We might be getting a little bit over bought, and of course we have to worry about the Non-Farm Payroll numbers coming out of the United States first thing in the morning on Friday. With that being the case, it is likely to be very choppy and difficult market, and I certainly see a lot of resistance near the 0.73 handle.

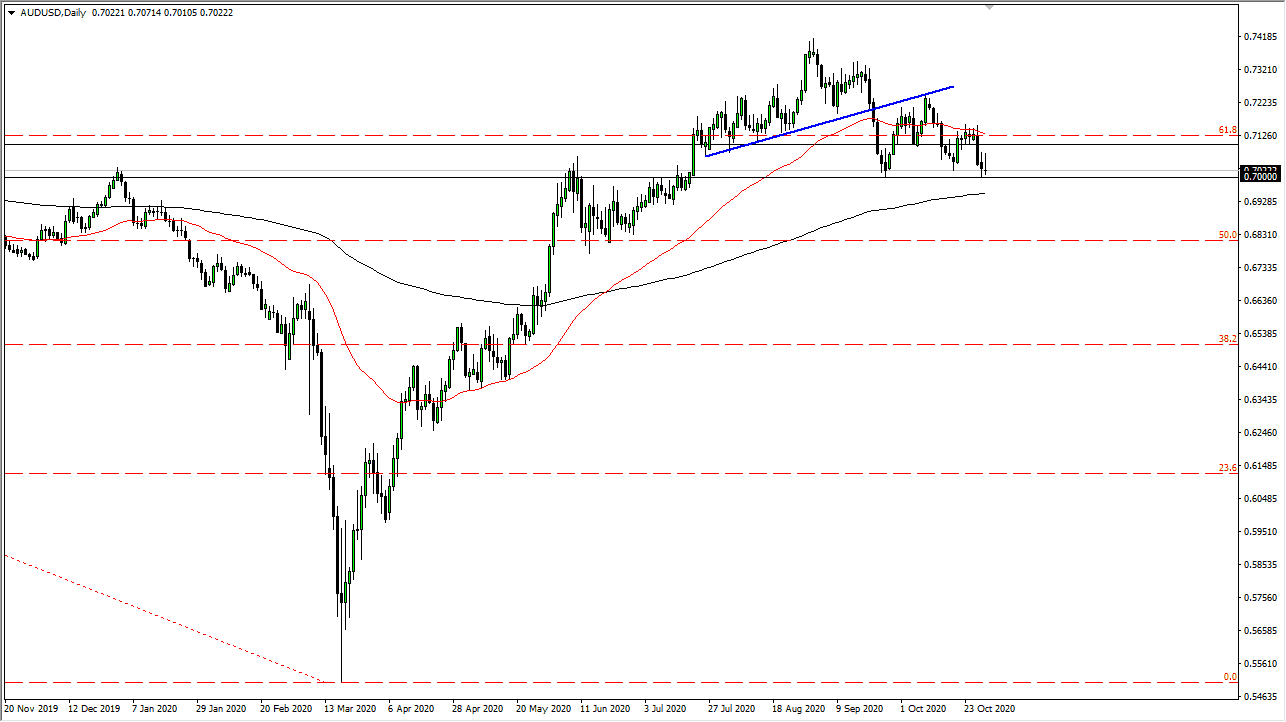

Looking at this chart, you can see that we had a significant selloff from that area and have fallen all the way down to the 0.70 level. The 0.70 level has been crucial more than once, and now that we have retested that area for support, and it held, that is a good sign. The next question asked about the overall trend is whether or not we can break out to a fresh, new high. Overall, I think that you are looking at a market that is going to react to the Federal Reserve and of course global growth and risk in general. The Australian dollar is highly levered to the Chinese economy, so it does make it a bit more resilient than some of the other currencies that we trade the greenback against. That being said, this is essentially a “one-way bet” in the sense that I am either long of this pair or on the sidelines. I have no interest in shorting the Australian dollar anytime soon because it is easier to make money buying US dollar against other currencies at the moment. However, you can make an argument for a previous uptrend line being tested during the trading session on Thursday and holding as resistance. This is certainly something to be paying attention to.

Looking at this chart, I think we will continue to move in somewhat of a range bound area and of course the Non-Farm Payroll noise coming out early on Friday will cause some issues. I do believe that if we drop towards the 0.70 level it is probably only a matter of time before the buyers step back in, perhaps based upon the hope that the jobs number will be bad enough that the Federal Reserve will have to step in and offer more stimulus. It is a bit of perverse logic, but that is the world we have lived in for over 10 years.