Gold markets have pulled back a bit during the trading session on Thursday, mainly due to the fact that there has been so much volatility. Even though the markets were a bit scared and you can make an argument for a bit of a “safety trade”, gold tends to get sold off when stock markets get hammered due to the fact that a lot of money managers need to close out positions in order to cover margin in other places. The NASDAQ 100 was massive in its selling, losing about 5% during the day which of course caught a lot of people off guard.

That being said, I still like the idea of gold and I do think that there are plenty of reasons to think that it will go higher. The Federal Reserve and other central banks around the world continue to do monetary policy experiments and liquidity and loosening, and that should continue to have people looking towards hard assets such as gold. In fact, I do believe that commodities in general should continue to go higher, due to the fact that the US dollar should continue to fall, and of course other currencies will. In fact, if you have the ability to trade gold in various currencies, you may look into that in the future.

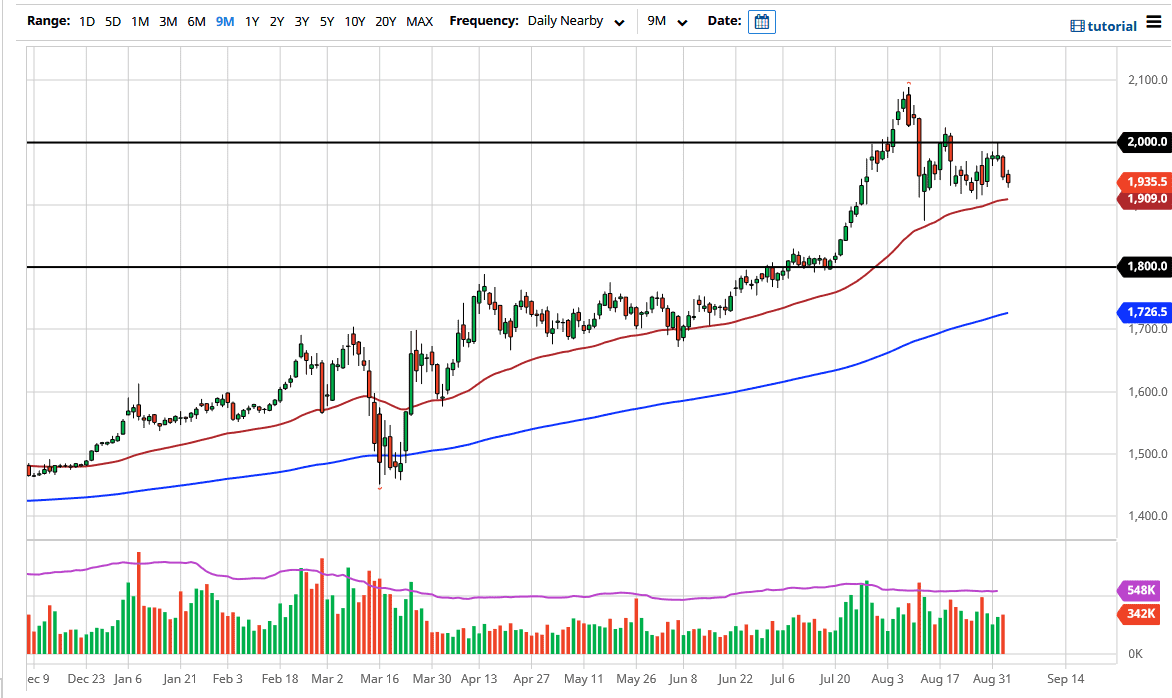

The 50 day EMA sits right around the $1900 level, so that should offer plenty of support as well. I think at this point in time it is likely that we have plenty of buyers in that general vicinity, and even if we did break down below the $1900 level I think there is even more support underneath near the $1800 level which was the massive resistance barrier that the market had broken out of but has not retested that area, which means that we may have to do that.

With the Non-Farm Payroll numbers coming out during the trading session on Friday, we can expect a significant amount of volatility in the US dollar, which will of course have a significant influence on the gold market as well. If we pull back, I will be looking for a bounce to take advantage of, obviously after 830 in the morning New York time, as we need to get the job summer out of the way. Longer-term, I still believe that we go much higher.