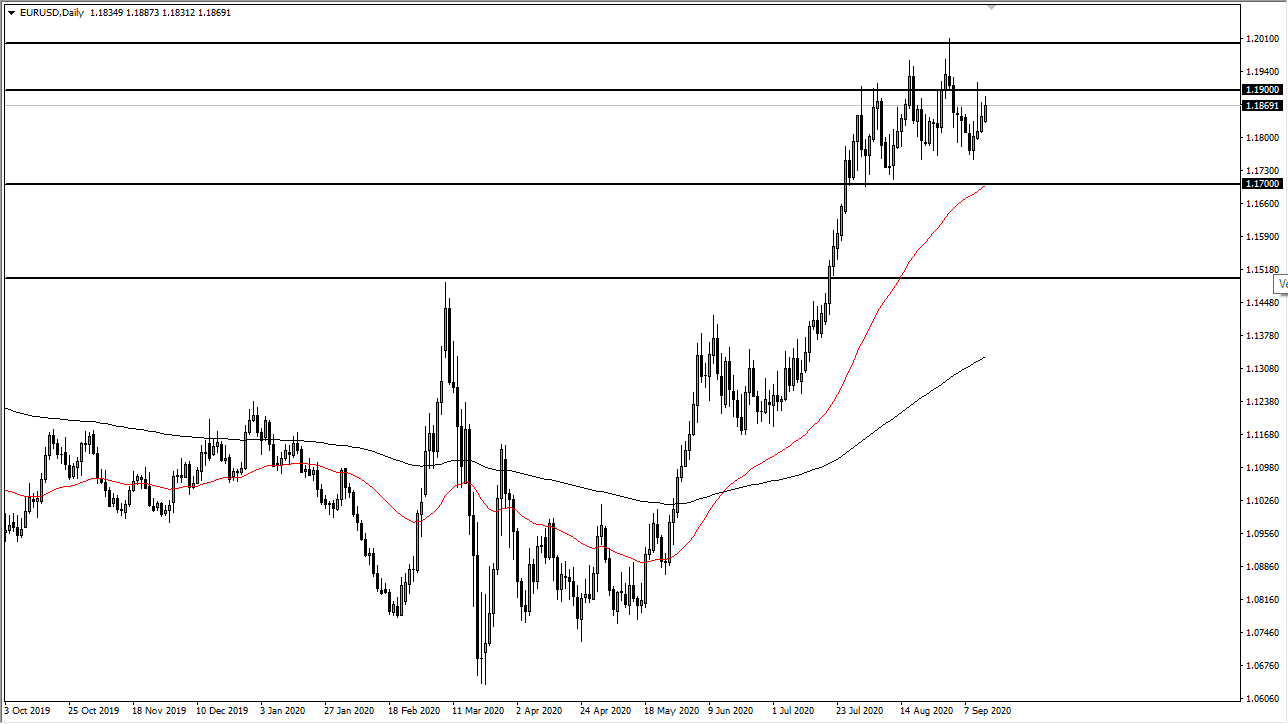

The Euro has rallied a bit during the trading session on Monday to kick off the week, but it seems to struggle in the same area time and time again. This area is above the 1.19 level, as we have seen the last three days show us just how difficult it is going to be to hang onto Euros above there. In fact, you can make a real argument for a potential reversal before it is all said and done.

This might not be as far-fetched as it sounds, because the Brexit situation continues to cause issues on both sides of the English Channel. Beyond that, you have coronavirus figures rising in the European Union, and getting ready to overtake the United States. I do not know how much credence traders have put into the virus, but I do recognize that there is a certain amount of relevance when it comes to valuing the currency. Beyond that, at the very least the Euro needs to digest the gains that it has seen in very short order, and it is worth noting that longer-term a lot of big money managers are expecting the Euro to trade towards the 1.25 handle.

I would also point out here that a lot of big money managers at one point suggested that the Euro was going to trade at parity to the greenback, and it never happened. Do not be surprised at all at this point if we do pull back a bit towards the 1.17 handle. A breakdown below there could open up a move down to 1.15, which would be rather interesting because it would coincide with a complete reversal on the US Dollar Index chart, which looks as if it is trying to form some type of base right now.

In short, this is a pair that is going to continue to be very choppy, so you will need to focus on shorter-term charts. The 1.19 level extends all the way to the 1.20 level as far as significant resistance is concerned, so that something that must be kept in the back of your mind. To the downside, the 50 day EMA sitting at the 1.17 level certainly at the little bit of credence to that support zone as well. It would not be a huge surprise if we went back and forth in this pair, because that is what it does most of the time.