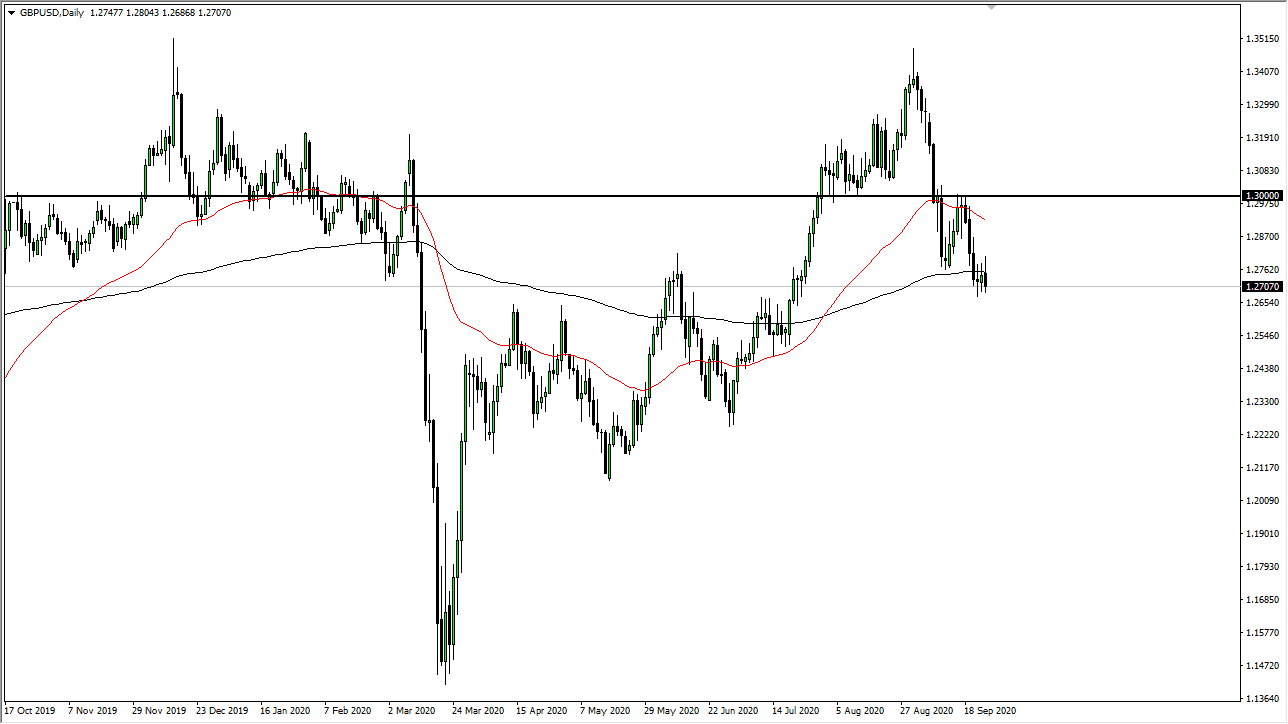

The 1.27 level seems to be offering a bit of support, but quite frankly after the candlestick on Friday, it does suggest that we have further to go to the downside. It is worth noting that the recent market structure has been an extreme low swing, a much lower high, and now a slightly lower low. In other words, we are forming a downtrend and it is likely that we continue to see more pressure in this market.

When you think about the British pound, it does not take a lot of imagination to understand why there might be some issues. To begin with, Brexit is still forefront a major issue, and as long as that is going to be the case the uncertainty surrounding the British pound will continue to be palpable. Under the best of circumstances this would cause volatility. Add to that the fact that the United Kingdom is likely to lock down its economy to a certain extent, that certainly is not going to help the situation either.

There has been talk about the Bank of England introducing negative rates, but then they walked that back. Since then, there has been conjecture in both directions but ultimately most central banks around the world are probably going to be looking at negative interest rates. I do think that it is only a matter of time before rallies get sold into and as far as buying the British pound is concerned, I am very hesitant to do so until we get a daily close above the 1.30 level. Yes, it would take that big of a move to convince me at this point.

This does not necessarily mean that we are going to break down and fall through a black hole, just that we are probably going to continue to “fade the rallies” on shorter time frames and pick up profit that way. The 1.25 level is obvious support, so that is most certainly something that you should be paying attention to as it is not only structurally important, but it is psychologically important as well. With all that in mind, I continue to look at this is a market that is likely to find more trouble than good in the near term.