India faces an acceleration in new daily Covid-19 infections, breaching the 90,000 level, overtaking Brazil as the second-most infected country globally, while remaining number four in the total death count. Despite the worsening pandemic, the Minister of Finance, Nirmala Sitharaman, and the Chief Economic Adviser to the Government of India (CEA), Krishnamurthy Subramanian, claim the economy entered a V-shaped recovery. The EUR/INR corrected into its support zone, from where a pending breakdown can unlock more downside potential in this currency pair, driven by extended Euro weakness.

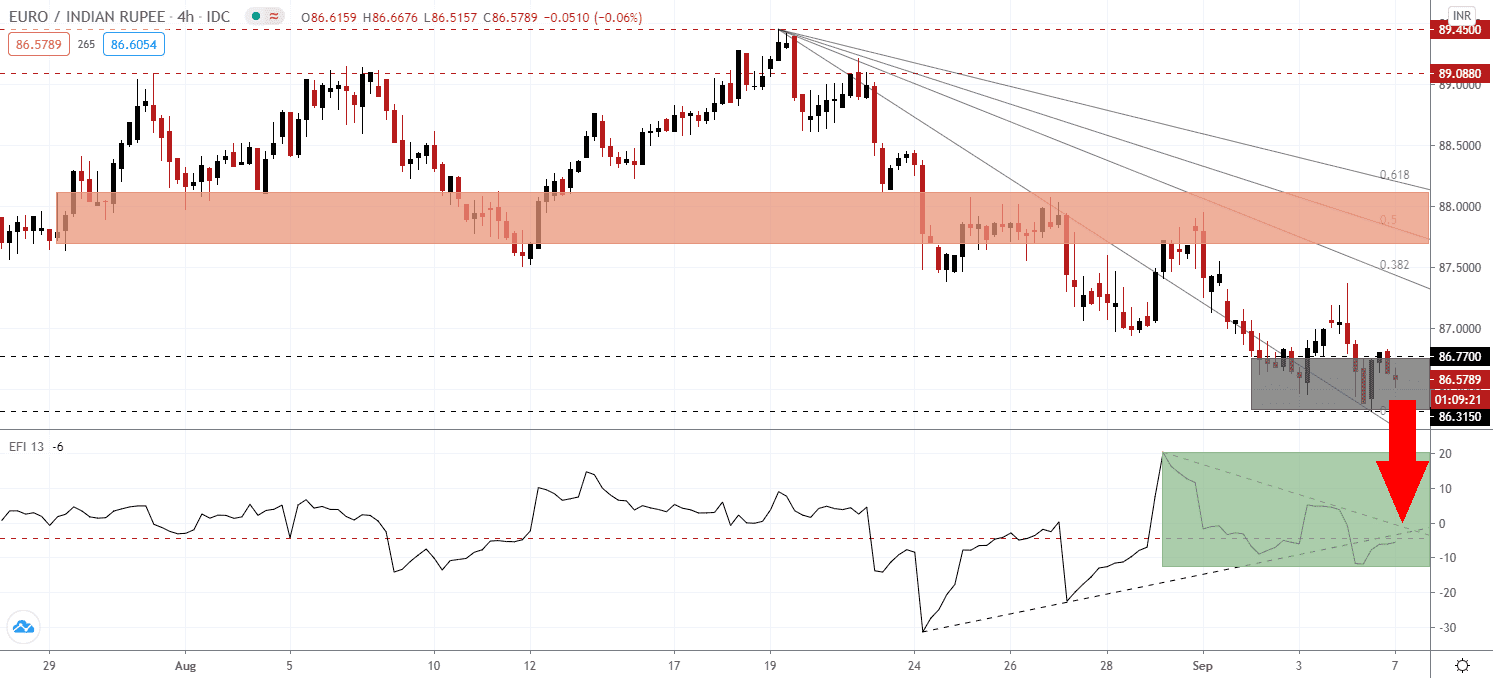

The Force Index, a next-generation technical indicator, maintains its position below the 0 center-line, confirming dominant bearish pressures. Adding the downside momentum is the breakdown below its ascending support level, as marked by the green rectangle, while the descending resistance level magnified them. With this technical indicator in negative territory, bears are in complete control over the EUR/INR.

Countering government claims for a V-shaped recovery are signs and growing evidence of a K-shaped recovery. The pandemic eliminated over 121 million jobs at its peak, but the Indian stock market surged, ignoring the economic damages caused by it. In a K-shaped recovery, the gap between those who benefit from the economy and those who fall behind widens. Signs are emerging globally and can trace their origin to the post-2008 global financial crisis. After the EUR/INR collapsed below its short-term resistance zone located between 88.070 and 87.644, as marked by the red rectangle, downside pressures expanded.

Adding to the bearish outlook for price action is weaker economic data out of the Eurozone. Consumer confidence unexpectedly decreased, German and Eurozone retail sales disappointed with a contraction, and France and Spain remain in a manufacturing recession. The European Central Bank (ECB) also considers more stimulus, keeping the Euro depressed. With the descending 50.0 Fibonacci Retracement Fan Resistance Level enforcing the breakdown sequence, the EUR/INR is well-positioned to collapse below its support zone located between 86.315 and 86.770, as identified by the grey rectangle. Price action will challenge its next support zone between 84.594 and 85.070.

EUR/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 86.580

Take Profit @ 84.600

Stop Loss @ 87.190

Downside Potential: 19,800 pips

Upside Risk: 6,100 pips

Risk/Reward Ratio: 3.25

A breakout in the Force Index above its ascending support level, serving as resistance, may lead the EUR/INR into a temporary advance. Forex traders should consider any counter-trend price spike as a secondary selling opportunity, as fiscal conservatism out of India and a pending domestic manufacturing revolution maintain a long-term bullish outlook. The upside potential remains limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

EUR/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 87.550

Take Profit @ 88.100

Stop Loss @ 87.190

Upside Potential: 5,500 pips

Downside Risk: 3,600 pips

Risk/Reward Ratio: 1.53