Compared to other developed countries, Singapore has gained relative control over the Covid-19 pandemic. Presently it has just 647 active cases, with none in critical conditions. The total death toll remains one of the lowest globally, but how it will handle an expected second wave of the virus over the fall and winter months will define the path of its domestic economy. Economists have downgraded their 2020 GDP forecast from a drop of 5.8% to 6.0%, amid ongoing disruptions in consumer spending. The USD/SGD embarked on a healthy short-covering rally but ended it with a breakdown below its short-term resistance zone.

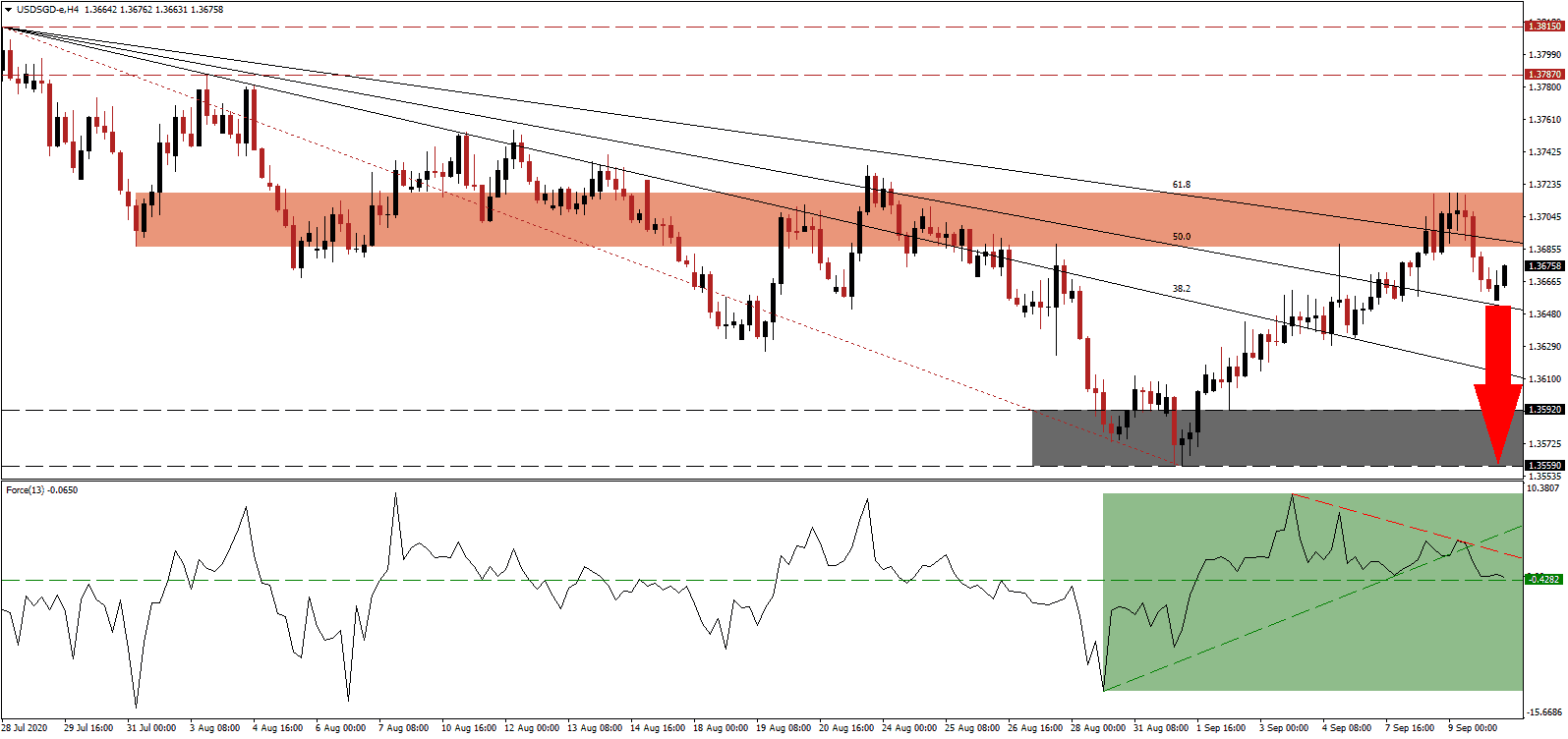

The Force Index, a next-generation technical indicator, confirmed the short-covering rally with a new multi-week peak. It swiftly corrected from there, moving below its ascending support level, as marked by the green rectangle. The descending resistance level is expected to pressure the Force Index below its horizontal resistance level. Bears wait for this technical indicator to slide deeper into negative territory to regain full control over the USD/SGD.

July marked the first full month where stores were open, but retail sales dropped 8.5% year-over-year. They recovered by 27.4% as compared to June. Sales at department stores plunged by 32.1% amid the lack of tourist arrivals related to Covid-19 restrictions. Despite the downbeat data, released figures were above estimates for a contraction in retail sales of 15.0%. After the USD/SGD moved below its short-term resistance zone located between 1.3687 and 1.3718, as marked by the red rectangle, bearish pressures became dominant.

One aspect worth monitoring is how Singapore will handle the issue relating to foreign workers, which moved to a core issue. Patrick Tay, a Member of Parliament, lobbies to increase the minimum qualifying salary for Employment Pass (EP) holders and favors to source more high-paying jobs domestically. Chan Chun Sing, the Minister for Trade and Industry, vowed that Singapore remains open to top international talent. The descending Fibonacci Retracement Fan sequence is well-positioned to force the USD/SGD back into its support zone located between 1.3559 and 1.3592, as identified by the green rectangle.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3675

Take Profit @ 1.3560

Stop Loss @ 1.3710

Downside Potential: 115 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.29

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/SGD may attempt a second breakout. Ongoing US Dollar weakness confines any advance to its downward-revised long-term resistance zone located between 1.3787 and 1.3815. Forex traders should consider any price spike as a secondary selling opportunity, with the threat of a double-dip recession in the US posing a genuine risk.

USD/SGD Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 1.3740

Take Profit @ 1.3790

Stop Loss @ 1.3710

Upside Potential: 50 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.67