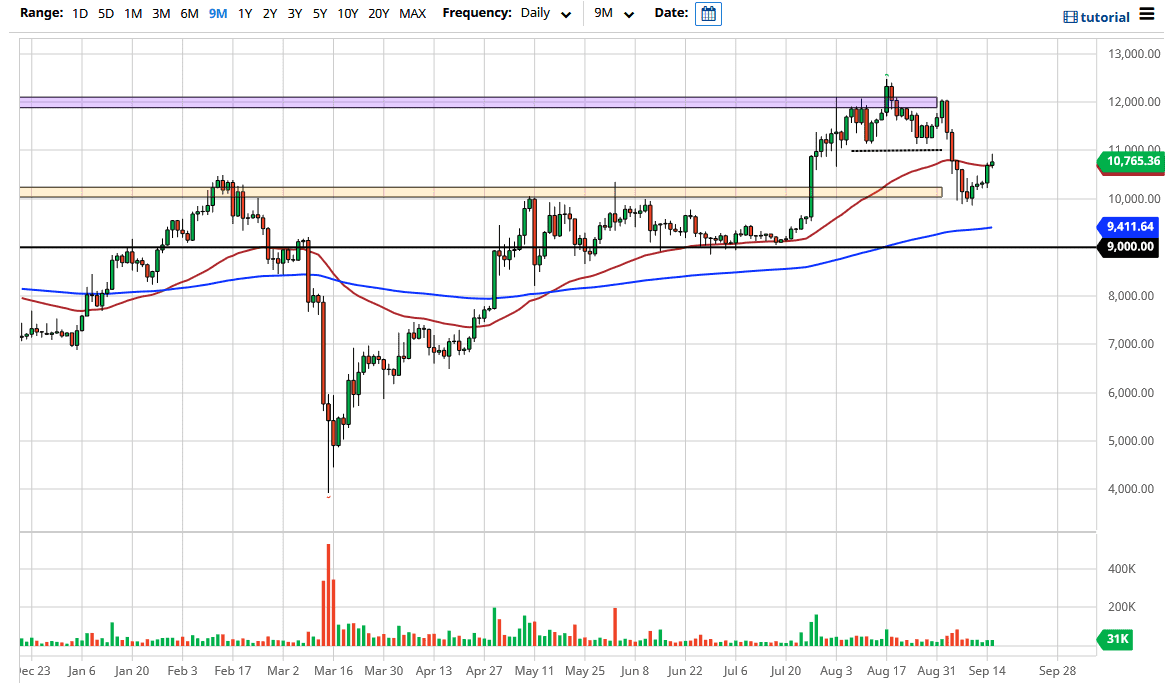

Bitcoin traders trying to break towards the $11,000 level on Tuesday but have given back the gains to form a less than inspiring shooting star. Furthermore, the US dollar is starting to flex its muscles again, which is kryptonite when it comes to cryptocurrency. Because of this, it would make a lot of sense to pay attention to the US dollar and what it is doing in order to give you another reason to buy or sell Bitcoin. Right now, I must say that the Bitcoin market looks vulnerable for some type of pullback again.

The key at this point right now is the $11,000 level. If we can break above there, then it would be smashing through a shooting star that shows real strength. If we break above the $11,000 level, at that point I think we will probably start looking towards the $11,500 level, perhaps even towards the $12,000 level. On the other hand, if we break down below the bottom of the candlestick for the trading session on Tuesday, we would not only break the area for the day, but we would also slice right back through the 50 day EMA, not something you want to see if you are bullish. Do not get me wrong, I do not necessarily think that this is going to be a sudden meltdown, just that it is not a very good sign.

If we get that move lower, and the US dollar strengthens, that should send this market looking towards the $10,250 level. Underneath there, the $10,000 level will then be targeted. Below there, we would then have to pay attention to the 200 day EMA which is currently sitting at the $9400 level, so we could get a move all the way down to that area, and what would be a very soft looking Bitcoin market, but it would not necessarily be the end of the world. After all, I see there is a “hard floor” in the market near the $9000 level.

I think at this point in time it is very likely that we are going to see a significant move in one direction or the other, probably in the magnitude of about $1000, possibly a bit more than that. Nonetheless, I think that we are setting up for a move so pay attention and by all means, pay attention to the US dollar.