The recent upward correction attempts for the GBP/USD collide with fears of the failure of the last round of negotiations between Britain and the European Union. At the beginning of this week's trading, the bulls' attempts did not exceed the 1.2929 resistance, and the pair stabilized around the 1.2860 support at the time of writing. A state of cautious stability dominates the performance of the sterling pairs, as investors are considering changing the risk balance of Brexit. I see this file as the most influential on the pair's path, more than what may happen in the United States in reference to the upcoming presidential elections.

Forex investors are cautious and clearly have different expectations about the future of trade talks after Brexit.

In this regard, British Cabinet Office Minister Michael Gove arrived in Brussels at the start of a critical period in the post-Brexit trade talks, amid speculation that the two sides will soon begin drafting a text of a trade agreement. This comes after the European Union was reported to have waived, demanding the UK to waive its red lines before work on trade terms began. Therefore, the pound sterling is trying to preserve its recent gains, which were supported by the announcement in The Times that the talks are improving, as Brussels expressed its willingness to work on the legal text, abandoning its demand for both sides to reach a broad agreement on the areas of outstanding disagreement.

The consideration of a compromise came after government trade advisers expressed their openness to the idea of an "implementation period" that would extend the status quo beyond December 31 if necessary.

In other words, and in particular, the government may not be against extending the transition period as is often recognized. It may also be on the verge of giving up in trade talks on Brexit. Therefore, any such result may force more investors to abandon their previous bearish bets against the British pound, and at the same time, raise the price of the British pound against the dollar.

"The Brexit negotiations are resuming, the benchmark for positive surprise is low," says Michael Wog Backus, a Deutsche Bank spot Forex trader. "There was a lot of false dawn but the mood music was calming and both sides indicated their willingness to compromise." I can see a scenario in which there is progress and stability in risk markets ...” he added.

In general, the analyst community is skeptical about the sudden stability of the pound, given the many false dawns in the Brexit negotiations and the major political differences that still exist so far between the two sides regarding access to UK fishing grounds and the so-called parity. This is in addition to the controversial rulings on state aid. Political constraints on both sides could mean that any trade agreement requires at least some form of settlement to emerge from both of them along the way.

There are many other risks lurking in the pound's path as well, including the British government which is increasingly speeding up the imposition of restrictions related to the Coronavirus, but nevertheless, some analysts also suspect that the British currency is at a tipping point.

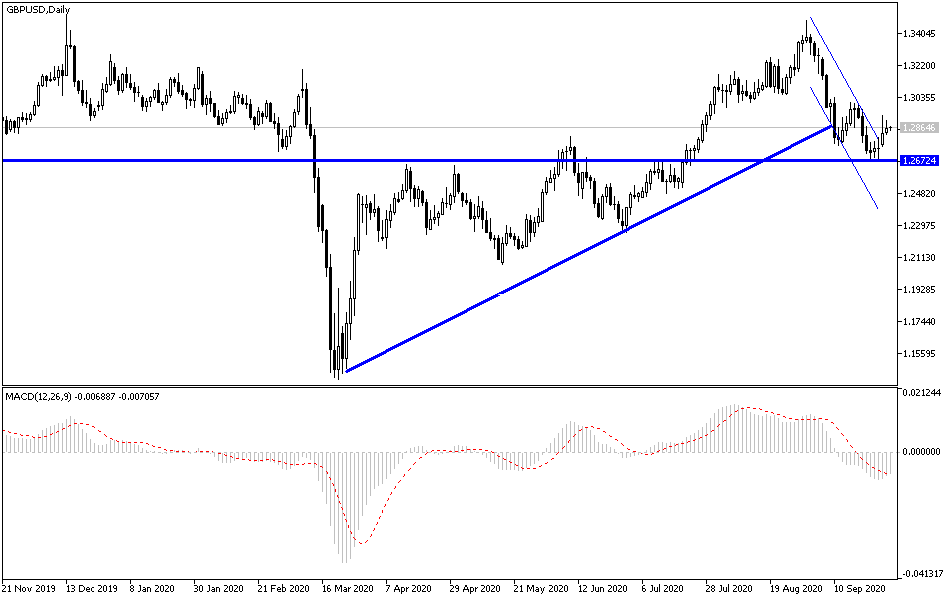

According to the technical analysis of the pair: An attempt to correct the upward correction of the GBP/USD pair will not succeed without breaching the 1.3000 resistance, which will support further buying of the pair. On the daily chart below, the pair's stability below the level of 1.2800 support will increase the strength of the bears' control to move the pair to stronger support levels, the closest of which are currently 1.2765, 1.2690, and 1.2600, respectively. As I expected at the beginning of this important week, the pair is subject to more extreme volatility until the final announcement of the Brexit round of negotiations. I still prefer to sell the pair from every upside.

Regarding today's economic calendar data: Regarding the British pound, the British GDP growth rate and the business investment rate will be announced, and for the US dollar, the ADP survey will be announced for the change in the number of non-farm jobs, then the US GDP growth rate, the PMI reading from Chicago, Pending Home Sales and then Crude Oil Inventory numbers.