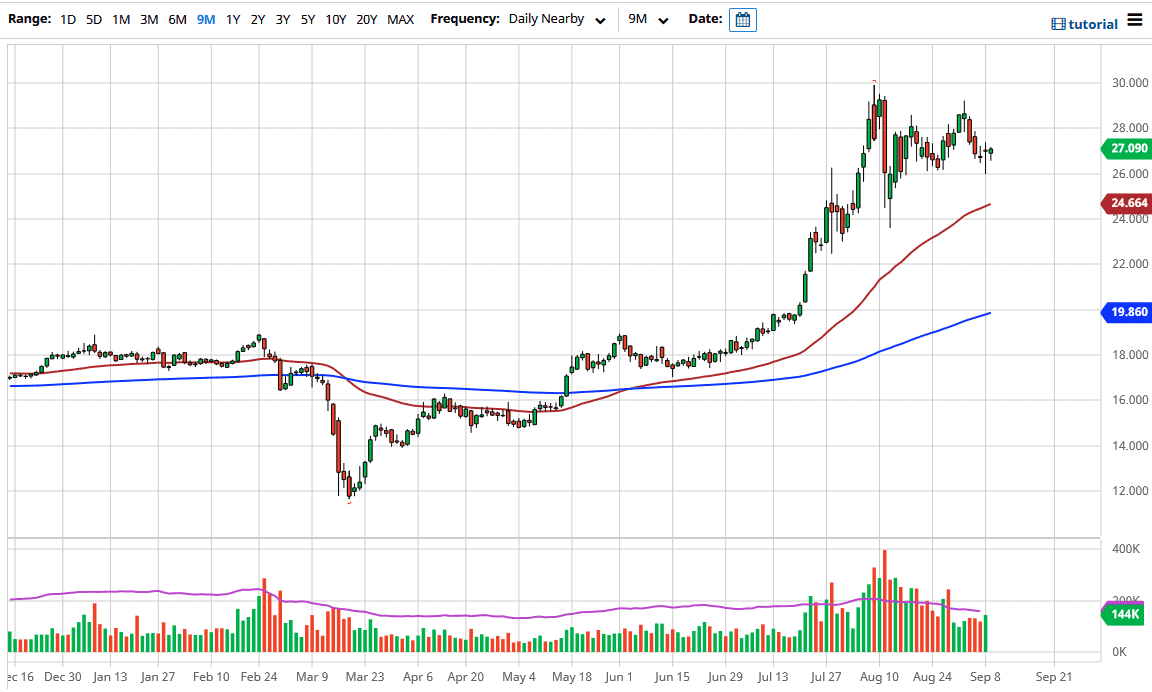

The silver markets have dipped a bit lower during the trading session on Wednesday but found a bit of buying pressure underneath to turn the market around. The hammer from the previous session was your first hint that we were in fact more than likely to go higher. This was helped by the US dollar losing a bit of steam during the day, but at this point in time, I think it is only a matter of time before the longer-term trend reasserts itself, as central banks around the world continues to loosen monetary policy. This drives precious metals higher in general, as it takes more of those US dollars to buy precious metals. Furthermore, people start to worry about the depreciation of their currencies, so therefore they look for hard assets to preserve wealth. Silver is one of the main areas people go to, following the path of gold, which also looks as if it is trying to rally.

Underneath, the $26 level should continue to be supportive, so I am paying attention to that level and will be a buyer of a bounce from that region, just as we had seen during the trading session on Tuesday. It is only a matter of time before value hunters get involved and start to pick up silver because it has had a rough several sessions before the hammer that printed on Tuesday. If we do break down below the $26 level, then I think we go looking towards the 50 day EMA which is creeping towards the $25 level. Underneath there, I think there is also supported at the $24 level. It is not until we break down below there that I become concerned about the silver uptrend. That being said, I do not like the idea of the pulling back very far from here, because there is an argument to be made for a little bit of a short-term up trending channel that has been respected as well. To the upside, I fully anticipate that $28 will be targeted, perhaps followed by $29. After that, we also have a massive $30 level above that should be very difficult to break above. However, if we do, the silver market will start to take off to the upside for a much bigger move. This would more than likely coincide with the US dollar getting absolutely crushed.