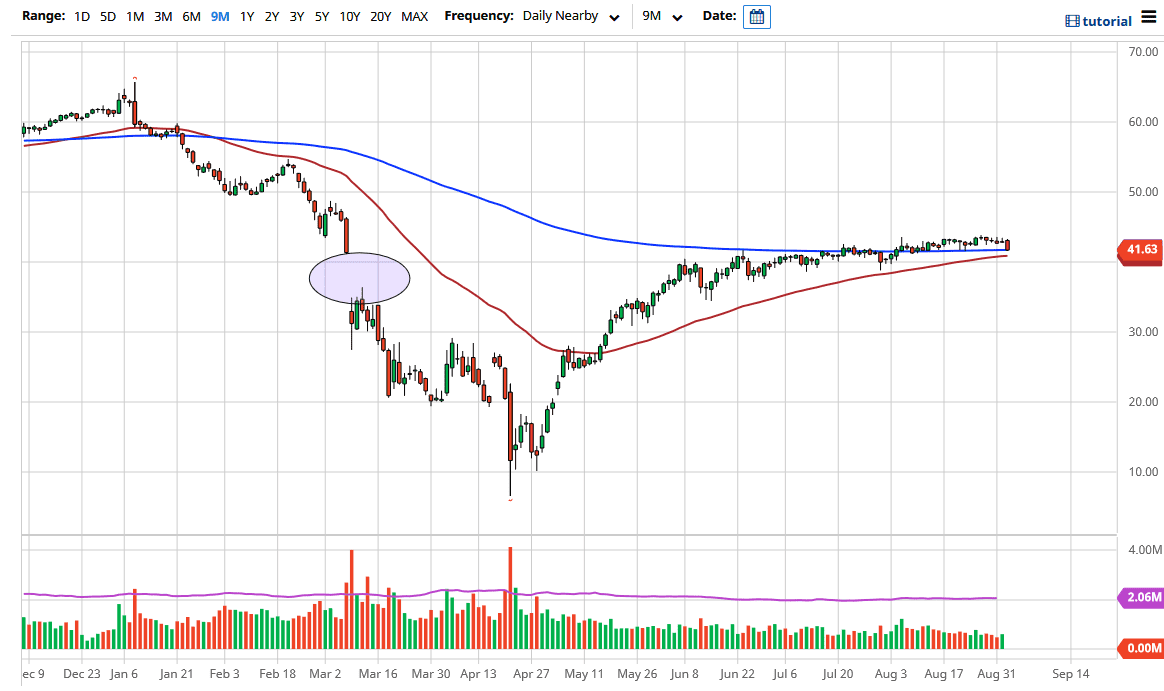

The West Texas Intermediate Crude Oil market has fallen rather hard during the trading session on Wednesday, as the EIA report came out bullish. More importantly, we have reported that Iraq is looking to get out of the production cuts for OPEC plus. That could bring more production into the markets, and if that is the case it is likely that we will reach much lower. The 50 day EMA underneath suggests that there could be support in that area, but if we break down below the $40 level that could seem like a much more significant move, and therefore it is likely that we go much lower. At this point, the $35 level would be a target, perhaps even as low as the $30 level.

Markets at this point that rally suddenly look like they could be shorting opportunities because the veracity of the candlestick might be the beginning of something bigger. The US dollar strengthening could also cause some negativity for the oil market, but I think this goes much further than that because although the EIA number was very bullish, we need to keep in mind that much of the oil-producing rigs in the United States were closed during the hurricane. In other words, it is a bit of a skewed number.

That being said, you still have to think there is an opportunity for the market to grind higher, but we must close above the 200 day EMA on Thursday. Furthermore, we have to worry about the Friday session, as it features the Non-Farm Payroll numbers coming out the United States which could foretell either demand or a lack of demand. I think we are looking at a situation where we are on the precipice of something rather big, so pay attention to whether or not we break down through these levels. If we do, the flush lower could be rather violent. The Thursday session is very crucial for the oil market to keep it slightly upward trajectory, and it needs to save itself sooner rather than later. Markets can only be dead for so long, so it looks like we are ready to finally move again. This will be especially exacerbated due to the fact that we are finally leaving the vacation season, so sometime early next week will start to see more volume if history is any type of indicator.