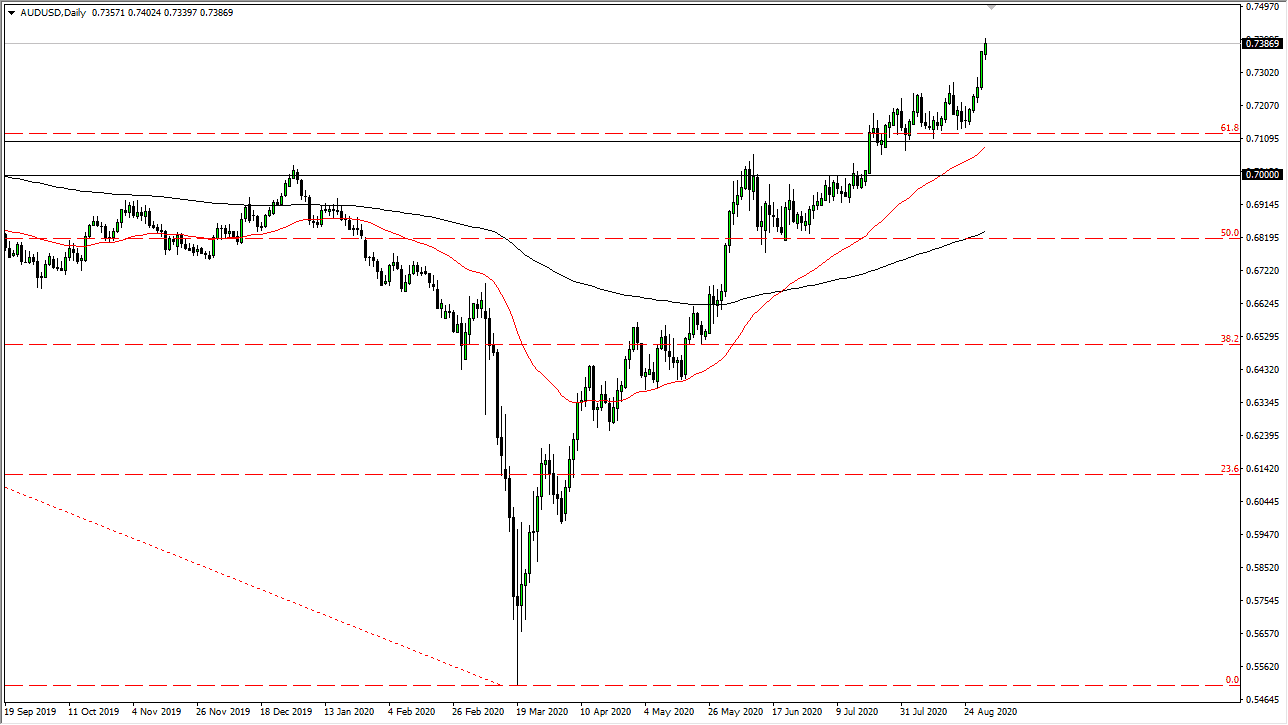

The Aussie dollar continues to look very strong, as we have broken above the top of a massive bullish candle from the previous session. By kicking off the week the way we have, it suggests that perhaps we have much further to go, and we did see a significant break out on Friday. With that being the case, I like the idea of buying the Aussie dollar on short-term pullbacks, because it has much further to go.

Based upon the recent structure, I believe that the 0.71 level is now your “floor in the market” that extends down to the 0.70 level. To the upside, I believe that the market is going to go looking towards the 0.75 handle, followed by the 0.80 level. In other words, we have much further to go but we may get the occasional pullback that comes into play and pushes traders into the market based upon “FOMO.” We have been in a major uptrend over the last couple of months, as the Federal Reserve has completely changed its criteria to raise rates. In other words, it looks as if the Federal Reserve is going to continue to be extraordinarily loose with monetary policy, so over time the US dollar most certainly will continue to suffer for it. Ultimately, I think what we are going to see is a lot of volatility, but clearly a lot of buyers on dips. The Australian dollar not only has the benefit of not being the US dollar, but it also is highly influenced by gold at times, and that has been a very strong market to deal with.

As far as selling is concerned, I do not have a scenario in which I’m willing to do it anytime soon, but I suppose if we break down below the 200 day EMA, it then I would more than likely consider it. Until then, and unless something happens in Australia, I cannot imagine a scenario where the Aussie dollar takes a serious beating against the greenback. Furthermore, we are going to get a job summer at the end of the week, so it is likely we will continue to see more people trying to get ahead of any type of bearish news coming out of the Bureau of Labor Statistics.