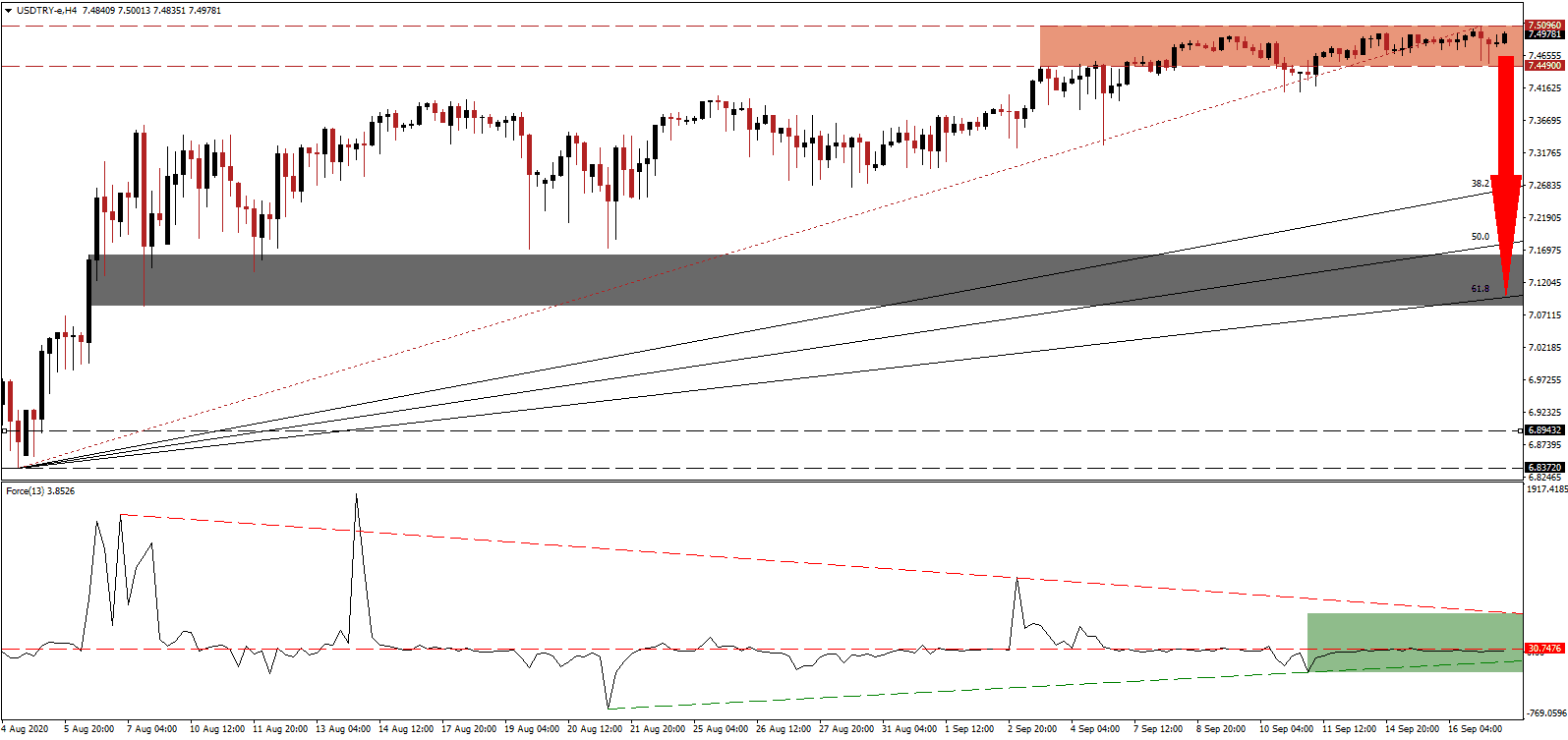

Turkey is approaching 300,000 Covid-19 infections but has a comparably low death toll above 7,200 in a country with a population shy of 85,000,000. It is also ahead in terms of current economic activity and 2021 recovery potential. President Erdoğan continues to face criticism by many Western leaders, and a temporary outflow of foreign capital adds to short-term Turkish Lira weakness. The data suggests his approach is moving the economy on a growth trajectory. The USD/TRY reached a new all-time high and is presently challenging its resistance zone, while bullish momentum remains absent.

The Force Index, a next-generation technical indicator, flatlined below its horizontal resistance level, as marked by the green rectangle, with a bearish bias evident. Adding to rising breakdown pressures is the descending resistance level, favored to pressure this technical indicator below its ascending support level and into negative territory. It will allow bears to resume complete control over the USD/TRY.

Ruhsar Pekcan, the Minister of Trade for Turkey, stressed that amid the global Covid-19 pandemic, the economy outperforms many of its competitors with August exports at $12.4 billion despite the slowdown in international trade. She added that Turkey would be one of the fastest-growing economies in 2021. The Turkish Statistical Institute confirmed a notable rise in total turnover for July, up 20.2% annualized. A new resistance zone formed between 7.4490 and 7.5096, as identified by the red rectangle, partially due to the sideways trend in the USD/TRY amid the lack of bullish momentum, with a new breakdown sequence likely.

Per the Istanbul Chamber of Commerce (ITO) Chairman, Şekib Avdagiç, a combination of credit expansion, short-term employment allowances, and a value-added tax (VAT) cut granted the economy a lifeline, allowing a swift recovery to emerge at the end of the second quarter. President Erdoğan stressed the economy is at peak performance, dismissing Western credit rating agency downgrades as worthless. The USD/TRY is well-positioned to correct into its short-term resistance zone located between 7.0843 and 7.1612, as marked by the grey rectangle, and enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level.

USD/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 7.4975

Take Profit @ 7.5725

Stop Loss @ 7.4200

Downside Potential: 4,125 pips

Upside Risk: 750 pips

Risk/Reward Ratio: 5.50

In case the Force Index advances above its descending resistance level, the USD/TRY may attempt another breakout to a new all-time high. The upside potential remains confined to a calculated resistance zone between 7.6597 and 7.7364. With the US Federal Reserve committed to zero-bound interest rates at least until the end of 2023, Forex traders should cautiously sell any advance from present levels.

USD/TRY Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 7.6350

Take Profit @ 7.7350

Stop Loss @ 7.5725

Upside Potential: 1,000 pips

Downside Risk: 625 pips

Risk/Reward Ratio: 1.60