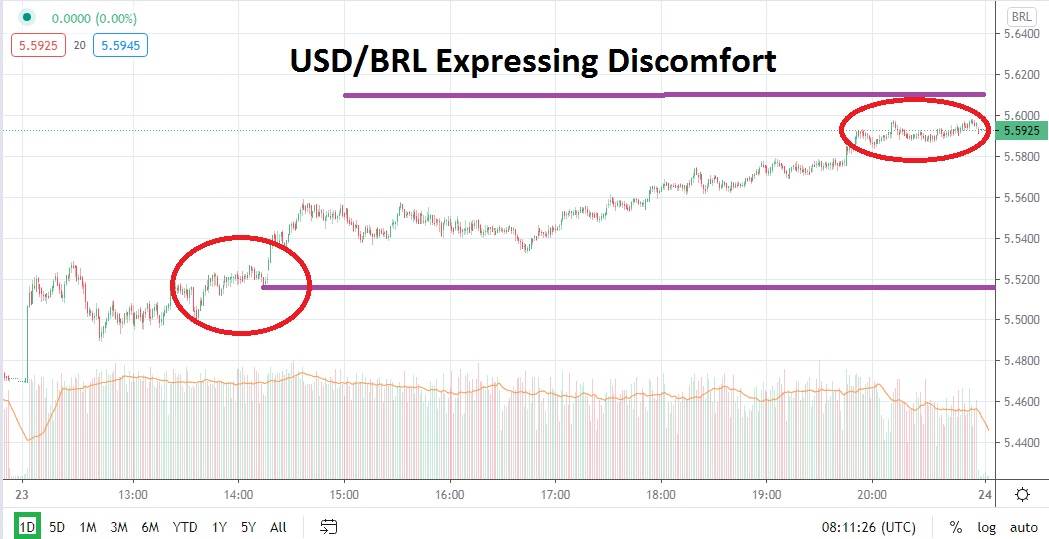

The Brazilian Real has turned sour this week and the USD/BRL is testing critical resistance levels which speculators should watch carefully. After reestablishing a bearish trend in late August, the Brazilian Real has effectively seen a lot of its gains wiped out in the past week of trading. On the 17th of September the USD/BRL was trading near the 5.2100 ratio, but as of early this morning the forex pair is near the 5.6000 juncture which it essentially last traded on the 27th of August.

Global risk appetite has taken a hit the past week and trading on equity indices will not be any easier today in most likelihood. US future markets are negative, but speculators should be extra wary because even though the declines are not anticipated to be as steep as they were a few hours ago, the future markets may be getting ready to fool traders into believing positive sentiment is about to emerge.

Yes, equity markets have been bullish mid-term in the US and they are still enjoying fundamentally high values, but before speculative fever erupts again with buying positions it might be wise to see momentum build. Timing the markets is nearly always a losing game in equities, but not participating in choppy markets if you are a day trader can also prove a wise move fiscally. The USD/BRL has seen bullish behavior erupt the past week as risk adverse trading globally has flourished.

If the resistance level of 5.6000 fails to hold and proves vulnerable, the next target for the USD/BRL will likely become the 5.6600 juncture which was last traded in late May. What should worry backers of the Brazilian Real is that trading within this price range actually puts the forex pair near the depths of the USD/BRL’s high water marks when coronavirus fears swept across the Latin American nation.

Even though the Brazilian government has been active trying to keep its economy moving forward as coronavirus took its toll, the USD/BRL finds itself back within dangerous waters and resistance levels must be looked at and potentially speculated on. If global risk appetite remains weak near term, the USD/BRL may continue to break through what is perceived as high resistance levels. Speculators may choose to be buyers under present trading conditions and use support levels as stop loss limit orders.

Brazilian Real Short Term Outlook:

Current Resistance: 5.6100

Current Support: 5.5500

High Target: 5.6600

Low Target: 5.5200