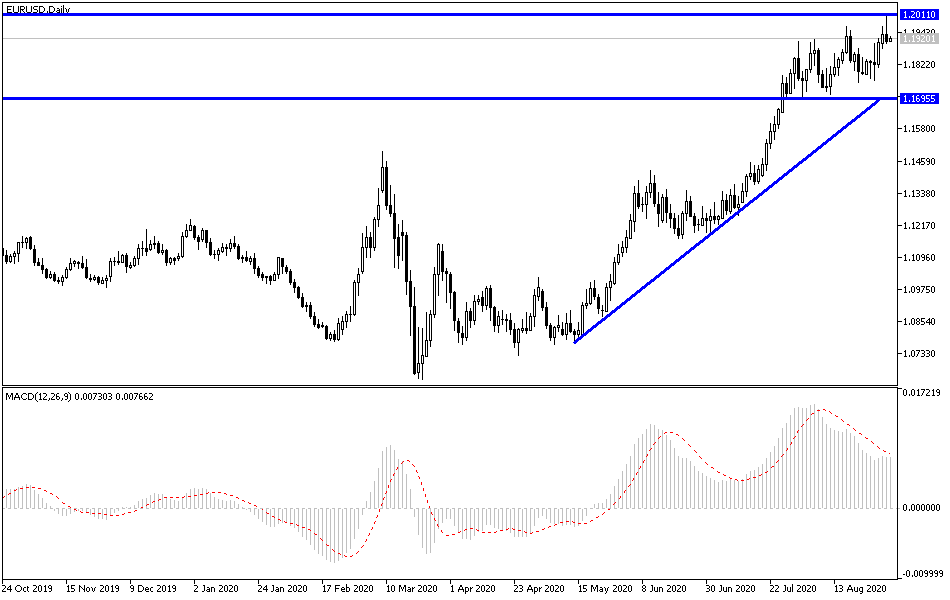

During yesterday's trading session, the pair jumped towards the 1.2010 resistance, its highest level in two years, amidst stronger pressure on the US currency. What stopped the pair's gains and contributed to its decline to the 1.1910 support level in the beginning of trading today, Wednesday, was profit taking sales, which we suggest it could happen with this peak test, in addition to the weak economic releases results from the Eurozone, especially inflation figures, which recorded negative results.

The EUR/USD exchange rate rose to its highest level since April 2018, and to the important psychological level at 1.20 in the beginning of September trading. Strong gains for the pair might be related to the USD weakness much more than the strength of the Euro itself, but it seems that the 1.20 psychological resistance has currently hindered the bulls. “The EUR/USD is swinging just below 1.2000 with the beginning of trading in New York and we still hear talk of selling in the spot market to defend the EUR/USD barrier option,” says Erik Bregar, Head of Foreign Exchange Strategy at Exchange Bank of Canada.

It wasn't just technical barriers that thwarted the masked bullish breakout in the EUR/USD pair; Euro-zone inflation numbers surprised sharply on the downside when the consumer price index fell below zero again for the first time since May 2016. Thus, inflation fell from 0.4% in July to -0.2% in August, according to the flash release from the European Statistics Agency, Eurostat, while forecasts were for a drop to only 0.2%.

Core inflation - which excludes food and energy - fell sharply from 1.2% in July to 0.4% in August, while markets had been expecting 0.9%. As it is known, the core consumer price index is getting more attention from the markets because it is believed to better reflect local trends, and because it ignores the commodity and regulated price elements such as energy, food, tobacco and alcohol. On her part, Daniela Ordonez, Eurozone economist at Oxford Economics, says: “We expect inflation to remain weak and well below the European Central Bank’s 2% target, as corporate pricing power will remain limited, labour market slump will remain large and energy prices will remain contained. If core inflation continues to decline, the pressure on the ECB to inflate monetary support will increase.”

Yesterday's data confirms that the European Central Bank (ECB) inflation target will be elusive for a longer period.

According to the technical analysis of the pair: Despite halting gains, the general trend of the EUR/USD pair remains bullish, and stability above the 1.1920 resistance remains a catalyst for the bulls' control and supports the return of the movement towards the 1.2000 psychological resistance again. The bearish reversal will be stronger if the pair moves towards the 1.1775 support. Still, I would prefer to buy the pair from every lower level. The closest support levels for the pair are currently at 1.1865 and 1.1775. The change in the US central bank’s policy and the continued negative impact of the coronavirus outbreak on the US economy will continue to stimulate the pair to push higher.

As for today's economic calendar data: From the Eurozone, the PPI, rate of change in Spanish employment and German retail sales will be announced. From the United States, ADP survey to measure the change in non-farm employment in the United States, then the US factory orders will be announced. As well as Statements by several members of the US Federal Reserve that may explain their position on the chang of the bank's policy settings.