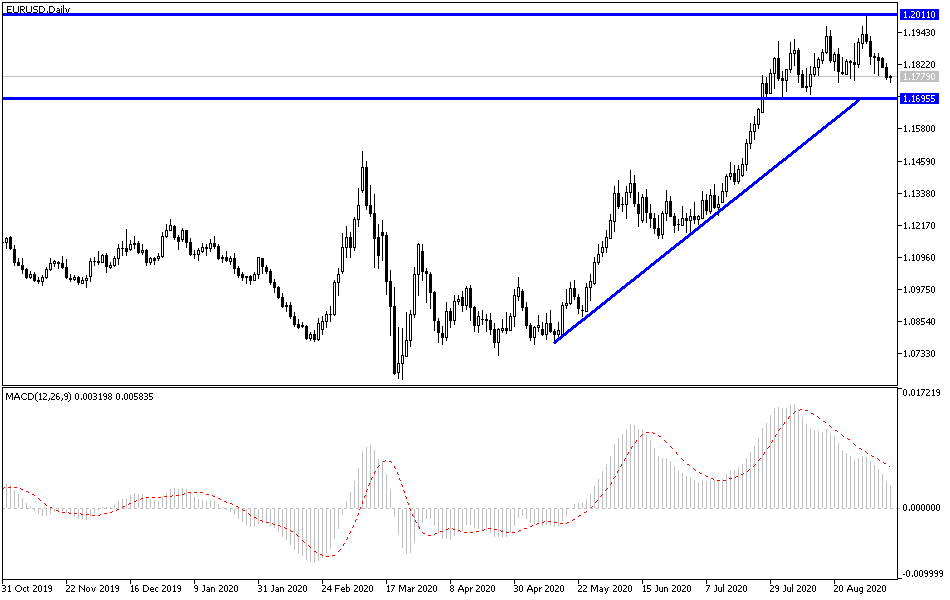

For six trading sessions in a row, the EUR/USD was moving in a descending correction range, pushing it to the 1.1756 support at the time of writing, completing the downward path that started at the end of last week's trading in light of the USD recovery. This was more supported than expected as American jobs numbers in addition to the negative results of the recent Eurozone economic releases confirmed that the bloc still has a long time to recover from the consequences of the Coronavirus, which is still in place. The negative outlook for the pair has increased recently, and some analysts believe that the Euro’s rise against the dollar has ended. The pair’s slide below 1.15 cannot be ruled out, at a time when Brexit trade talks are heading to a dead-end and the European Central Bank (ECB) remains concerned about the strength of the Euro’s exchange rate.

The single European currency gained nearly 12% from its May lows around 1.08, and investors remained optimistic about the outlook, as future exchange rate agreement indicates that the Euro is steady around 1.19 against the dollar for the next day. These gains helped lift the Euro-Trade Weighted Index (TWI) to its highest levels in several years and sparked a protest last week from European Central Bank chief economist Philip Lane, who said before the bank's monetary policy decision on Thursday, that the EUR/USD rate is “important” because, at present, its levels will affect economic growth and inflation.

Commenting on the pair’s performance, Kit Juckes, chief foreign exchange strategist at Societe Generale, says: “The dollar's rebound has been delayed. Perhaps the decline in the GBP/USD could be the catalyst for the weakness of the Euro as well” and added: “A bad Brexit (which the UK Prime Minister is referring to) could lead to a TWI drop, meaning there is a drop of more than 5%. More importantly, at some point, talk of a bad Brexit will affect the Euro, and there are still a lot of Euro buying deals that can get soured”.

According to the technical analysis of the pair: As we expected, the EUR/USD pair will remain under pressure due to concern of ECB’s monetary policymakers regarding the rise in the value of the Euro against other major currencies, especially since the markets are awaiting the bank’s announcement tomorrow regarding its monetary policy amid expectations that the bank will indicate that the bloc's economy is negatively affected by the strength of the Euro, and that event will bring a lot of trouble to the pair, and currently, the closest support levels for the pair are 1.1745, 1.1680 and 1.1600, and I see the last two most important levels to buy at the present time to gain the bounce. On the upside, the 1.2000 psychological resistance will remain an important target for the bulls to control performance again.

As for today's economic calendar data: There are no important economic releases from the Eurozone or the United States of America, and investor sentiment will be an important factor in the pair's movements.