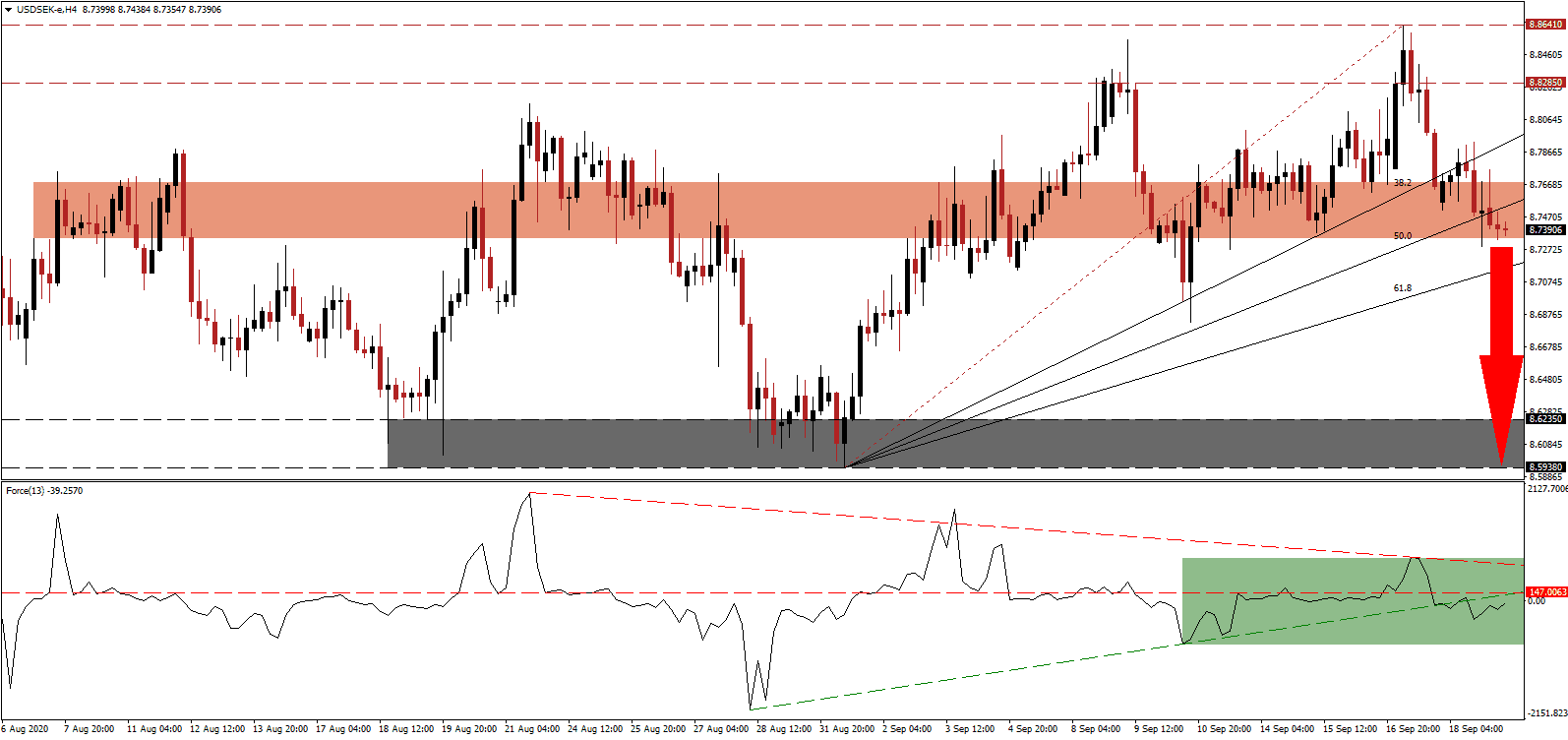

Sweden continues to report a steady and low rate of new Covid-19 infections, praising its approach to the initial wave, which faced heavy criticism due to an unacceptably high death toll. The Nordic kingdom did not implement a nationwide lockdown, attempting to achieve herd immunity rather than preventing the spread of the virus. The export-heavy economy suffered an equal price as others, but the death toll reached 5,865. By comparison, the other two Nordic kingdoms, Denmark and Norway, reported 638 and 267 deaths, respectively. After being rejected by its resistance zone, the USD/SEK embarked on a corrective phase.

The Force Index, a next-generation technical indicator, offered an early warning of a reversal amid the formation of a negative divergence. A brief spike above its horizontal resistance level swiftly reversed. While the descending resistance level maintains downside pressure, as marked by the green rectangle, the breakdown below its ascending support level magnified bearish momentum. This technical indicator remains below the 0 center-line, keeping the USD/SEK firmly under the control of bears.

Given the relative stability of Covid-19 in Sweden, the government lifted the nationwide ban on care home visits, where many of the reported deaths clustered. Lena Hallengren, the Minister for Health and Social Affairs, confirmed the move and did acknowledge the ban was one of the most challenging restrictions of the pandemic. How the government will react to the second wave of Covid-19 will dictate the economic trajectory moving forward. The USD/SEK currently challenges its previous short-term resistance zone located between 8.7340 and 8.7683, as identified by the red rectangle, from where a breakdown is pending.

One positive development for the domestic economy is the unemployment rate, which decreased to 9.1% in August. While it remains well ahead of the pre-pandemic level of 6.8%, redundancy notices are trending lower, approaching levels before the global pandemic. The Sveriges Riksbank, the world’s oldest central bank, warned about the state of the labor market and negative impact on its 2.0% inflation target. A breakdown in the USD/SEK from present levels and below its ascending 61.8 Fibonacci Retracement Fan Resistance Level can extend the corrective phase into its support zone located between 8.5938 and 8.6235, as marked by the grey rectangle.

USD/SEK Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 8.7390

Take Profit @ 8.5940

Stop Loss @ 8.7790

Downside Potential: 1,450 pips

Upside Risk: 400 pips

Risk/Reward Ratio: 3.63

A breakout in the Force Index above its descending resistance level could lead to a brief reversal of the sell-off in the USD/SEK. Forex traders should sell any advance amid the worsening outlook for the US economy and the US Dollar. Covid-19 cases in the US passed the 7,000,000 level, with new daily infections on the rise. The upside potential remains limited to its resistance zone between 8.8285 and 8.8641.

USD/SEK Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 8.8100

Take Profit @ 8.8500

Stop Loss @ 8.7790

Upside Potential: 400 pips

Downside Risk: 310 pips

Risk/Reward Ratio: 1.29