South Africa reports the lowest daily new Covid-19 infections among all Top 10 infected countries, hardly a relief for the struggling economy, which by some account poses a more massive health threat than the virus itself. Africa’s most industrialized nation faces its deepest recession in 28 years, magnified by the nationwide lockdown to slow the spread of the global pandemic. The silver lining remains that the government of President Cyril Ramaphosa ran out of time to delay necessary reforms. While the USD/ZAR extended its counter-trend advance, the decrease in bullish momentum favors a new breakdown.

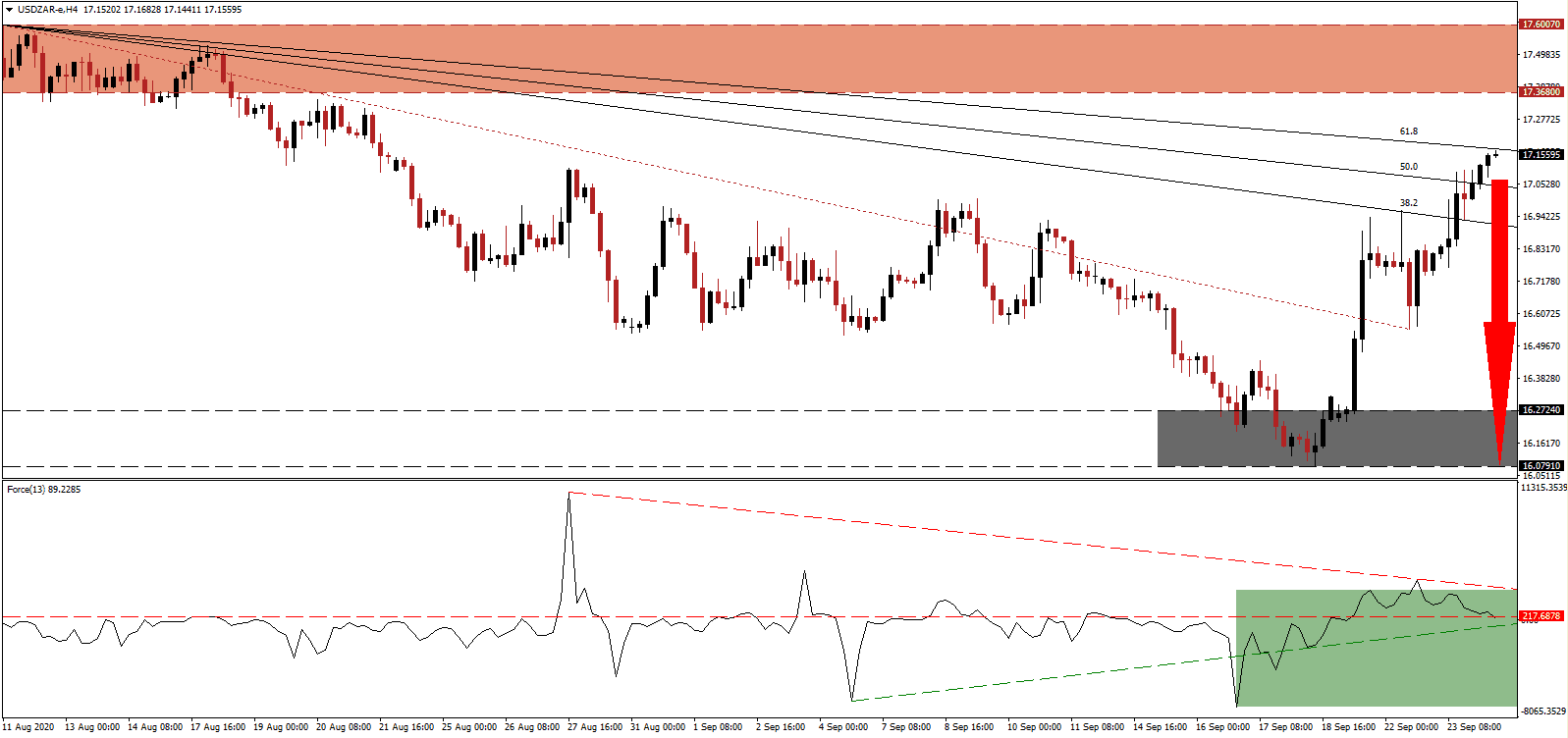

The Force Index, a next-generation technical indicator, already reversed its temporary advance above its horizontal resistance level and moved below it. Adding to downside pressures is the descending resistance level, as marked by the green rectangle, with a collapse below its ascending support level pending. This technical indicator is on track to move into negative territory, granting bears complete control over the USD/ZAR.

Addressing the problems with Eskom, the state-owned enterprise (SOE) responsible for over 90% of electricity output and distribution, and partially blamed for economic problems amid rolling blackouts to prevent the outdated grid from collapsing, President Ramaphosa calls for repayment of debt. Municipalities owe Eskom over R31 billion, while prepaid electricity meters in all households were also proposed. The USD/ZAR presently challenges the adjusted descending 61.8 Fibonacci Retracement Fan Resistance Level, with the downward revised resistance zone located between 17.3680 and 17.6007, as identified by the red rectangle, poses an upside limit in case of a final push higher.

One core problem with the latest National Economic Development and Labour Council (Nedlac) recovery plan is the absence of a timeline. Until the government acts on its proposals, recovery for South Africa in a slowing global trade environment cannot materialize. While businesses remain on life-support, early indicators point to an uneven post-Covid-19 economic rebound. Despite the uncertain outlook, US Dollar weakness can spark a sell-off in the USD/ZAR, taking it back into its support zone located between 16.0791 and 16.2724, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Price Action Reversal Scenario

- Short Entry @ 17.1550

- Take Profit @ 16.0850

- Stop Loss @ 17.3550

- Downside Potential: 10,700 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 5.35

Should the Force Index pierce its descending resistance level, the USD/ZAR may seek to extend its advance. While the spike in global Covid-19 cases resulted in a US Dollar rally, it is not a safe-haven asset and positioned for capital outflows amid its dimming economic prospects. Forex traders should view any rally from present levels as a selling opportunity. The upside potential remains limited to 17.6007, the top range of its resistance zone.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 17.4450

- Take Profit @ 17.5700

- Stop Loss @ 17.3550

- Upside Potential: 1,250 pips

- Downside Risk: 900 pips

- Risk/Reward Ratio: 1.39