The bleeding of losses in the EUR/USD continues, and it collapsed at the beginning of Thursday's trading to the 1.1641 support, its lowest level in more than two months. The single European currency is still suffering from market anxiety about the strength of the second wave of cases and deaths due to Coronavirus, which threatens to close the economy again, as some countries began implementing strict restrictions and measures to contain the epidemic. In this context, yesterday's IHS Markit quick survey data showed, after the re-emergence of Coronavirus infection rates, that the private sector in the Eurozone remained stagnant in September as the faster growth in manufacturing was offset by a renewed decline in the services sector. Accordingly, the composite production index - which includes the manufacturing and services sectors - decreased to 50.1 in September from 51.9 in August. Economists had expected the reading to decline to 51.7.

Having rebounded in July and August from Covid-19 lockdowns during the second quarter, the PMI has since signalled that the economy nearly halted as high infection rates and ongoing social distancing measures curbed demand. Commenting on this, Jessica Hinds, an economist at Capital Economics, said that today's data indicates that the recovery is stalling, with the possibility of a contraction in activity in the services sector.

The economist added that with some governments now imposing additional and more stringent restrictions, there is a clear and growing risk that it will recede, at least in the countries most affected by the virus. Industrial production growth accelerated in September to the fastest pace since February 2018, while services recorded the largest contraction in production since May at 53.7, and manufacturing PMI hit a 25-month high. Economists had expected the reading to rise to 51.9 from 51.7 in August.

The Services PMI fell to a four-month low of 47.6, while the result was expected to remain unchanged at 50.5 in August. Germany continued to lead the recovery in September, driven by a sharp rise in manufacturing production. The composite production index fell more than expected to 53.7 in September from 54.4 in August. The expected reading was 54.1. The survey showed continued loss of momentum in recovering from covid-19 closure. After increases in both past two months, the service sector contracted in September.

The Services PMI fell to a reading of 49.1 from a reading of 52.5 a month ago. The reading was expected to rise to 53.0. Meanwhile, the Manufacturing PMI rose to a 26-month high at a reading of 56.6 from 52.2 in August. Economists had expected the index to rise to 52.5. On the other hand, French private sector activity deteriorated for the first time in four months in September due to renewed disruption related to the epidemic.

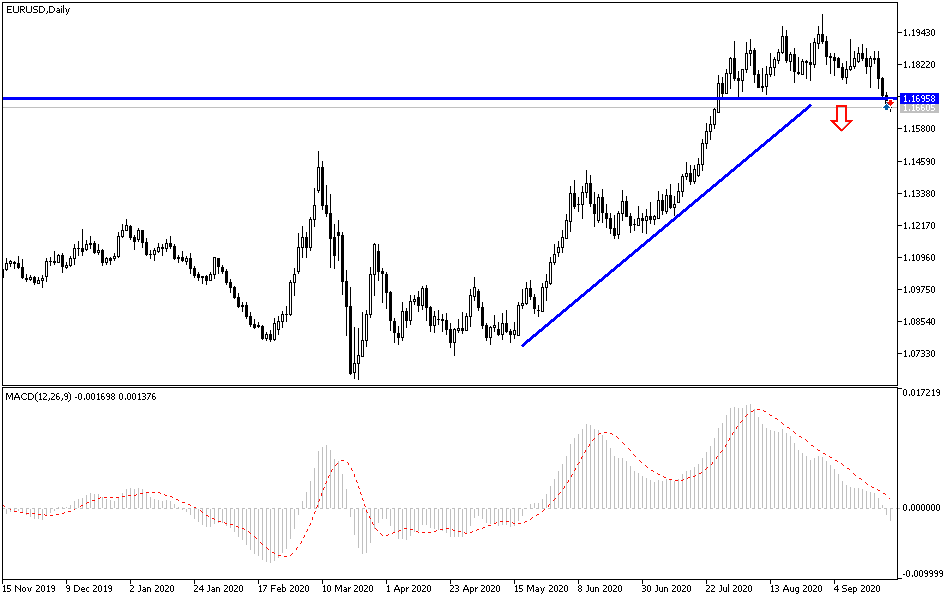

According to the technical analysis of the pair: The bear’s dominance on the EUR/USD performance is still the strongest, and the recent selling operations have pushed the technical indicators into oversold areas, and buying can be considered to gain from the expected bounce opportunity. Support levels at 1.1490, 1.1555 and 1.1640 might be best suited for that. On the upside, there will be no initial chance for a bullish correction without the pair surpassing the 1.1830 resistance at the earliest. The developments on the ground regarding the Eurozone’s containment of the new wave of Corona must be monitored, as the matter out of control means a further collapse of the Euro.

As for the economic calendar data today: First, the German IFO business climate index reading will be announced, then the US jobless claims and new home sales, then more importantly, statements from the US Federal Reserve Governor and the US Treasury Secretary.