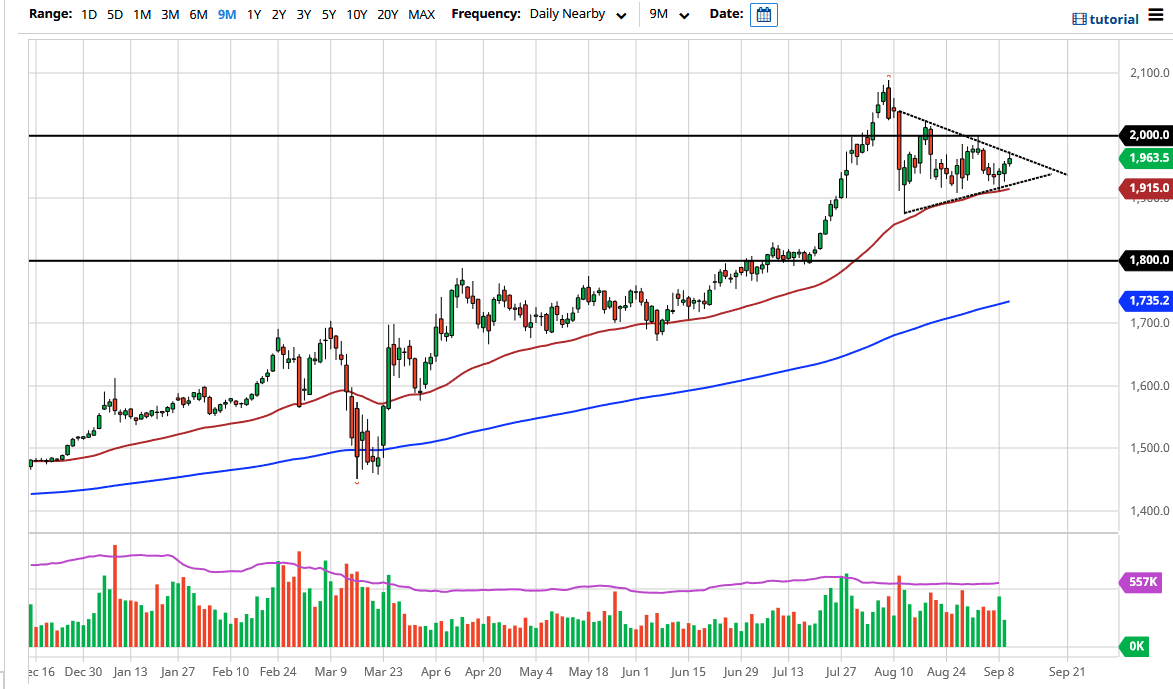

Now we need to decide whether or not this is going to be a symmetrical triangle, or if it is going to be a rectangle? At this point the odds are about 50-50 so it just shows how confused the market seems to be. The path of least resistance is simply trading back and forth in the range that we have been in, between the $1920 level and the $1980 level, with about $20 on either side offering a bit of a buffer.

If the market were to break above the $2000 level, that will almost certainly be on either some type of major risk aversion type of trade, or a falling US dollar. If it is a risk aversion trade, you will probably know the reason, it will be all over the news, and smashing through the $2000 level does in fact open up the possibility of going towards the $2100 level. With that, I do believe that it is only a matter of time before we have to make a bigger move, and if I had to pick one side or the other, I anticipate that it will probably be gold going higher.

Having said all of that, if we do fall the first place, I will be looking is the $1900 level for support, as it is not only a large, round, big figure, but it is also the scene of previous support. The 50 day EMA is sitting just above there, so that could come into play as well. If we break down below there, then I will be much more aggressive in buying gold closer to the $1800 level. That was the scene of a major breakout, so I do think that there is a certain amount of “market memory” down in that area. Do not be wrong, I do not necessarily think that the market is going to go straight up in the air, but at the end of the day I do think that it is still positive for a multitude of reasons. However, now that we are through the ECB meeting, that hurdle has been cleared as the Euro was relatively stable after the fact, lending a little bit of credence to gold strength down the road.