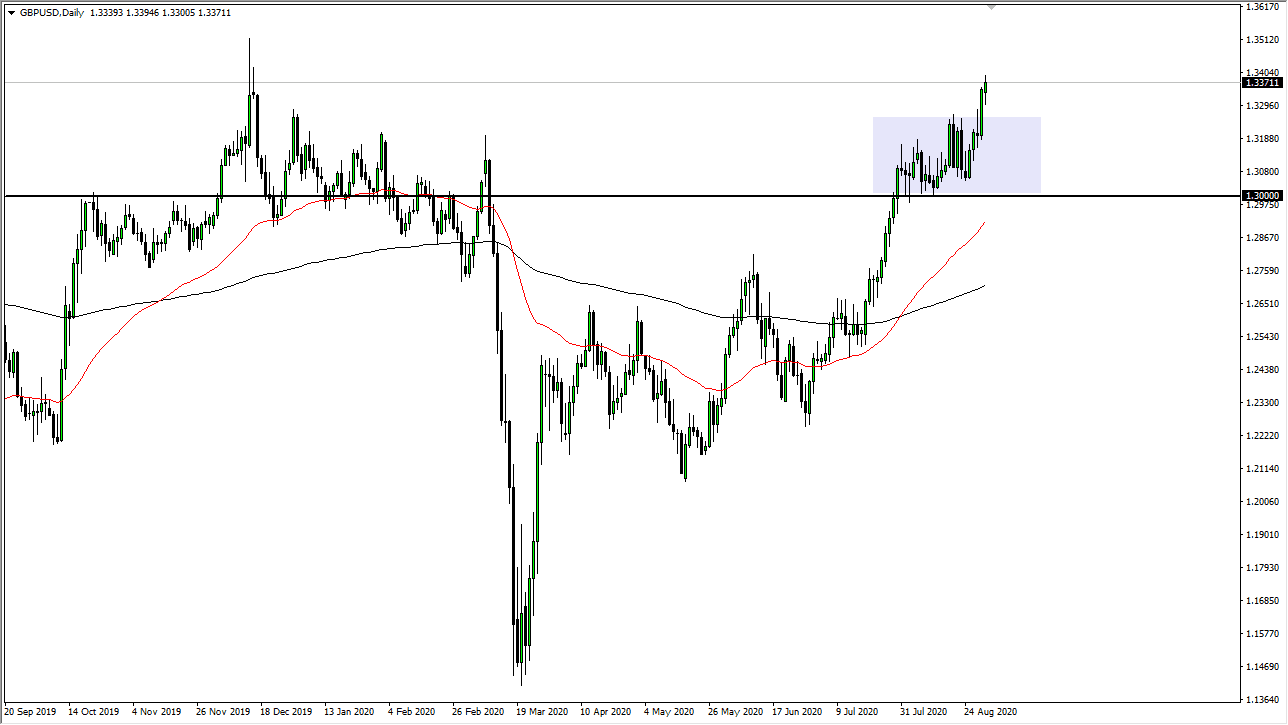

The British pound has shown itself to be somewhat resilient during the trading session on Monday, as we initially dipped lower but then shot higher again. This shows that the market still wants to go higher, but we are getting a bit stretched. At this point, I look at the potential for a pullback as an opportunity, not something that you should be concerned about. I would be especially interested in the British pound closer to the 1.33 handle, and even more so than that down at the 1.32 handle. Regardless, one thing you cannot do at this point is short the Sterling, because it is one of the strongest currencies that I follow.

I believe that the British pound is going to go looking towards the 1.35 handle given enough time, but that does not mean we get there in the short term. In fact, I think it is probably going to be after the job number on Friday coming out of the United States. With that, I think that this market eventually finds plenty of buyers to pick up dips, and therefore you should be looking for value going forward. Selling the British pound is almost impossible, at least not to break down below the 1.30 level at the very least. Even then, I see a lot of support near the 1.2750 level, extending at least the next 100 points underneath.

The US dollar will continue to get work against due to the fact that Jerome Powell has raised the bar for monetary tightening, so therefore it should continue to reflect itself in the shrinking value of the greenback. The British pound is one of the main beneficiaries of this, which is interesting considering that we still have to worry about Brexit. Nonetheless, it is what it is, and the markets are rising. There is no point in trying to figure it all out, just simply follow the trend, as “price is king.” Ultimately, I do think that we go looking towards 1.35 handle, but it may take some time to get there. I look at any time this market pulls back as a potential buying opportunity, but I recognize that we are getting a little bit overdone in the short term. Regardless, even if you told me that this pair was going to sell off during the day on Tuesday, I would simply be on the sidelines waiting to buy it at lower levels.