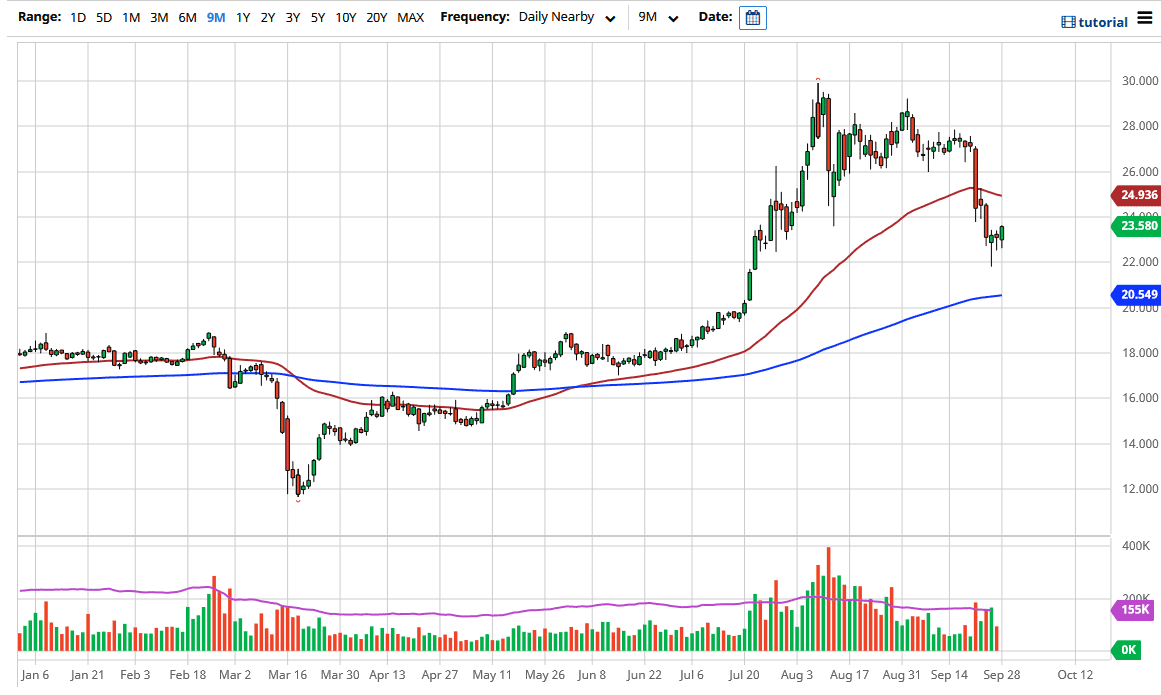

Silver markets have initially fallen during the trading session on Monday, only to turn around and rally a bit. Ultimately, we did up forming a very bullish looking candlestick and it does suggest that we are going to continue to rally. I do not necessarily think that we are at the bottom quite yet, and I would not be surprised at all to see a little bit of a pullback. However, I have no interest in shorting silver as you know, due to the fact that there is so much uncertainty out there.

One mistake that a lot of retail traders make is that the tend to treat silver at the same way they treat gold. This is a huge mistake considering that silver has a massive industrial component built into it as well. That being said, the market is likely to continue looking at the possibility of a grind higher or lower when it comes to the global economy, and whether or not there will be demand for silver. Do not get me wrong, it is not that silver does not act as a precious metal at times, it is just that it is not “as precious” as gold so it can lag a bit.

If you are looking for the safety trade, silver will not be where you need to go. If you are looking for a way to sell the US dollar, silver can serve that function quite well, but the reality is that silver is also extraordinarily volatile and then when it comes to the futures market. Silver contracts have nowhere near the volume of gold, and that is why you see massive moves. Furthermore, the contracts are much bigger, so it takes a lot less to wreck your account if you are not very careful. With that in mind, I am bullish silver, but I also think that you need to “leg into it very carefully”, and perhaps buy dips along the way. I am much more bullish when it comes to silver closer to the $20 level that I right now, because quite frankly we have not found a major support level quite yet. This looks like it could be a simple bounce that reaches towards the $25 level. I am not saying we cannot turn around here, just that it is not necessarily the optimal entry.