The West Texas Intermediate Crude Oil market has done almost nothing over the last several days, other than to grind sideways and drift slightly higher. However, this is a market that certainly is not that impressive considering we just had a hurricane rip through one of the largest oil-producing regions in the world. The fact that oil production was shut down in the Gulf of Mexico and we barely moved tells you that although the oil market is slightly bullish, the reality is that there is not any hint of excitement. With that being said, it is a slow grind so that is the only way you can play this market in the short term.

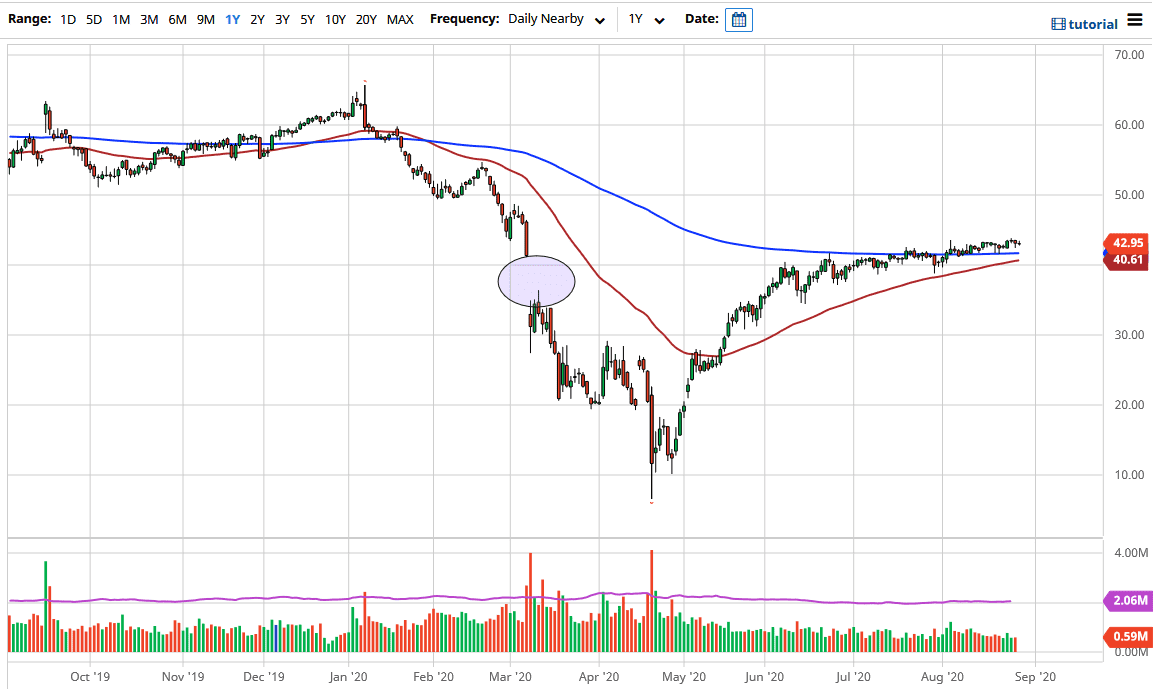

Underneath, the 200 day EMA is going to offer plenty of technical support, and now we are starting to see the 50 day EMA finally grinding towards that level as well. To the upside, I think that we are going to go looking towards the $49 level, which is the beginning of a sell-off, which extends to the $50 level. In other words, I think we will go trying to find that supply area before selling off again. That being said, if we were to break down below the $40 level, then the market could break down towards the $35 level, possibly even the $30 level if things get truly ugly. However, without a doubt, the biggest help to the crude oil market right now is the fact that the US dollar continues to fall in value. In other words, it is as if supply and demand does not even matter, at least at the moment, because the US dollar is falling apart.

I do believe that we are going to continue to see a lot of questions asked about the demand for crude oil, which has not been exactly strong. If a hurricane cannot get crude oil a rally, I am not really sure what will do that seemingly impossible task at the moment. If the global economy continues to be very slow, that is also going to work against the value of crude oil. We have plenty of supply out there, even though OPEC has stuck to cutting production rather stringently. If they were doing that, oil would probably be $20 lower at this point.