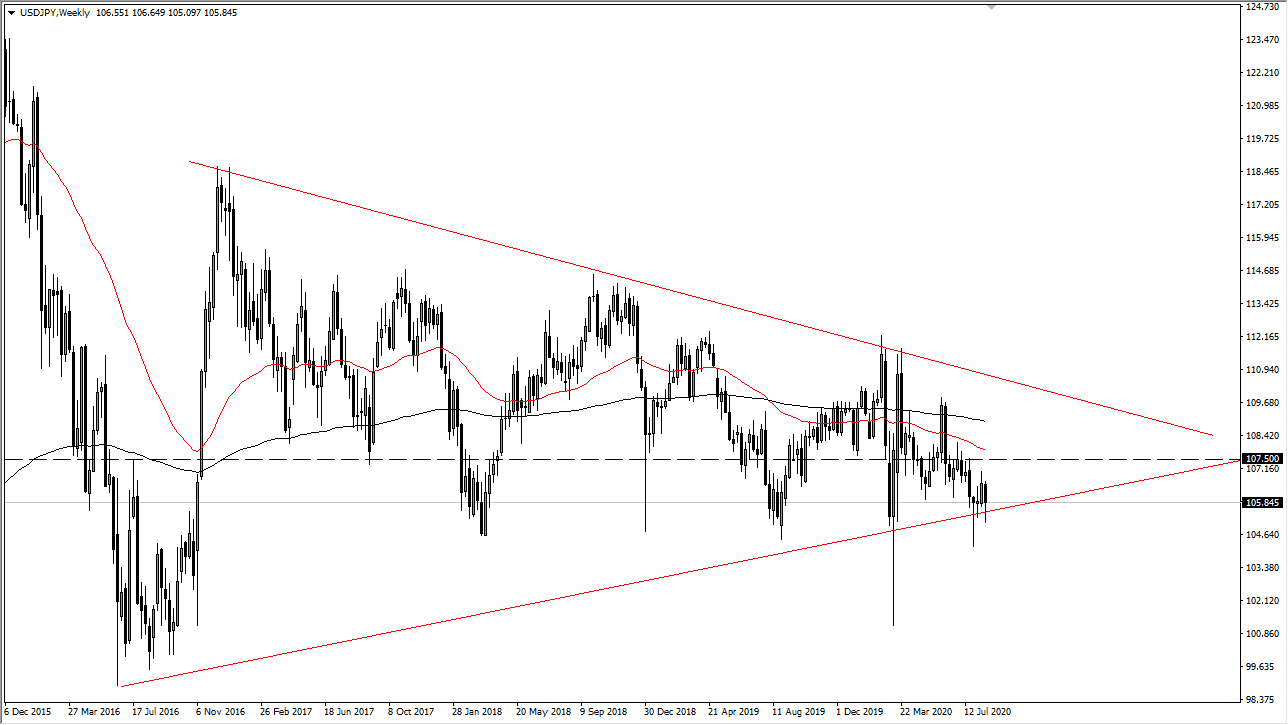

USD/JPY

The US dollar has fallen during the course of the week, breaking below the ¥105.50 level at one point, before turning around to show signs of support. Ultimately, this is a market that looks like it could rally a bit from here and go looking towards the ¥107 level. That is an area that begins massive resistance extending all the way to the ¥107.50 level, and I think that signs of exhaustion in that area will continue to be sold into. The Federal Reserve continues to flood the market with greenbacks, so although we may get a little bit of a relief rally, I do not know that this changes anything from a longer-term standpoint.

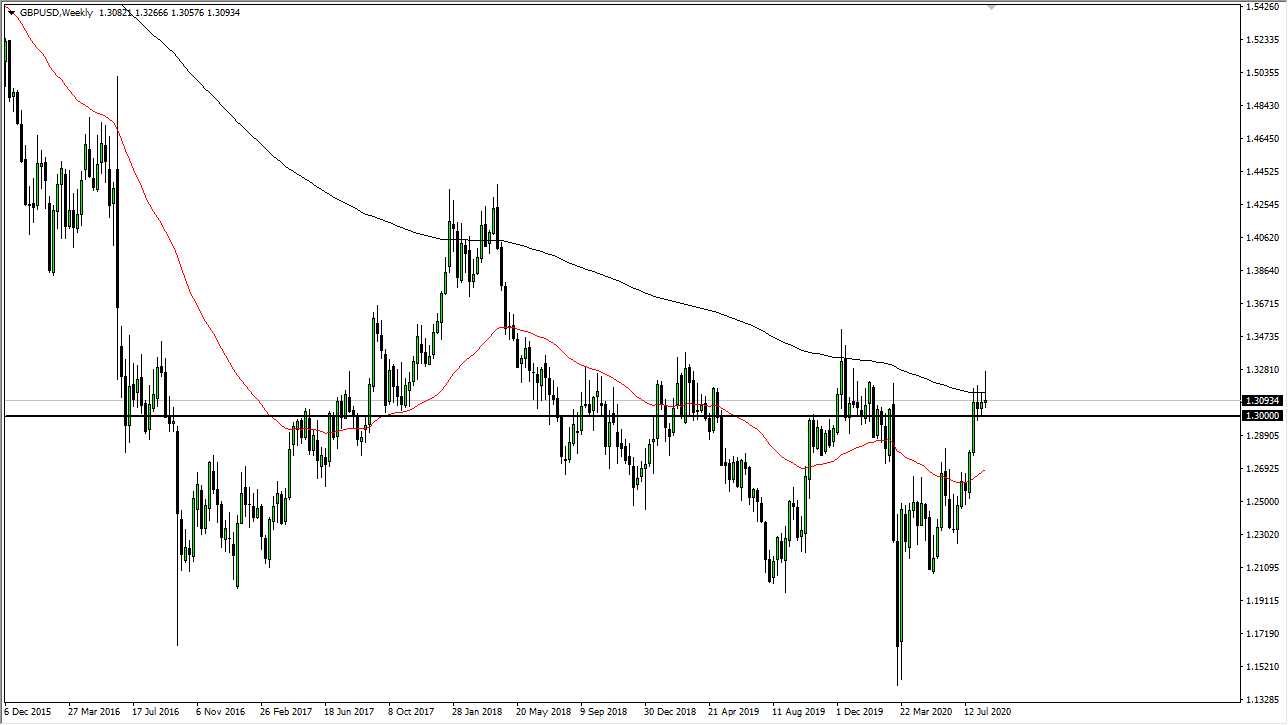

GBP/USD

The British pound initially tried to rally during the course of the week, breaking above the 200 week EMA, however, we have given back all of the gains to show signs of exhaustion. I still think there is a significant amount of support near the 1.30 level, so I think although the candlestick for the week looks rather dire, the reality is there is a lot of support underneath here as well. This simply means that we are not quite ready to continue going higher for the longer term. The back-and-forth is the most likely scenario.