While Singapore recorded over 57,000 Covid-19 infections to date, the death toll of 27 is significantly lower than in other countries. Presently, only 577 active cases remain, of which none are critical. Southeast Asia is the most populated and most-infected part of the world, but primarily due to India’s dominance in both. Despite the superior Covid-19 statistics, Singapore is amid its worst recession on record. The export-oriented industry depends on a global recovery, anticipated to be lengthy and uneven, but the speed of domestic adjustments in Singapore places it ahead. An extension of the breakdown sequence in the USD/SGD remains a distinct probability.

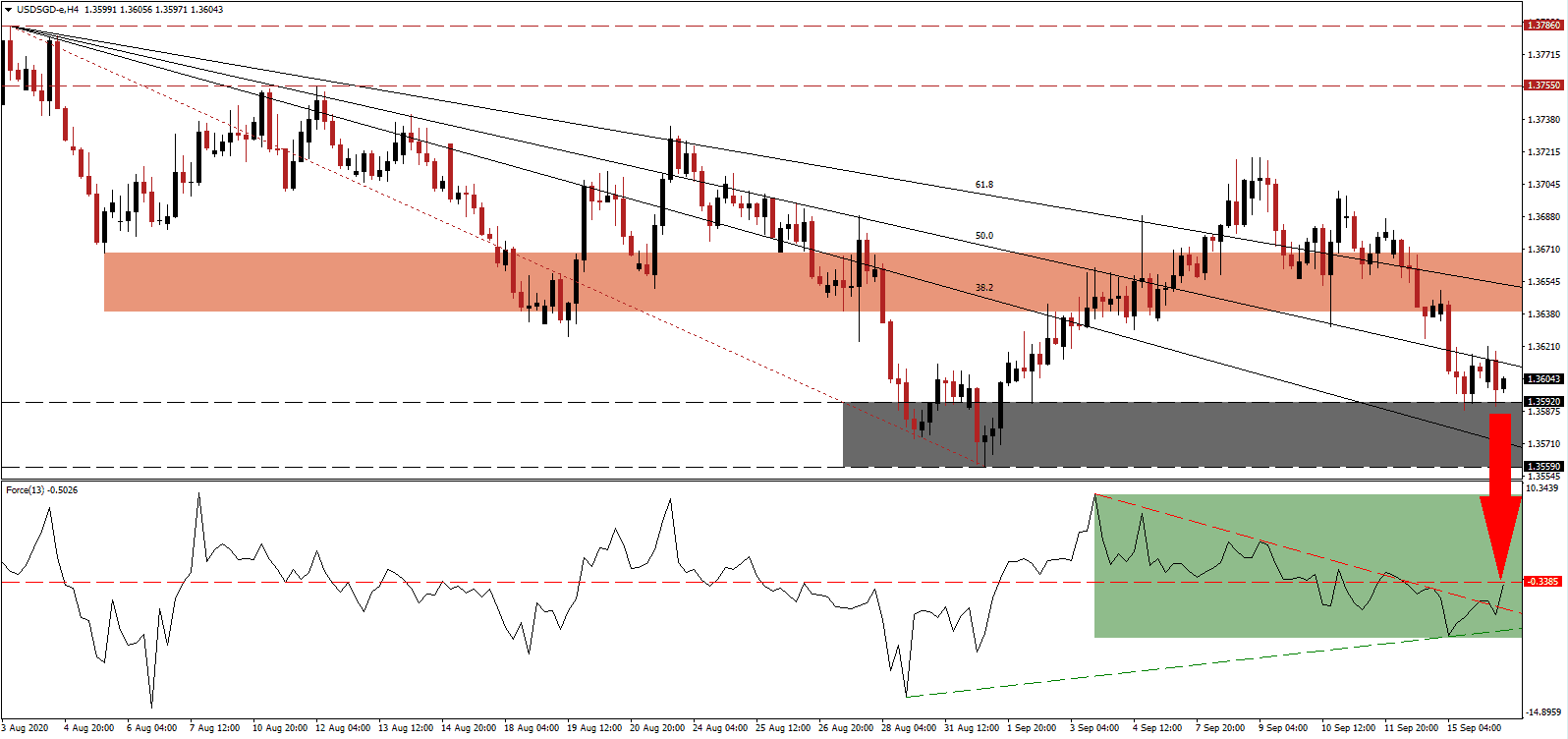

The Force Index, a next-generation technical indicator, reversed after setting a higher low, allowing for a new ascending support level to emerge. It pierced its descending resistance level to the upside, as marked by the green rectangle, and now challenges its horizontal resistance level. A lower high is expected to result in the collapse of this technical indicator farther into negative territory, allowing bears to maintain their control over the USD/SGD.

Second-quarter employment fell by a record of 103,500 in Singapore, shattering the previous one set in the first quarter of 25,600. Growing opposition to the 2005 Comprehensive Economic Cooperation Agreement (CECA) signed with India mounts as the recession deepens. The Covid-19 crisis in Singapore spiked in crowded dormitories of migrant workers, many from India. How Singapore changes policies will impact the strength of its recovery and recalibration of the economy. Following the breakdown in the USD/SGD below its short-term resistance zone located between 1.3639 and 1.3669, as identified by the red rectangle, bearish pressures accumulated.

Deputy Prime Minister Heng Swee Keat urges that Singapore must remain open to harvest the benefits of growth across Asia. Citizens complain that Singaporean firms import foreign labor without advertising positions to Singaporeans first. Opposition groups highlighted 127 professions where mostly Indian migrants receive offers, bypassing local talent. India does not advertise high-paying jobs for Singaporeans, adding to anger over CECA. The breakdown in the USD/SGD below its descending 50.0 Fibonacci Retracement Fan Support Level added to downside pressures, clearing the path for more downside below its support zone located between 1.3559 and 1.3592, as marked by the grey rectangle. Price action will face its next support zone between 1.3442 and 1.3478.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3605

Take Profit @ 1.3445

Stop Loss @ 1.3640

Downside Potential: 160pips

Upside Risk: 35 pips

Risk/Reward Ratio: 4.57

In case the Force Index resumes its upward trajectory above the 0 center-line, with the descending resistance level serving as temporary support, the USD/SGD may seek more upside. The outlook for the US economy and the US Dollar is increasingly more bearish, adding to bearish progress. Forex traders should consider any advance from present levels as a selling opportunity amid the reduced upside potential at its intra-day high of 1.3718.

USD/SGD Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 1.3670

Take Profit @ 1.3715

Stop Loss @ 1.3640

Upside Potential: 45 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.50