September does tend to be very volatile in general, mainly because a lot of traders come back from vacation, thereby increasing the liquidity and what was a relatively quiet market. Nonetheless, it should be noted that this September was a bit different, due to the fact that there was so much in the way of retail money flooding into the markets buying options. This pushed the index quite higher due to the fact that market makers needed to hedge their risk exposure.

When someone buys call options, they have the right to grab stock at a predetermined price. What happened during the month of September and perhaps even during the month of August, is that so many retail traders had gotten involved in buying call options that the volume flooded the market. Further exacerbating this was the games that Softbank was playing, thereby exposing market makers to massive losses if the market continued to fall. Once the market started to take off, it kicked into high gear what is known as a “gamma squeeze.” Without going too far into it, what it means is that market makers started to be forced to buy SPY and other ticker symbols in order to mitigate massive risk that they were suddenly exposed to. In that sense, it became a bit of a self-fulfilling prophecy that “stocks only go up.”

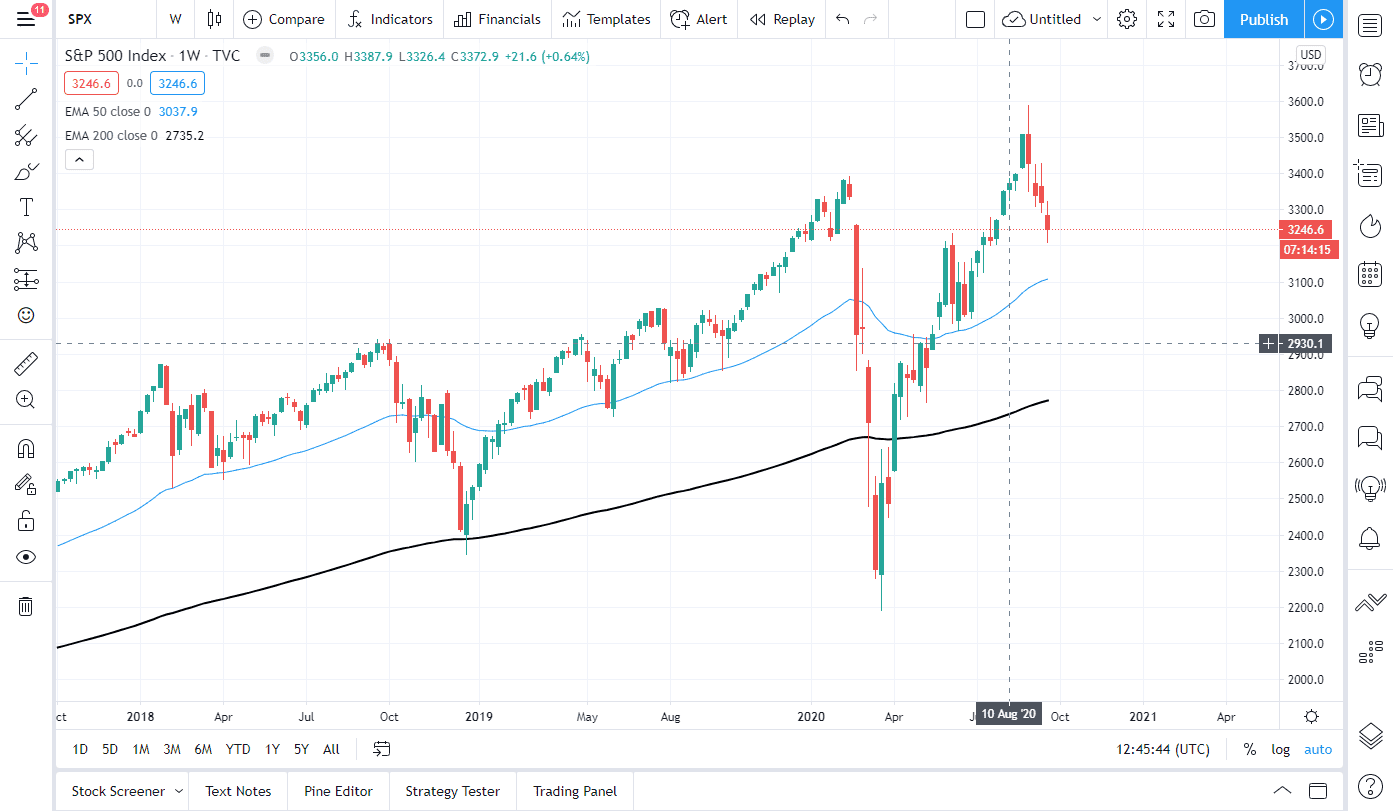

Now that we are out of that phase, the market has sold off quite drastically, as lack of demand for options, at least in the same way that there had been before, is dropping off. Those market makers sell the underlying stock in order to balance their books back out. This leaves us with a very interesting conundrum going forward this year. I do believe that the S&P 500 eventually recovers, but October is more than likely going to be just as volatile as the last eight weeks or so has been, because we have not only a rebalancing of the market but we have to worry about the presidential election, coronavirus figures, and a whole slew of other issues in the United States. It is because of this that I believe the market is likely to continue trying to break down a bit, but it is worth noting that the 3200 level is crucial support. Giving that up opens up the possibility of a move to 3100, followed very likely by an attempt at 3000. On the other side of the coin, if the market does break above the 3400 level, we could be looking at all-time highs but would need some type of catalyst to make that happen. The most likely catalyst: stimulus coming out of Congress, and unfortunately that has been messy to say the least.