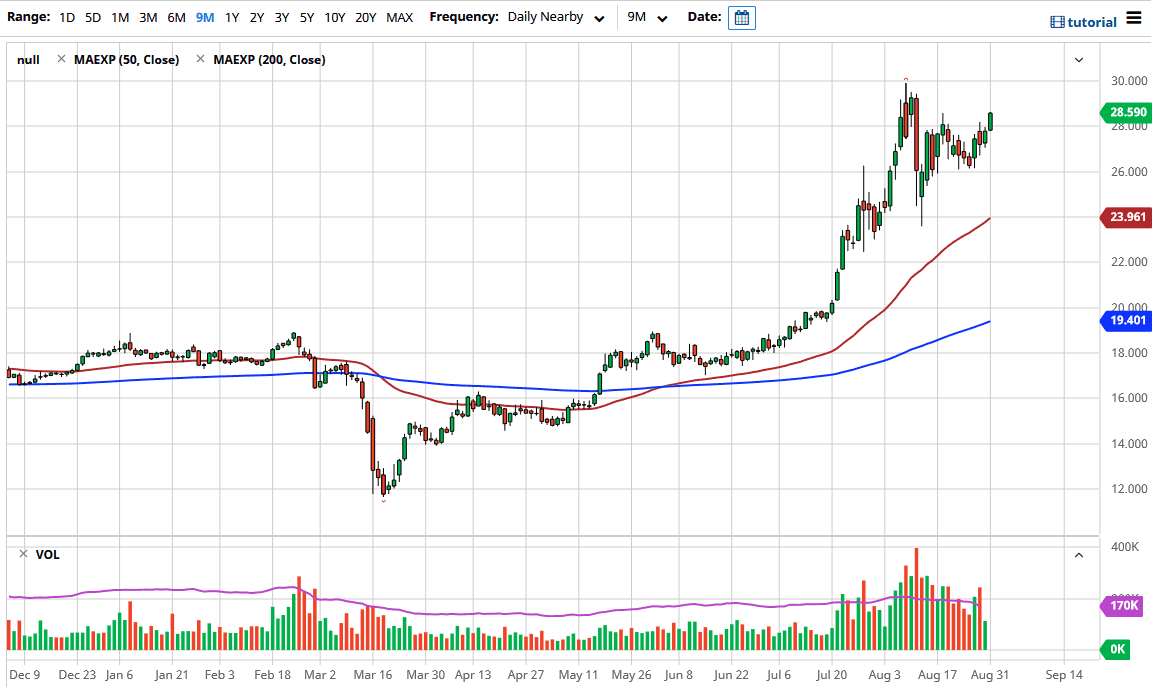

By breaking back above the $28 level, it looks very likely that we are going to continue to try to reach towards the $30 level. That is an area that was the recent high and if we can take that out, silver is very likely to go much higher. In fact, in the past when we have broken above the $30 level, we eventually go looking towards the $50 level.

A lot of this will be driven by the US dollar, or perhaps I should say the fact that the US dollar is falling. As long as that is going to be the case, precious metals should do fairly well. Silver tends to be a lot wilder than gold, so the move in silver will probably be exacerbated. After all, the contract in and of itself is much more volatile most of the time as it is a thinner market. Because of that, you simply must keep an eye on your position size, because you could find yourself in a lot of trouble if you time to trade incorrectly.

The candlestick for the day is rather significant because we are closing towards the top of it. That normally means that there should be some type of follow-through, as there is true conviction in the market. Furthermore, we have been in an uptrend for some time, so none of this should be a surprise. With Jerome Powell suggesting that the bar to raising interest rates is going to increase, it does make sense that the US dollar should continue to fall over the longer term. Silver will be one of the first markets to react, again because it is so thin.

I like buying dips, and have no interest in shorting this market. I believe that there is a massive amount of support underneath, most notably at the $26 level which is held recently. If the market pulls back, I will be buying in bits and pieces because I truly believe that we are going to break above the $30 level eventually, allowing silver to blast off into the stratosphere. While things could change, it would take a pretty significant move by the central banks to make silver suddenly a market that you should be selling.