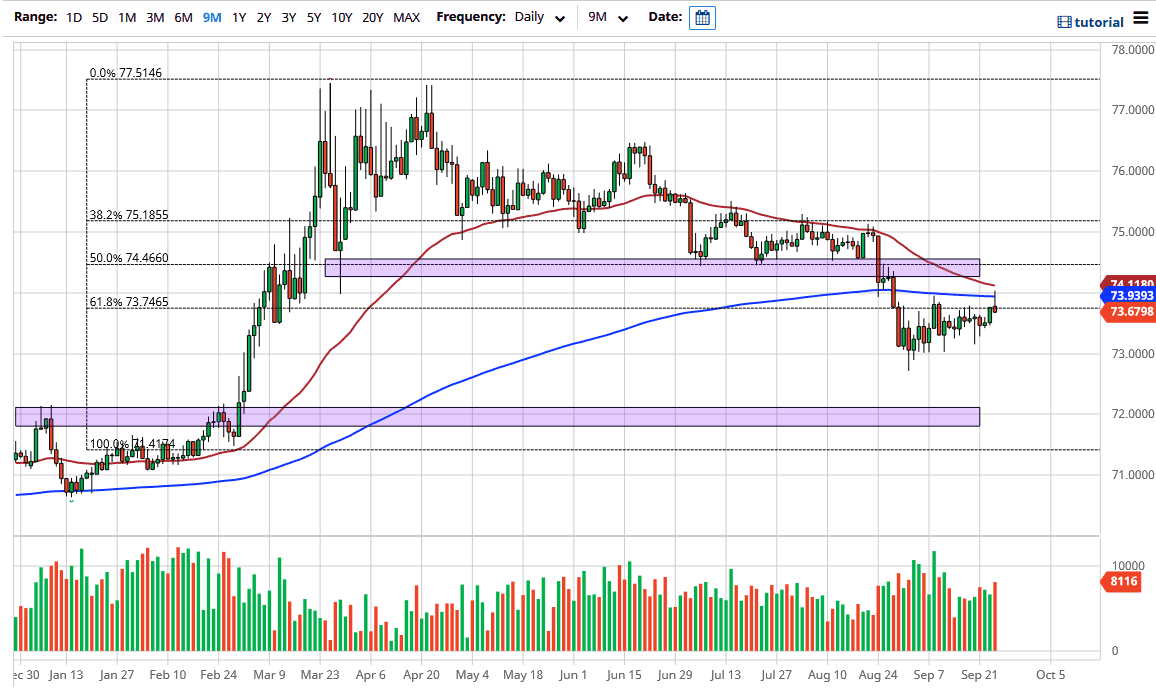

The US dollar initially rallied a bit against the Indian rupee yet again during the trading session on Tuesday as we continue to grind higher from the ₹73 level. However, later in the day we have turn things around to form a bit of a shooting star. Ultimately, the 200 day EMA has offered resistance, as it sits right at the ₹74 level. By showing resistance there and forming a shooting star, the market looks as if it is ready to continue grinding lower.

The 50 day EMA is also racing towards the ₹74 level, so that continues to offer resistance as well. Ultimately, this is a market that has struggled a bit to show US dollar strength, even though we have seen a lot of it and other pairs. The ₹74 level has been important a couple of times in the past, and most certainly the ₹75 level will be as well. In other words, it looks like we are going to continue to grind a bit lower, perhaps reaching down towards the ₹73 level underneath that has caused significant support. If we were to reach down towards that level, a break down could unleash even more selling, perhaps reaching down towards the ₹74 level.

Looking at this chart, a break above the ₹75 level would have a complete reversal of the US dollar against the Indian rupee and we could go much higher. All things being equal, the US dollar has been strengthening against everything but there are certain emerging market currencies that have been a bit difficult. The Indian rupee has certainly been one of them, perhaps due to the fact that it had been so oversold. I think we are likely to see more of a grind lower eventually, as there is significant resistance above. However, I am more than willing to go back and forth on short-term charts because that might be basically the most important way to look at this market. I think volatility in choppiness continues to be a major issue, and of course there will be the occasional headline. However, it is worth noting that trading against the Indian rupee has been a bit of a shelter against US dollar strength. Notice how we have only rallied slightly here, when we have seen the Aussie dollar and the Euro get hammered against the greenback.