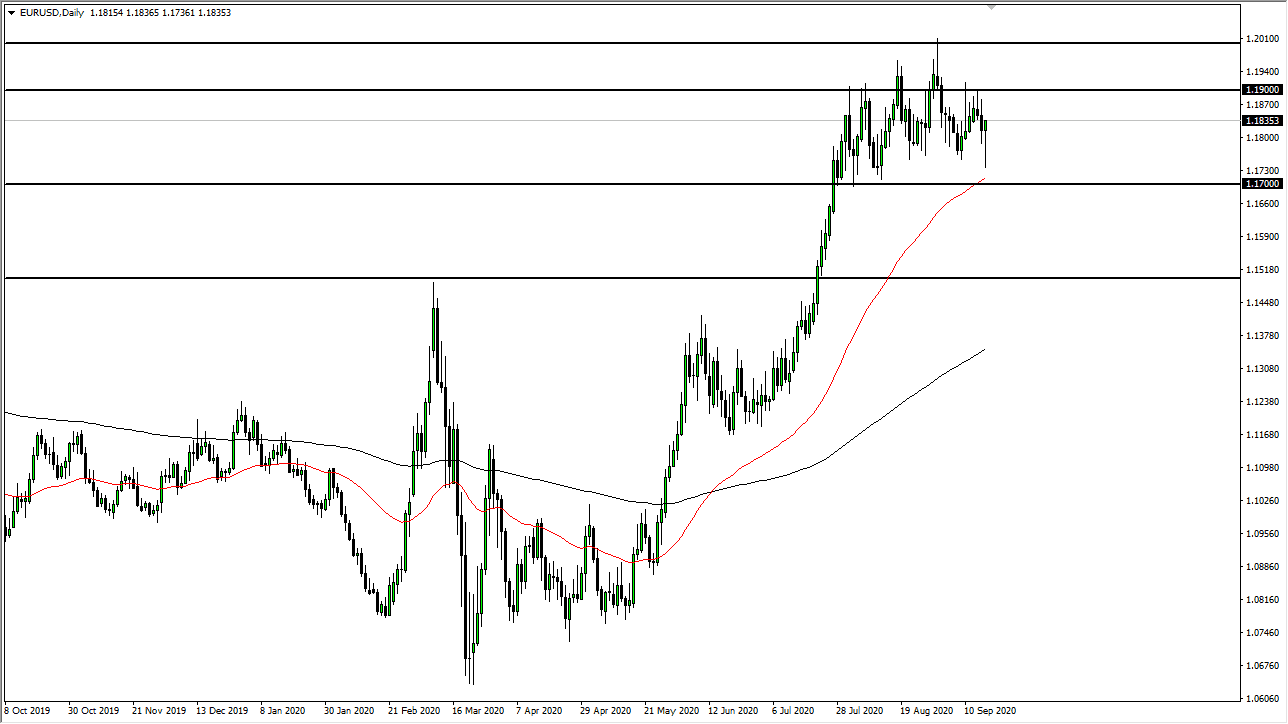

This is a very strong bullish candlestick, but at the end of the day it is very suspicious due to the fact that we have made lower highs and lower lows here in the last couple of candlesticks. I also recognize that the 1.19 level above is massive resistance that extends all the way to the 1.20 level. Overall, this is the biggest barrier to Euro strength longer term, so if we were to break above the 1.20 level on a daily close, then the market could go much higher. However, recently they have not been on a break above there, so that is something worth paying attention to.

The 1.19 level has been like a brick wall as of late, and you can see that there were several wicks on the daily chart that show we could not break above there and that sellers are jumping in. This is interesting, considering that the Federal Reserve is still very loose with its monetary policy, but sometimes price is more important in whatever the narrative is. Do not get me wrong, it is not like I expect this market to break down drastically, but it is worth noting that the market could not break above the 1.19 level for several attempts. This tells me that we are likely to grind sideways at the very least.

Underneath, I believe that the 1.17 level is an area of support, and we have most certainly seen that area act as a buying opportunity during the trading session on Thursday. I do not know if and when we break out of this range, but right now we have to assume the range holds. Because of this, I would anticipate that there will probably be some selling pressure later in the day, as Friday will have a lot of people wanting to take risk off in the market, and of course we will probably get relatively close to the area above where people would be wanting to either take profits or perhaps try to short the Euro again. Expect choppiness, but the last week or so has shown this market to look a little less attractive for the buyers that it once did.