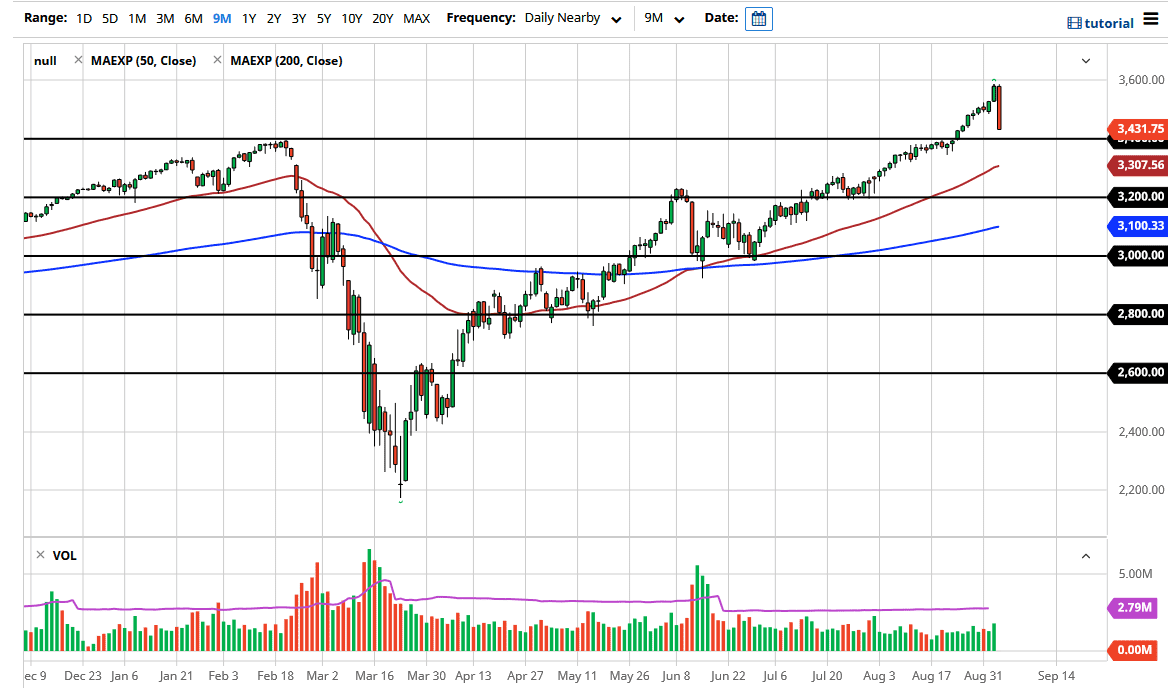

The next major area is going to be the 3400 level, an area that I think will attract a lot of attention. It was the previous resistance barrier, and therefore it is likely that the market will pay a certain amount of attention to that. When trading indices, one tends to lead the other, and I think what we are seeing here is a potential for the S&P 500 to be the leader. The 3400 level holding could be a good sign for the market to turn around, perhaps dragging the NASDAQ 100 and the Dow Jones Industrial Average coming right along with it.

That being said, you need some type of daily close to place a trade. In other words, I am telling you that you should not be trading this market on Friday. To make things even more potentially dangerous, we have the Non-Farm Payroll numbers coming out so that automate things quite difficult to say the least. Under the best of circumstances those days are difficult, so again, you cannot lose money if you are trading. I cannot stress this enough: the potential to lose money on Friday is incredible.

We could also break down below there, looking towards the 3300 level where the 50 day EMA is. That is another area where we could see interest, so I would be very interested in some type of hammer on a daily candlestick or along those lines. Notice that I keep pointing out that it is the daily close you need to see. You cannot take something like a hammer on an hourly chart after the stock markets have been decimated. During the Thursday session alone, we wiped out the previous seven trading sessions. A lot of confidence has been shaken, and losses have been drastic. In fact, I am almost positive you will hear some time later today or over the weekend that some find blue up in the futures market. It almost always happens on these types of days. With that, just be patient, as Jesse Livermore once stated: “we get paid to wait for the right opportunities.” We most certainly will have one, but we need to let the market tell us when it is time to buy.