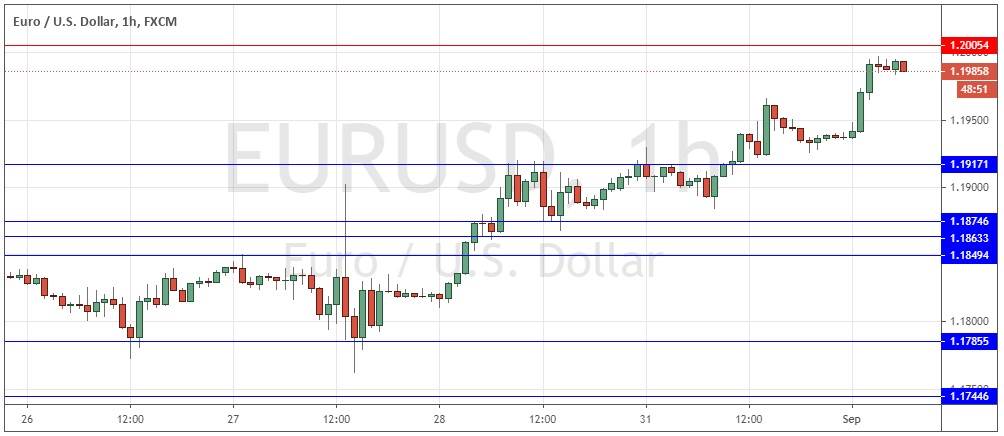

EUR/USD: Unclear whether price can break 1.2000

Yesterday’s signals were not triggered, as there was no bearish price action when the resistance level identified at 1.1917 was first reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered before 5pm New York time today.

Short Trade Idea

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2005.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Idea

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1917.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote yesterday that the macro environment (weak Dollar and a recovering Eurozone economy) was generally favourable to the Euro, the bullish price action may have run out of steam as it was close to the major round number at 1.2000 which is the start of a congestive area from a few years ago.

I thought that buying from from bounces at key support levels should still be worthwhile trades over the next few days, but it was unlikely that we will see the price get beyond 1.2000 any time soon.

We did not get a deep enough retracement to give a buy signal at support, but the price rose throughout the day to close in New York at a new multi-month high. The Asian session then saw the price continue to rise higher to reach a high just below the big round number at 1.2000.

This is somewhat more bullish action that I had expected, but I was right about taking a bullish bias and that we were not likely to see the price get above 1.2000.

This area of resistance at 1.2000 should now be very pivotal. The U.S. Dollar is weak everywhere, but it will be a little surprising if we see the price get established above 1.2005. If we do, that will be a bullish sign, and could produce another strong upwards movement right away as there are no more resistance levels until we get past the 1.2100 handle.

I will take a bullish bias if we get a bounce at 1.1917 or if we get two consecutive hourly closes above 1.2015 during today’s London session.

Short trades, maybe scalps, from failures at 1.2000 / 1.2005 could also be good trading opportunities here, especially near the start of the London session. Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time. There is nothing of high importance due today regarding the EUR.

Concerning the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time. There is nothing of high importance due today regarding the EUR.