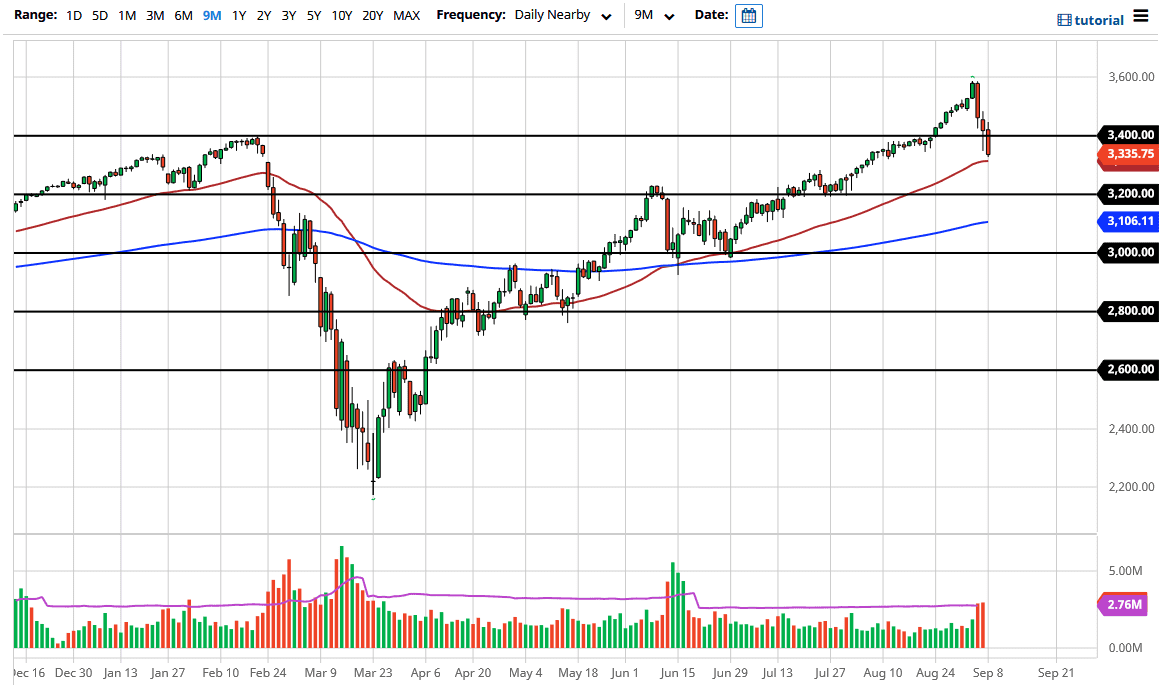

The S&P 500 has fallen rather hard during the trading session again on Tuesday, reaching down towards the 50 day EMA. At this point, the market will more than likely pay attention to this technical analysis figure, but the thing that does concern me is that we have broken down below the bottom of the hammer. The hammer from the Friday session should be respected but since it is not likely that we will continue to see a bit of negativity. That being the case, if we break down below the 50 day EMA, then we are likely to go looking towards the 3200 level.

Looking at the size of the candlestick and the fact that we closed towards the very bottom of it does suggest that we will have a continued downward pressure, and that will cause quite a bit of a problem as well. With this, I like the idea of fading short-term rallies, with the 3400 level offering resistance. If we break above there, then it is likely that the market goes higher, perhaps reaching towards the 3600 level. I would need to see a daily close above that 3400 level to be impressed though, so at this point in time the market needs to either save itself soon, or it is going to continue to go much lower.

That being said, we are still technically in an uptrend so there will be the occasional burst of buying. I think you need to be cautious about shorting this market hand over fist, but small positions on signs of exhaustion after a quick bounce could make a certain amount of sense. On the other hand, I feel much more comfortable buying a gap that shows signs of support. This is especially true near the 3200 level which I think is going to be a major level but pay attention to.

With the way things have been going, I think it is obvious that we are going to see a lot of volatility picking up over the next couple of days, so with that being the case it is very likely that keeping your position size small is probably the most important thing, be it a bullish or bearish position as the market has a lot to worry about right now, and we are clearly seen a major unwind of the “buy at any costs” attitude.