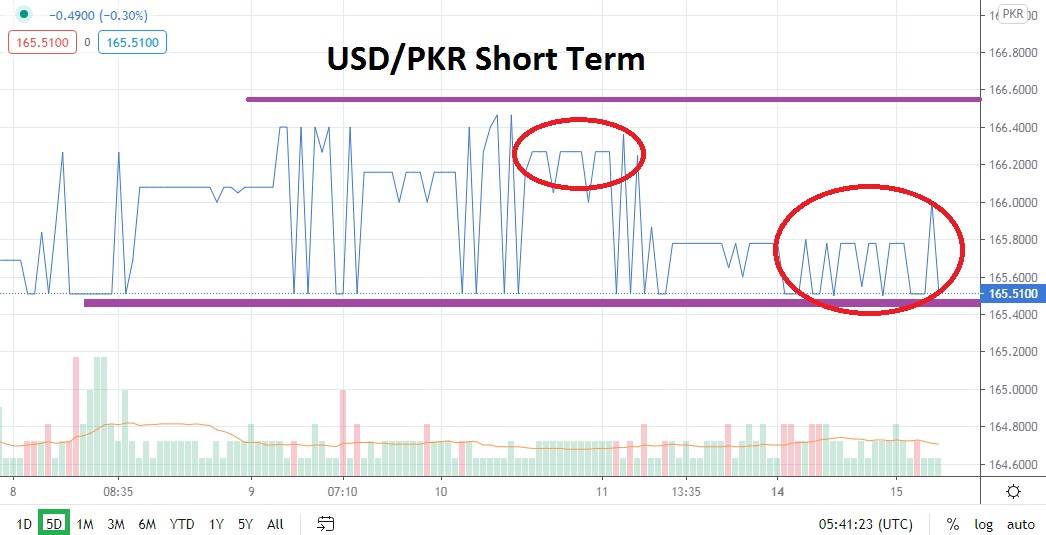

The USD/PKR offers speculators an intriguing support level to demonstrate their trading capabilities. The 165.5000 continues to hold its ground and has served as a launching pad for reversals higher. This has given traders an opportunity to use limit orders slightly above the juncture to seek momentum higher and pursue their goals.

However, the past week of trading has provided a support level which is almost too perfect. Experienced traders know all forex pairs provide challenges and are seldom easy to take advantage of consistently.

The USD/PKR offers a dynamic trading environment. First, the forex pair is not completely transparent because news from Pakistan is rather limited. Second, support levels when they seem to perpetually hit a target and reverse higher can suddenly prove to be an illusion and vulnerable.

What also should worry speculators is the recent reversals higher have been limited. This means traders of the USD/PKR need to use take profit orders which are targeted carefully and not look for gains that are off the charts. In other words, traders of the USD/PKR must not let the temptation of greed to interfere with their trading. It is great to make money, but if you do not cash out your winning positions you will likely suffer from reversals lower which will wipe your profits out.

In other words, short term positions are best within the USD/PKR. This will also eliminate your exposure to trades which can create high transaction costs due to overnight carrying charges for your forex position.

Speculators may want to continue to look for upside momentum from the USD/PKR, but they should be suspicious of the sudden and seemingly invincible support level of 165.5000 which has been displayed the past week. This support level could likely prove vulnerable. And traders with a sense for skepticism may believe that it is their trade which will cause the sudden spike which is seen on their trading platform even though it is not true.

The USD/PKR has seen a consolidated short term range and traders should suspect a breakout is likely to happen soon. The USD has been consistently weaker mid-term against many currencies, but this is not the case with the Pakistani Rupee. The USD/PKR has experienced a long term bull run higher and I am not here to tell you to wager against the trend.

Buying the USD/PKR around the 165.6000 level with carefully chosen leverage and stop losses near the 165.0000 juncture could prove worthwhile. However, near term traders should look for only limited movement higher which means placing a take profit near 166.2000 may be a good target.

Pakistani Rupee Short Term Outlook:

Current Resistance: 166.0000

Current Support: 165.5000

High Target: 166.5000

Low Target: 164.5000