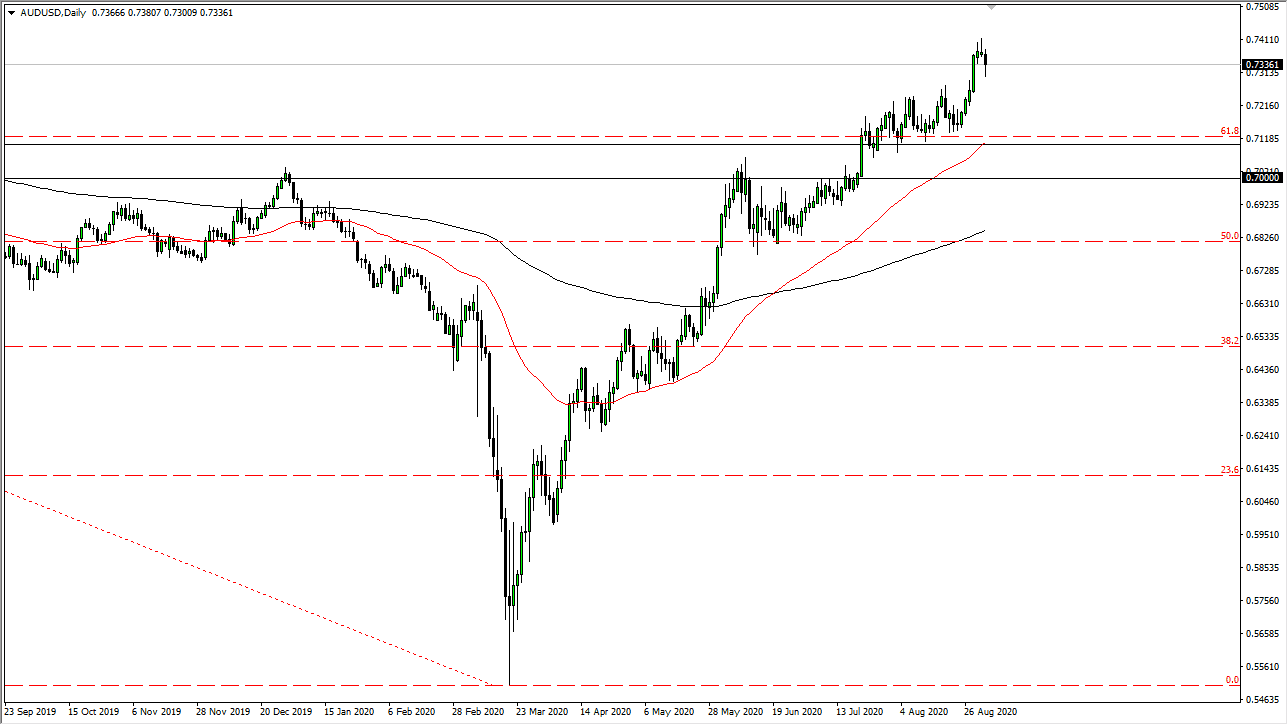

The Australian dollar has pulled back significantly during the trading session on Wednesday, but by the time we closed business in New York, we had recovered quite a bit. This shows the resiliency of this pair and the fact that the US dollar will continue to struggle. Looking at this candlestick, it does show a certain amount of resiliency, but that does not necessarily mean we cannot pullback from time to time and pick up a little bit of value. I am looking to pick up the Aussie dollar every time it drops a bit. The market certainly has a lot of support at the 0.72 handle, but I would also anticipate somewhere near the 0.71 level, followed by the 0.70 level. I would be very surprised if we break down below there.

To the upside, I recognize the 0.74 handle as an area that could cause some resistance, but longer-term I do think that we are going to go towards the 0.75 handle. That is an area that will obviously attract a lot of attention due to the fact that it is a major level, but I do think that eventually, we go even higher than that. Ultimately, I believe that the Australian dollar goes looking towards the 0.80 level but that is probably a story for months from now, if not a couple of years. The Federal Reserve will continue to loosen monetary policy as much as possible, so I think any time we pull back there will be plenty of buyers willing to jump in.

The Australian dollar is reacting more or less based upon the strengthening Chinese economy as well, so it is essentially a couple of different reasons to think that we could continue to go much higher. That does not mean that it will not have the occasional major pullback, but those pullbacks will be thought of as value that a lot of people will be willing to take advantage of. Ultimately, I do not have any situation in which I’m willing to short this market until we get well below the 0.68 level, something that does not look very likely to happen anytime soon. Because of this, it would take a significant change in the overall attitude to make that happen.