The USD/PKR is not a widely traded forex pair. Additionally, there are not many experts who can give you inside advice regarding the Pakistani Rupee regarding its currency expectations because of an intimate knowledge of Pakistan’s central bank mechanics and fiscal capabilities. And I am not an expert either. However, the unknowns surrounding the USD/PKR may attract capable speculators because it is a technical trader's dream.

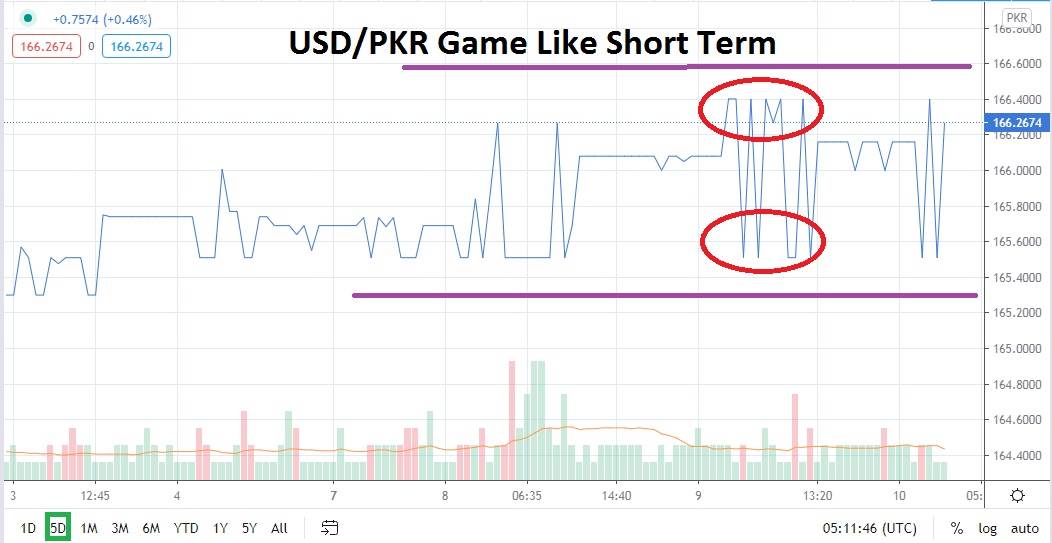

Five-day charts are often the theme I choose to show the trading of the USD/PKR. A one day chart is tricky because of the lack of trading volume in my opinion. A five-day chart shows the extreme nature of the forex pair’s ability to consistently test support and resistance junctures.

Speculators with experience who enjoy pure technical trading and are not afraid of a rather limited amount of independent economic news can sincerely enjoy trading the USD/PKR. Traders need to know how to place limit orders and effective stop losses. If you do not have this knowledge ask your forex broker to explain how this is done using their trading platforms.

Support for the Pakistani Rupee appears to be near the 165.5000 level. The resistance currently appears to be approximately 166.5000. The range of the USD/PKR moves in a rather tantalizing manner which seems to use short term support and resistance levels on a consistent basis. Yes, the support and resistance levels can prove unstable too. They are not guarantees, but they do provide a road map of potential trading results. If a trader uses the support levels to buy the USD/PKR and the resistance levels to sell the USD/PKR they might be able to find profitable outcomes.

The USD/PKR has had a long bullish trend and if a trader looks at a long term chart they will clearly see the rising exchange rate between the US Dollar and Pakistani Rupee. Traders need to contemplate their take profit orders carefully too, they should enter their orders swiftly and not interfere as their trades are working. Emotions must be managed, conservative leverage must be used, but if an experienced trader has the patience to allow their USD/PKR trades to work, they can find opportunistic trends to take gain advantages.

The USD/PKR’s range is remarkably similar to trading games technical trades train on when they begin to examine the possibility of using charts as analysis to participate in forex. Buying the USD/PKR around support levels of 165.5000 and using a stop loss near the 165.0000 could prove an attractive trade for patient speculators.

Pakistani Rupee Short Term Outlook:

Current Resistance: 166.5000

Current Support: 165.5000

High Target: 167.5000

Low Target: 164.5000