There is a lot of concern out there when it comes to global growth and this of course works against the value of industrial metals. I know that you are quite often taught that silver is a precious metal, but it has an industrial component to it as well. If you are looking to bet against global growth or try to mitigate risk, it makes much more sense to buy gold as it is a much more stable contract.

That being said, if there is significant industrial demand, silver does get a bit of a boost. This is not to say that it does not have the asset component to it, just that it is going to underperform gold if we are looking for some type of “safety trade.” At this point, the most important thing to pay attention to if you are trading the silver market is going to be the US Dollar Index. When you look at the chart, the 96 handle is crucial, just as the 95 handle is. Somewhere between 95 and 96 you need to see the US dollar weekend, because if it does not, silver is going to get absolutely hammered.

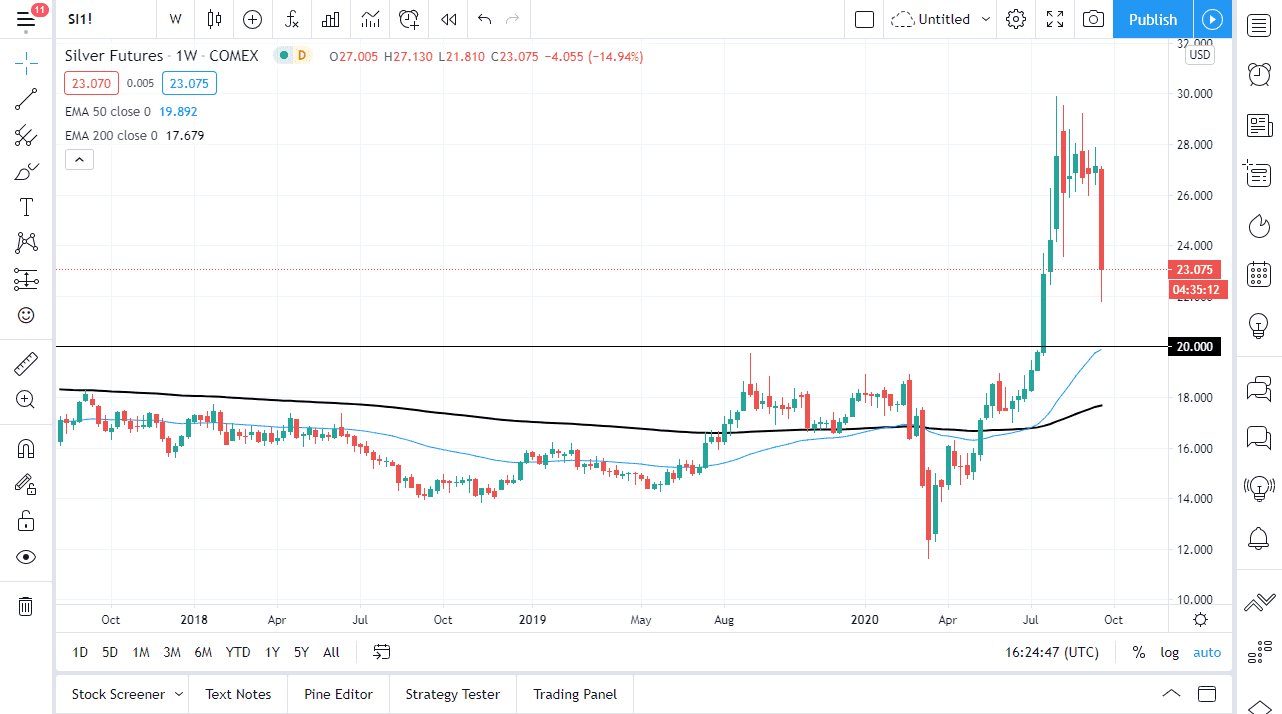

All that being said, I believe that the $20 level underneath would be an excellent price to get involved, and I think it is very possible you may get that opportunity. That does not mean that we will rally between now and then, but I do recognize that after the nasty candlestick that we have had during this past week, there is normally some follow-through even if you do get a bit of a bounce. With that in mind, I believe that the beginning of months will probably be relatively soft for silver, but by the time we get towards the end of October I anticipate that the Federal Reserve or somebody out there will do something to pick up risk assets again, thereby sending silver higher. I also recognize that the $30 level above is the “ceiling” at this moment without some type of major catalyst. Historically speaking, if you can get above the $30 level, you are going to go looking towards the $50 level. If we break down below the $20 handle, I think at that point we need to start reevaluating the entire situation.