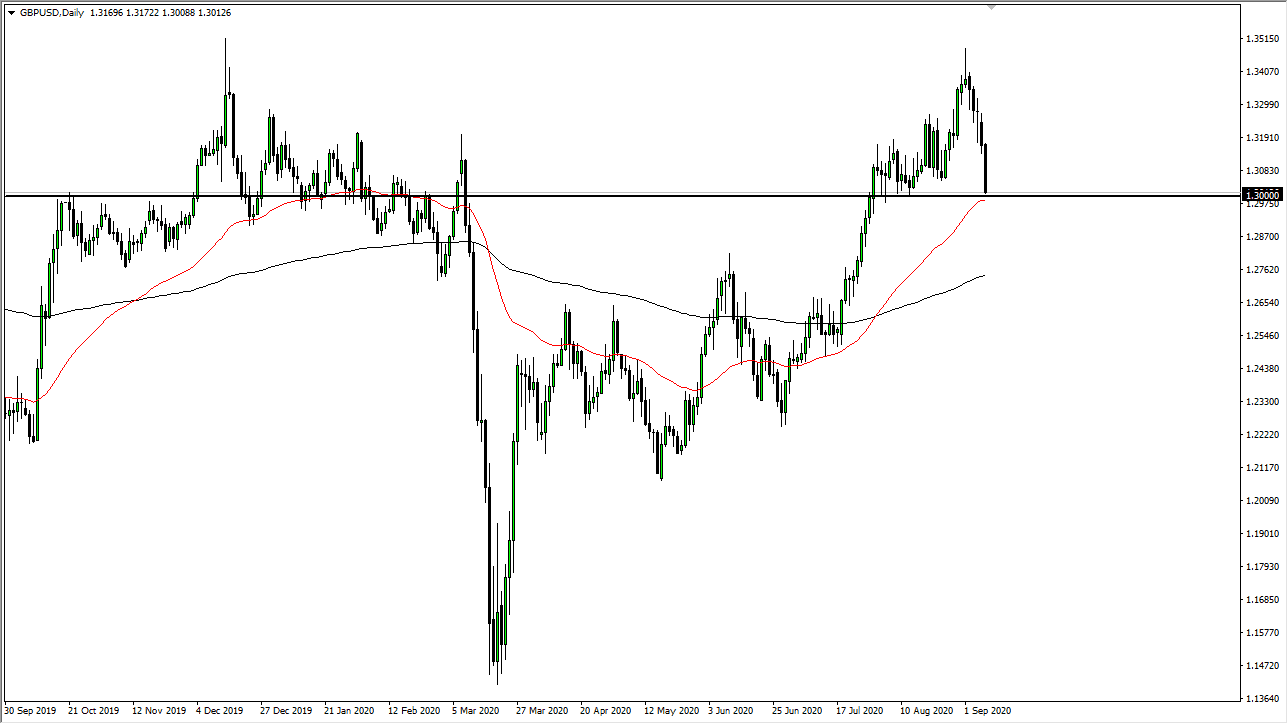

The British pound has broken down significantly during the trading session on Tuesday as traders pushed the cable pair below the 1.30 level. It now looks as if we are going to go looking towards lower levels, perhaps as low as 1.2750 given enough time. This is a market that clearly has a lot of concern built into it, mainly due to the Brexit situation again. It looks as if the United Kingdom is likely to work towards getting out of the European Union without a deal, and that has everybody freaking out yet again. What is interesting to note is that a lot of professional traders are starting to come back to work from vacation, so it is very likely that we will see is increased volume, and perhaps more of a serious move for a longer-term trade.

It looks as if people are starting to worry about Brexit again, so that could send this market looking towards the next major support level that I see on the chart, namely the 1.2750 level. Down in that area, there should be significant support, especially as the 200 day EMA sits right there as well. The Federal Reserve is working against the value of the greenback, so that will help keep this market somewhat afloat, but one has to say that it looks like the shift in sentiment is strong and probably “has legs.” That is very likely to cause massive chaos in this pair and financial markets overall, as the US dollar strengthening puts risk assets under serious pressure. This has most certainly been the case for some time, as liquidity from the Federal Reserve has been the only thing keeping up quite a bit of markets out there.

Looking at the size of the candle also tells you that there was serious conviction when it came to selling this pair, so that is something that should also be paid close attention to. With that, I believe that there is going to be some follow-through, but we may get a short-term bounce in the meantime. That bounce will more than likely be sold into, and a clearance of the 1.2960 level could really unwind this pair rather rapidly. We are living in tenuous times, so keep your position size to about half of what you normally would as the volatility is about to get worse, not better.