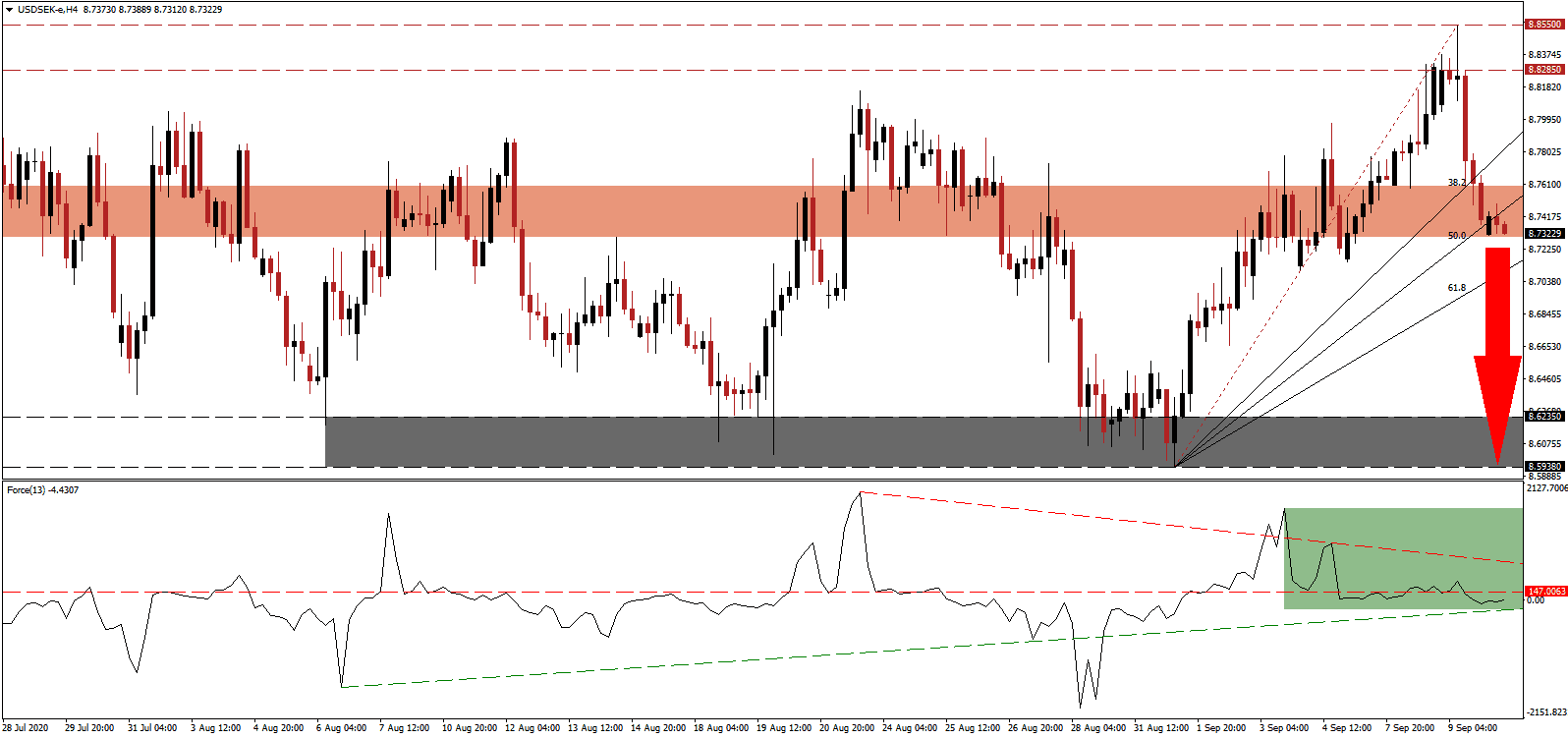

Sweden never imposed a Covid-19 related nationwide lockdown and kept most of its economy open. The cost was a high death toll, especially among the elderly population, while the economy is set to plunge together with its counterparts. While the Swedish government predicts a 2020 GDP decrease of 4.0%, the Sveriges Riksbank, the country’s central bank, forecasts a plunge as high as 10.0%. By contrast, the European Commission outlined a 6.1% contraction. The USD/SEK plunged from its long-term resistance zone into its previous short-term resistance zone, from where a new breakdown is favored.

The Force Index, a next-generation technical indicator, presented an initial warning that the rally was vulnerable to a reversal. While price action advanced, the Force Index recorded a series of lower highs, and a negative divergence formed. The descending resistance level pressured it below its horizontal support level, turning it into resistance, as marked by the green rectangle. This technical indicator moved below the 0 center-line and is now on course to collapse below its ascending support level, granting bears complete control over price action in the USD/SEK.

With nearly 70% of Swedish exports destined across the EU and the UK, the export-oriented economy will face the fallout of the global Covid-19 pandemic. Swedish consumers also adjusted their shopping behavior, irrelevant to a government-induced lockdown or absence thereof. The unemployment rate is forecast to pose a challenge through 2021, but the risk of a second wave of infection remains. Since the USD/SEK reached its former short-term resistance zone located between 8.7296 and 8.7596, as identified by the red rectangle, bearish pressures have accumulated, suggesting an accelerated sell-off.

Following the high death toll in retirement homes, the government announced kr9.7 billion in additional funds to boost elderly care, after the leftist government of Prime Minister Stefan Lofven faced heavy criticism for its Covid-19 response. It continues to defend its approach towards herd immunity, and the latest sample of 120,000 tests over the weekend returned a positive rate of just 1.3%. A breakdown in the USD/SEK below its ascending 61.8 Fibonacci Retracement Fan Support Level will clear the path for a collapse into its support zone located between 8.5938 and 8.6235, as marked by the grey rectangle.

USD/SEK Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 8.7300

Take Profit @ 8.6000

Stop Loss @ 8.7700

Downside Potential: 1,300 pips

Upside Risk: 400 pips

Risk/Reward Ratio: 3.25

A sustained breakout in the Force Index above its descending resistance level may lead to a short-term retracement of its breakdown sequence. US Dollar weakness continues to intensify, mixed with political uncertainty related to the November elections. The economy faces heightened risks of a double-dip recession, and Forex traders should sell any rallies. The upside potential remains limited to its resistance zone between 8.8285 and 8.8550.

USD/SEK Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 8.8000

Take Profit @ 8.8500

Stop Loss @ 8.7700

Upside Potential: 500 pips

Downside Risk: 300 pips

Risk/Reward Ratio: 1.67